When selecting which stocks and exchange traded funds (ETFs) to buy, there are generally two styles of investing; value investing and growth investing.

Value investing was made popular in the 1930s by the investor Benjamin Graham. The strategy involved buying stocks that appeared to be underpriced or undervalued, and focusing on companies that pay good dividends.

On the other hand, growth investing involves buying stocks that have higher expected growth in sales, earnings or cash flows. They generally have higher valuations. These stocks choose to reinvest profits back into the company rather than paying it out as dividends to shareholders.

What is a good growth stock ETF?

While there are tens of thousands of companies around the world that would be considered a growth stock, ETFs have made it easy for investors to gain access to a basket of growth stocks.

Growth ETFs are focused on investing in stocks that have high growth characteristics, looking for growing sales and higher valuations. Companies that are normally considered growth stocks tend to be in high growth sectors such as technology (for example, Apple, Tesla, and Amazon).

A good growth stock ETF is one which identifies companies with strong earnings potential. Most of the returns come from capital growth rather than dividends.

What are the best growth ETFs on the ASX?

There are no ETFs on the ASX that exclusively track a growth share index. However there are active ETFs focused on identifying growth stocks, and other index ETFs that have a high proportion to growth companies.

Below are the top 15 ETFs on the ASX with the highest exposure to growth companies.

| ASX ticker code | ETF Name | Growth companies exposure | Management fee per year |

| HYGG | Hyperion Global Growth Companies Fund (Managed Fund) | 92% | 0.70% |

| ATEC | BetaShares S&P/ASX Australian Technology ETF | 87% | 0.48% |

| CLDD | BetaShares Cloud Computing ETF | 86% | 0.67% |

| CRYP | BetaShares Crypto Innovators ETF | 80% | 0.67% |

| RBTZ | BetaShares Global Robotics and Artificial Intelligence ETF | 75% | 0.57% |

| FANG | ETFS FANG+ ETF | 73% | 0.35% |

| IBUY | BetaShares Online Retail and E-commerce ETF | 73% | 0.67% |

| MKAX | Montaka Global Extension Fund (Quoted Managed Hedge Fund) | 69% | 1.25% |

| WCMQ | WCM Quality Global Growth ETF (Quoted Managed) | 66% | 1.35% |

| MCGG | Munro Concentrated Global Growth Fund (Managed Fund) | 66% | 0.70% |

| MAET | Munro Global Growth Fund (Hedged Fund) | 64% | 1.35% |

| MHHT | Magellan High Conviction ETF | 64% | 1.50% |

| FDEM | Fidelity Global Demographics Fund (Managed Fund) | 64% | 0.89% |

| NDQ | BetaShares NASDAQ 100 ETF | 62% | 0.48% |

| HGEN | ETFS Hydrogen ETF | 62% | 0.69% |

The majority of the ASX-listed growth ETFs are international growth ETFs which hold global companies. This is because the Australian market has fewer growth-focused sectors (such as technology and biotech) with only 18% of the market considered to be growth. Still, global share ETFs have been some of the most popular ETFs on the ASX.

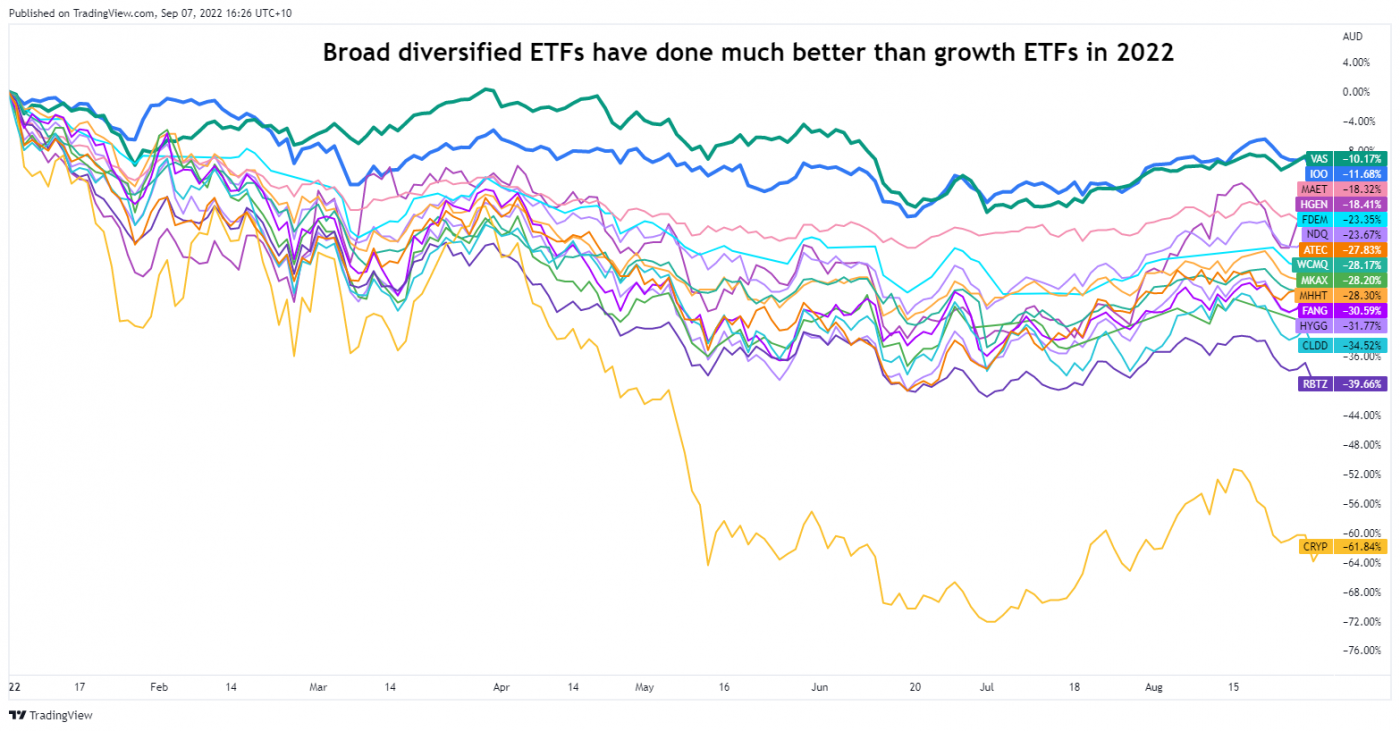

However, just because an ETF has high exposure to growth companies does not mean they give you the best returns. Many of the above ETFs are thematic ETFs that have lost up to 70% of their value since the start of 2022. There are also active ETFs, which aim to outperform an index, but as our research has shown, more than 80% of active fund managers underperform.

The best-performing long-term growth ETF has been the BetaShares NASDAQ 100 ETF (NDQ), which has returned 19% p.a. over the five years to August 2022. NDQ, which tracks the U.S. technology sector, is offered to Stockspot clients as a Stockspot Theme.

Should you invest in Growth ETFs?

Growth ETFs have the ability to produce high capital growth returns. But, they also come with more volatility.

If you can’t handle volatility, including large daily price falls or drawdowns of more than 50%, then it might be better to stick with a simpler investing strategy. Stockspot recommends investing in simple ETFs such as the broad Australian and global shares ETF (ASX: VAS and ASX: IOO). In 2022, these ETFs have outperformed growth ETFs because they hold a more balanced mix of growth and value shares

If you are choosing a growth ETF, we recommend picking one that has good diversification (in terms of the number of companies, countries and sectors) and where the management fee is low.

Are growth ETFs a good investment for 2022?

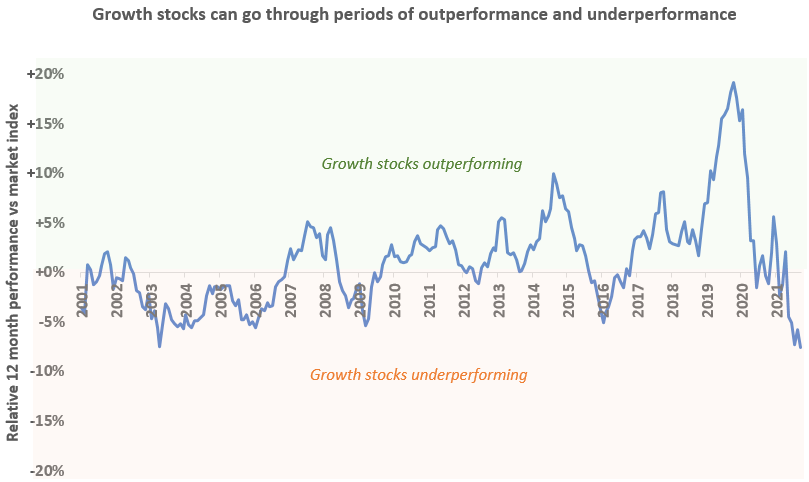

Growth ETFs can enjoy some better returns than other strategies, but there are times when growth does well and times when it performs poorly.

In 2022, growth ETFs have fallen more due to rising interest rates and inflation, whereas value ETFs have outperformed due to their high weighting to commodities.

Our advice is that instead of focusing on either growth or value ETFs, it’s best to pick ETFs that have a combination of growth and value. This is often known as a blended approach or style to investing. This way you diversify yourself across a wider range of companies and maximise your chance of owning the best stocks across different market environments.

We prefer simple broad market ETFs that choose companies based on size (i.e. market capitalization) instead of growth or value styles. It means you don’t have to predict what’s going to be the most popular stock next year or whether growth or value is going to outperform. Instead, own a portfolio that can handle all market conditions.