The technical term for our penchant for things we know is familiarity bias. We gravitate to “the devil we know”.

What’s wrong with preferring things I know

No one can ever convince me there’s a better breakfast spread than peanut butter. Sure, I am missing out on trendier almond and coconut spreads, but I’m happy with my childhood choice of toast accompaniment so there’s little downside to not branching out.

A problem arises when the lack of adventure into toast toppings spreads (no pun intended) into other parts of life and decision making. The familiar becomes comfortable, and at best you’re a little bit unhealthy. At worst it could cause you to make some dangerous decisions.

In 1991, two Stanford university academics (Heath & Tversky) examined if familiarity with a topic impacts your decision making. They found when people are faced with a choice, they will pick the most familiar even if the odds of winning are lower! In other words people ‘’prefer the devil they know” regardless of whether it’s the best decision.

Familiarity in money

We see familiarity bias at play in money and investing all the time. Take a savings account for example. A lot of people leave their money in savings accounts or term deposits instead of investing.

Savings accounts are often the first place we put our money as children, they seem safe. Given you’ll get about 2% from a high interest savings account compared to 6% to 8% from investing you’re clearly being left behind. For most people a savings account is a ‘known quantity’ so they stick with what they know even if their wealth would be much larger in 20 years if they invested.

Why Australians love property

There’s a good reason why owning a home is the Great Australian Dream – property is familiar.

Not only is it tangible (you can touch it) but most Australians have grown up never seeing a property downturn. The concept that property may fall in value is so foreign to most people that they completely discount the possibility of it happening. So people borrow to buy their 4th, 5th, 6th houses without considering the risks of poor diversification and high debt if a downturn happened.

Don’t confuse familiar with safe

Familiarity bias also affects other investment choices. Australian investors generally prefer Australian shares, (known as home-country bias) yet this comes at the expense of investing in great global businesses.

According to the Class SMSF Benchmark Report, the top 10 shares held by Australian Self Managed Super Fund (SMSFs) investors are all Australian shares!

| Top 10 Investments by Australians | ||

| Ranking | Investment | |

| 1 | Telstra | |

| 2 | Westpac | |

| 3 | BHP | |

| 4 | National Australian Bank | |

| 5 | ANZ Bank | |

| 6 | Commonwealth Bank | |

| 7 | Wesfarmers | |

| 8 | Woodside Petroleum | |

| 9 | Woolworths | |

| 10 | South 32 | |

Source: Class SMSF Benchmark Report 2017

Only investing in Australian shares means that your portfolio is highly concentrated in one country and you miss out on global opportunities. According to ASIC, the Australian share market has a total market size of $1.9 trillion (as at January 2018), which represents around 1.7% of the world’s total share market value. That’s a lot of share market value and different sectors Australian investors miss out on.

When Australians do invest overseas it tends to be into companies they are familiar with too. Here are the top 10 global investments by Australians. Recognise any of them?

| Top Global Investments by Australians | ||

| Ranking | Investment | |

| 1 | Apple | |

| 2 | ||

| 3 | Microsoft | |

| 4 | Berkshire Hathaway | |

| 5 | Johnson & Johnson | |

| 6 | Visa | |

| 7 | Twenty-First Century Fox | |

| 8 | Lloyds Banking | |

| 9 | Wells Fargo | |

| 10 | Paypal | |

Investing where you work

According to an eZonomics poll, 24.5% of people are more likely to invest in the sector in which they work. Many studies including The Behaviour of Individual Investors have found this leads to poor performance because people take too much risk under the ‘illusion of control’.

Investing in the sector you work in creates another problem – lack of personal diversification. Putting all your eggs in one basket (your job plus savings) exposes you to much more risk in a downturn. In the 2000 dot com bubble many people who worked in tech companies also invested in them. When the tech bubble burst they lost their jobs and most of their savings. Here’s 9 Reasons why tech shares are the worst investment right now and the #1 reason is over-familiarity!

How to beat familiarity bias

It’s understandable why people stick to brands, businesses and assets they’re familiar with when they invest. It seems safe and feels comfortable. But familiarity often leads you astray!

The most important step to beat familiarity bias is broad diversification. As a general rule, more assets in your personal portfolio will reduce the amount of risk you’re taking without sacrificing good long term returns. Outsourcing to an online investment adviser can help you do this well.

Our clients are diversified across different asset classes and companies without even knowing it. Of the 1,500 companies we invest in most of them you would never have heard of. That might be a scary concept but it actually what makes your portfolio safer.

Many people would never consider buying bonds and gold because they are unfamiliar but they both have an important role in reducing risk. By including bonds, gold and little-known shares from around the world our portfolios have reduced risk by 30 to 60% compared to just owning a portfolio of Australian shares.

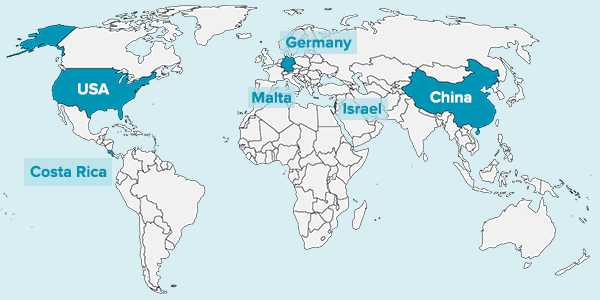

Try this exercise, rank these 6 countries by life expectancy from highest to lowest:

Germany, Costa Rica, Israel, Malta, USA, China

The answer is below in the footnotes. Was your response impacted by familiarity?

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Answers: Israel (82.5 years), Malta (81.7 years), Germany (81.0 years), Costa Rica (79.6 years), USA (79.3 years), China (76.1 years)