Shares and real estate have both generated reliable income and capital returns for Australians over the long-term, but whether to invest in property, shares (or both) often leads to heated debate.

Every so often a chart surfaces showing how dramatically Australian house prices have climbed over the past couple of decades. It is easy to look at those charts and conclude that property has outperformed shares and is the better long-term investment. After all, the percentage gains appear enormous and the numbers feel tangible in a way that share market indices often don’t.

The 67% of Australians who own the house they live in are usually passionate believers that property is the best investment – but what’s commonly believed isn’t always true, and the catch is that these comparisons are not comparing apples with apples.

Property and shares are rarely out of the news, with weekly predictions about Australian property bubbles and busts fuelling speculation and creating confusion for the majority of investors.

Against this tide of information overload, it is important to remember there are advantages and risks associated with both property and share ownership.

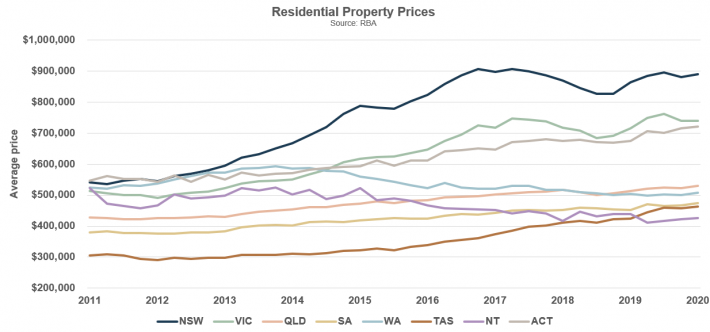

Source: Corelogic, Feb 2024

The Australian housing market

Historically there has been a belief in Australian culture that home ownership leads to an improvement in living standards, representing a symbol of success and security. Therefore people think it is the best investment for the long-term.

Since 1961, home ownership has been relatively stable at around 70%, with a decline in recent years to 67% due to stretched affordability. Home ownership tends to increase with age, alongside general increases in wealth.

However, recent analysis shows a rise in the proportion of renters, as buying a home becomes less affordable in all capital cities.

Despite recent price rises, there are significant risks associated with taking on a large mortgage including interest rate risk and lack of diversification.

Share ownership in Australia

Australia has one of the world’s highest share ownership rates, with around 35% of adults owning shares outside of their superannuation. (Source: ASX)

Owning shares doesn’t typically have the same level of personal attachment when compared to property, as the part-ownership of a business is less tangible than a physical house.

Notwithstanding this fact, shares have generated reliable income and returns for Australians over the long-run.

Investing in ETFs instead of individual shares

In the past 5 years, Australians investing in shares have increasingly turned to diversified products such as Exchange Traded Funds (ETFs) to reduce the risk of investing in single shares and provide access to international markets.

Investing in shares or property: what to consider

There are many factors to consider before deciding what is the best investment for you.

- Look at what you can afford and test different interest rate scenarios before making a major investment decision.

- What is your attitude to share market movements? Would you have the discipline to stay invested even during periods of market volatility?

- How stable is your income? Would you be able to continue paying a mortgage if something changed to you or your partner’s work situation?

- How much of your decision is impacted by tax? Tax law changes regarding property (negative gearing) and shares (franking credits and capital gains tax) could occur at any point in time.

- Consider your lifestyle, whether or not you have dependents and the kind of area that would be best to live in. Buying a property in an area with access to desired facilities such as public transport and schools may not always be immediately affordable.

- Can you commit the required time to maintain a property?

- Personal values and situations affect your decisions about opportunity costs and risk appetite for investing decisions. Social pressure can push individuals into making choices that are not best suited for them, even though these choices may have worked out well for others.

- Rather than buying property to live-in, some people buy property as an investment to rent out. This brings another whole other set of potential advantages and disadvantages. Two of the most common are negative gearing and landlord costs.

- Think about whether you should buy or rent.

Property vs shares: returns

When comparing property vs shares, raw house price growth can be misleading. House price data only shows what a buyer paid on a specific day, it ignores the ongoing costs of property ownership; including maintenance, renovations, holding costs, and transaction fees.

Homes are not static assets. According to the ATO, a dwelling has a useful life of 25 to 40 years, meaning major components like kitchens, bathrooms, roofing, plumbing, wiring, and outdoor areas must be replaced or upgraded over time just to keep the property functional.

With the average Australian home now worth over $1 million, this implies homeowners may need to reinvest close to the full value of the dwelling every few decades simply to maintain its value. These hidden reinvestments, often hundreds of thousands of dollars or more, are never reflected in headline property growth figures, yet they materially inflate the returns people attribute to real estate.

Shares work very differently. Long-term returns for indices like the ASX 300, S&P 500, or Nasdaq already include all reinvestment required to keep businesses competitive.

Companies replace ageing assets, invest in technology and staff, and fund growth internally before paying dividends. The returns investors see are net of those costs, not gross. In contrast, property investors must pay ongoing expenses out of pocket, with gross rental yields around 3% and net yields often far lower once rates, insurance, maintenance, land tax, void periods, and transaction costs are considered.

The RBA estimates basic holding costs alone of property is around 2.6% per year, meaning much of the rent simply preserves the asset rather than generating real income.

Shares, on the other hand, pay dividends after costs, often boosted by franking credits, and can be bought or sold at a fraction of the transaction cost of property.

When people point to raw house price growth and declare property the winner, they are unintentionally comparing two very different things.

Property figures combine land value appreciation with hidden renovation and replacement spending. Share market figures include all reinvestment inside the company plus dividends paid out to investors.

One number is gross. The other is net.

Property vs shares: comparison

Investing in property or shares both have advantages and disadvantages. Below are some factors to consider before making a decision to invest in either.

| Consider | Property | Shares |

| General | Pros: – Peace of mind and stable place of residence – Flexibility to renovate Cons: – Lack of liquidity and unable to quickly change mind after the initial commitment | Pros: – Easily bought and sold – Regular income from dividends Cons: – Not a physical asset – Generally more volatile in the short-term |

| Diversification | Pros: – Lack of correlation with other asset classes and good protection against inflation Cons: – Poor diversification and highly concentrated in a single asset | Pros: – Easy to gain exposure to the entire index of thousands of companies to reduce risk Cons: – The entire market can also have periods of weak performance |

| Leverage Risk | Pros: – Able to borrow more and leverage returns which can be great during times of low interest rates Cons: – Higher repayments if interest rates rise – Leverage magnifies losses so you can lose more than you invested | Pros: – No leverage means you can’t lose more than you invested – Interest rates typically have less impact on share prices Cons: – No benefits of higher leverage during periods of high growth |

| Taxes and transaction costs | Pros: – Potential for negative gearing benefits Cons: – Relatively high transaction costs associated with buying, selling and property maintenance | Pros: – Potential for franked dividend benefits – Transaction costs and fees can be low – Involves very little ongoing effort after an initial investment Cons: – Capital gains tax when shares are sold |

This article was adapted and published in The Australian ‘The hidden costs that prove Australian property is not the best investment‘ publication date 16 December 2025.