Inflation changes which assets lead returns. In this blog we answer the most common questions about the Topaz Inflation Portfolio.

Why are people opting for inflation-focused investment portfolios?

Inflation doesn’t just reduce purchasing power, it changes which assets drive returns. When inflation expectations rise and stay elevated, traditional growth portfolios built around shares and bonds can behave very differently to what investors expect.

Stockspot’s Topaz Inflation Portfolio was designed as an alternative way for high-growth investors to pursue long-term returns when inflation matters more. Rather than relying on income or a single inflation hedge, the portfolio combines a diversified mix of assets that have historically performed better across inflationary environments; including commodities, precious metals, infrastructure, emerging markets and inflation-linked bonds.

Since launch in October 2023, this approach has delivered strong results, including a 50.4% return in 2025, while remaining focused on the core objective: protecting purchasing power over full market cycles.

Why build an inflation-focused investing portfolio?

The core idea is simple:

inflation changes which assets lead returns.

In low and stable inflation environments, most growth portfolios behave similarly. Shares are driven by earnings growth, bonds provide diversification, and inflation isn’t the dominant risk. But when inflation expectations rise, those relationships start to break down.

Bonds can become less defensive. Long-duration growth assets become more sensitive to interest rates. Real assets, such as commodities, precious metals and infrastructure, tend to play a much larger role in protecting purchasing power.

The Topaz Inflation Portfolio is designed for high growth investors who want to explicitly address that risk, rather than relying on a traditional share-and-bond mix built for a low-inflation world.

Why does inflation change how investment portfolios behave?

Inflation isn’t a single state, it comes in regimes that can last for many years.

History shows that when inflation expectations rise and persist, asset leadership can shift dramatically. The 1970s are a classic example: both shares and bonds delivered weak real returns over the decade, while gold rose around 20-fold.

More recently, markets repriced inflation risk again in 2024 – 2025. Precious metals were a clear beneficiary, supported by:

- Geopolitical risk and trade tensions

- A weaker US dollar

- Record central bank gold buying

- High global debt levels limiting interest rate increases

These forces reinforced the role of inflation-sensitive assets as both return drivers and diversifiers.

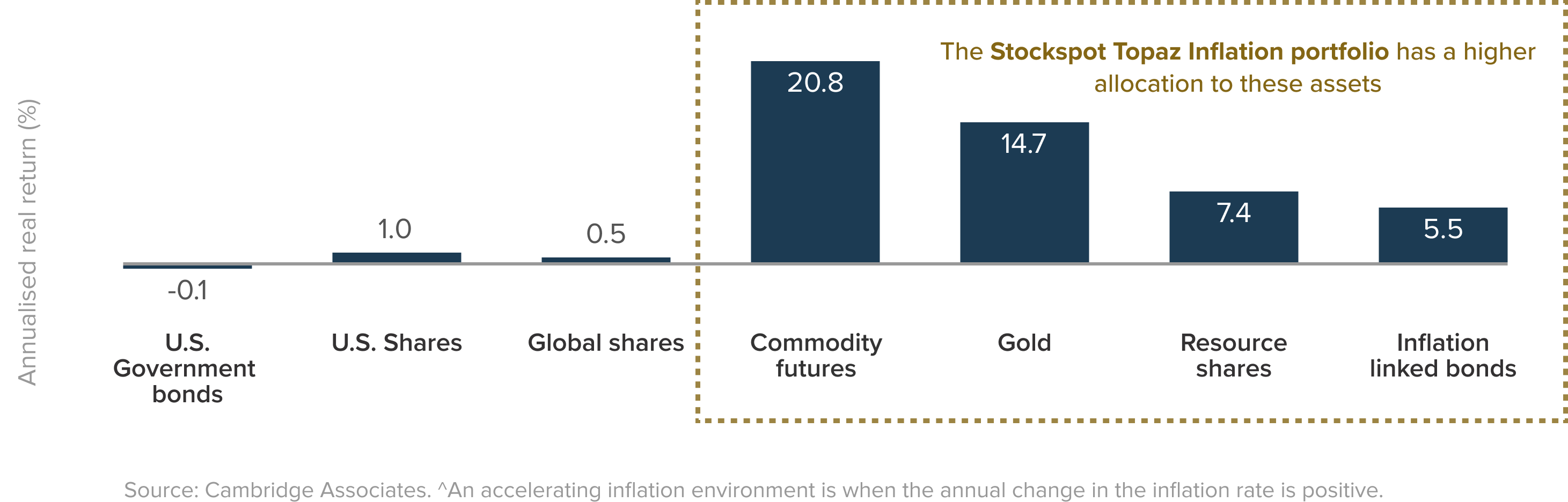

Asset returns after inflation (real returns) during periods of accelerating inflation 1979-2019^

What assets does the Topaz Inflation Portfolio invest in?

Rather than relying on a single hedge, the portfolio combines multiple inflation-sensitive assets, each playing a different role:

- Gold and silver: Tend to perform well when real interest rates fall and when confidence in financial assets weakens

- Gold miners and resource equities: Provide leveraged exposure to rising commodity prices

- Broad commodities: Benefit as input prices rise across the global economy

- Infrastructure: Often has revenues linked to inflation through regulated pricing or long-term contracts

- Emerging markets: Can benefit when inflation is linked to global growth and demand

- Inflation-linked government bonds: Provide explicit CPI protection and help manage volatility

This diversification is deliberate. Inflation rarely affects every market in the same way, and leadership can rotate over time.

You can view the current portfolio structure and allocations on our website or within our product factsheet.

Why do these assets tend to perform better when inflation is above 2 – 3%?

When inflation sits comfortably within central bank targets, it tends to fade into the background. But as inflation rises above that range, it becomes a dominant driver of returns.

At higher inflation levels:

- Bonds become less reliable as diversifiers

- Long-duration growth assets become more rate-sensitive

- Real assets play a larger role in preserving purchasing power

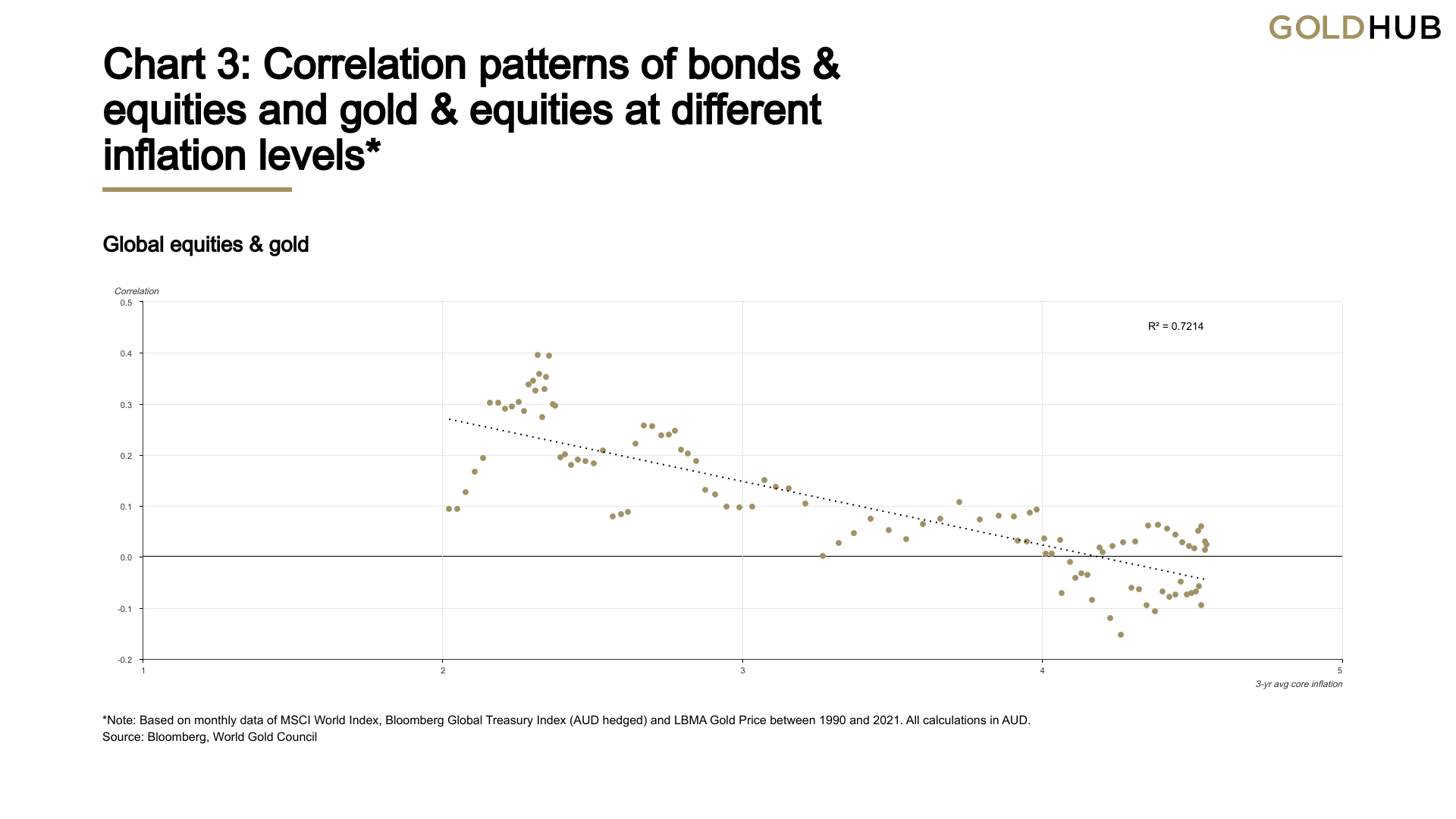

For Australian investors in particular, history shows that bonds lose diversification power as inflation increases, while assets like gold become more effective.

The Topaz Inflation Portfolio is designed to lean into that environment while still targeting long-term growth.

Should an inflation portfolio focus on income and why doesn’t Stockspot Topaz inflation?

Income often feels reassuring because it’s tangible, you see cash hitting your account. But income and capital growth are interchangeable. What matters is total return after inflation.

A portfolio can pay an attractive yield and still lose purchasing power if inflation rises faster than that income. We’ve seen this play out across many income-focused funds that delivered weak real returns despite high yields.

The Topaz Inflation Portfolio deliberately produces lower income (currently under 2% per year), with most returns delivered through capital growth. This can also be tax-efficient, as more return is deferred rather than paid out annually.

Yield is a by-product, not the goal.

What drove the strong performance in 2025 for Stockspot Topaz Inflation?

Precious metals were the standout performers in 2025:

- Gold rose over 60%

- Silver gained around 130%

- Gold mining equities surged roughly 140%

These moves were driven by inflation expectations being reassessed globally, alongside geopolitical and structural factors.

Because the portfolio already held meaningful allocations to these assets, investors benefited from the upside. At the same time, disciplined rebalancing helped manage risk as prices rose.

Over the 2025 calendar year, the portfolio returned 50.4%, and 80.8% p.a. since inception.

What is the future for Inflation portfolios after Stockspot Topaz Inflation’s strong returns in 2025?

Gold, silver and related assets are treated as strategic allocations, not short-term trades.

Returns will vary year to year, and recent performance is unlikely to repeat in a straight line. But even when precious metals lag, they can still add value by behaving differently as inflation expectations shift.

The Stockspot Topaz Inflation portfolio is designed so the winners rotate over time, rather than relying on any single asset to do all the work.

What do investors need to know about Topaz inflation vs standard Topaz portfolio?

Over the very long run, we expect Topaz Inflation and Topaz to deliver broadly similar returns – both are high growth portfolios.

The reason returns have diverged since late 2023 is asset repricing. Markets reassessed long-term inflation risk, and assets like gold and silver were repriced higher.

Where the Inflation portfolio is designed to differ is during periods when inflation proves more persistent than expected. History suggests those regimes can last much longer than investors assume.

Our goal isn’t to forecast a repeat of the 1970s, it’s to ensure investors are positioned for inflation-driven regime shifts, while remaining diversified and focused on long-term outcomes.

This article is adapted from my interview with Livewire Markets: Inside Chris Brycki’s unconventional inflation-busting portfolio published 22 Jan 2026