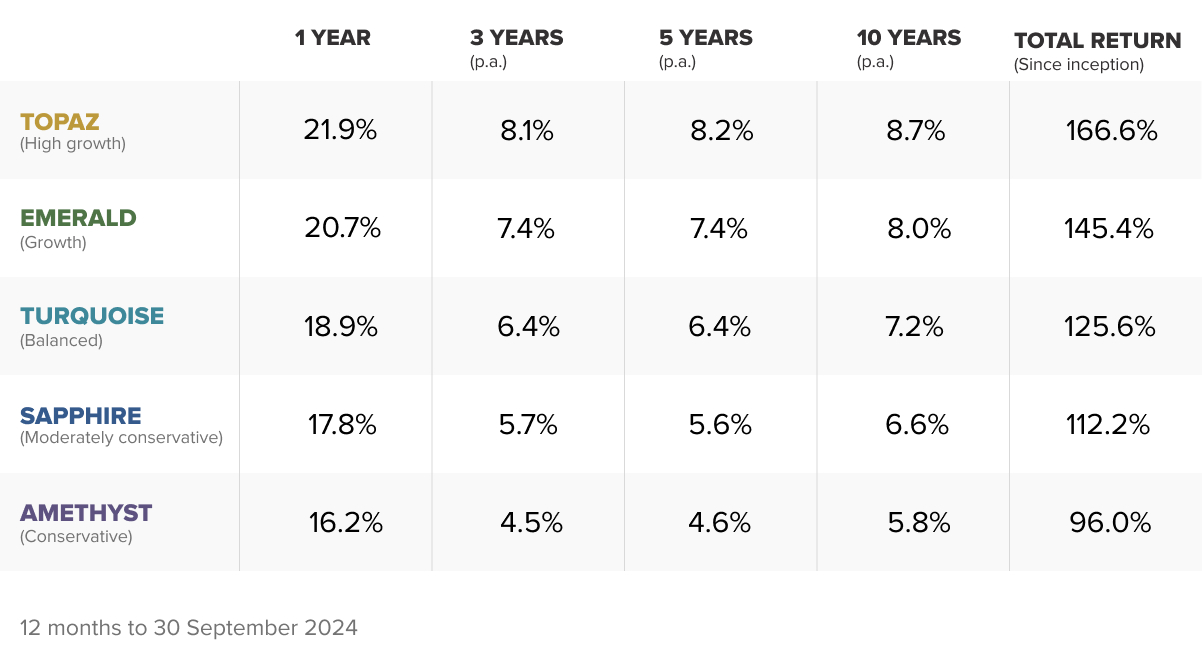

Stockspot’s performance for the 12 months to 30 September 2024 was close to its historical best in both the Stockspot Model Portfolios and Sustainable Portfolios.

Our five core options returned 16.2% to 21.9% after fees while our Sustainable options returned between 17.3% and 23.1%.

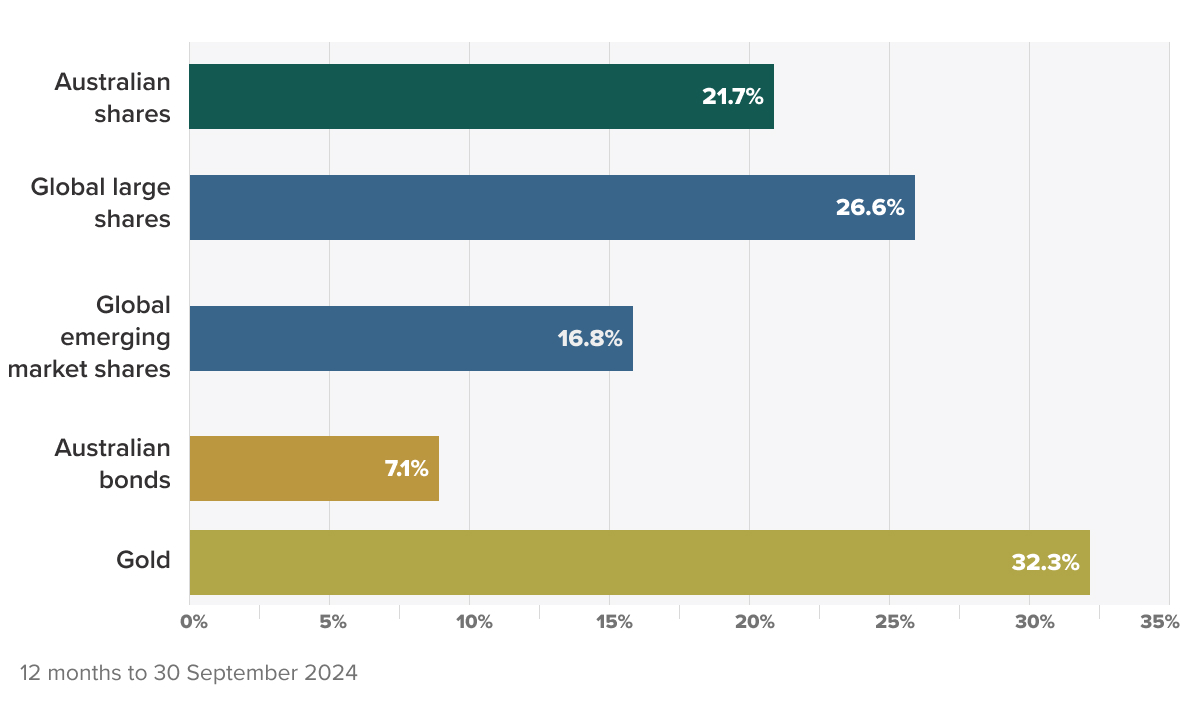

Gold was the standout investment, returning 32.2% over the year. With all portfolios holding a 14.8% allocation, it contributed 4.8% to each portfolio’s return.

The Stockspot portfolios have outperformed 99% of similar diversified funds in Australia over the last 10 years.^

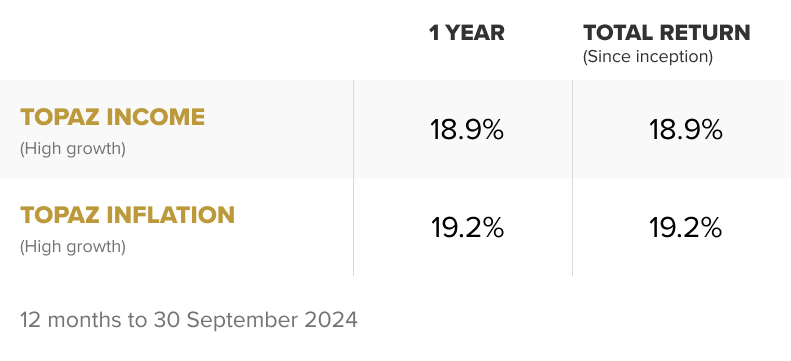

Income and Inflation portfolio returns

Our Topaz Income and Topaz Inflation portfolios have completed their first 12 months, delivering solid after-fee returns of 18.9% and 19.2% respectively.

Both of these portfolios are designed to carry a similar level of risk as the Topaz portfolio. However due to their tilts towards income-generating and inflation-linked assets, their returns will vary from the Topaz returns from year-to-year.

In the Topaz Income portfolio, international property performed exceptionally well, achieving a 25.9% return as investors anticipated U.S. interest rate cuts.

In the Topaz Inflation portfolio, gold miners bolted by 41.5%, driven by record-high gold prices, while global infrastructure added 25.1%. The only investment with a negative return over the year was the commodity ETF as grains and oil prices fell.

Emerging markets rise

Within the core portfolios, our Emerging markets ETF surged 5.3% in September, reaching its highest level since April 2022. This rally was largely fueled by the Chinese share market, which soared 25% in the final week of the month – marking its biggest weekly gain since the 2008 Global Financial Crisis.

China’s consumer economy has faced challenges with low confidence, declining real estate prices, and liquidity issues impacting major property developers. However, in September China introduced unexpected stimulus measures aimed at boosting economic growth. These included cutting a key short-term interest rate, lowering the reserve requirement ratio for banks, and injecting 800 billion Chinese yuan in liquidity support.

The sharp rise in Chinese shares and the Emerging Markets ETF serves as a reminder of the importance of staying diversified, even when some assets go through periods of underperforming. While emerging markets have struggled with poor returns over recent years, their different growth drivers compared to Australian or U.S. shares can help balance portfolios, especially when other assets aren’t as strong.

Here is a recent article we wrote answering some common client questions about emerging market shares.

Diversified investors do best

We know that active funds often lag behind the market index, but did you know that many investors also underperform compared to the investment products they choose? This phenomenon, known as the ‘behaviour gap’, is usually caused by attempts to time the market, leading to poorly timed entry and exit points.

The recent 2024 Mind The Gap study by Morningstar found that investors underperformed the funds they invested in by between 0.4% and 2.6% per year.

While that may sound concerning, it’s actually encouraging for those who are diversified across different assets. Asset allocation funds (like the Stockspot portfolios) saw the smallest behavioural gap at 0.4%, likely due to their lower volatility and the understanding among investors that timing the market is notoriously difficult.

In contrast, individual sector funds saw a 2.6% gap – a significant loss for those chasing hot market sectors!

One of Stockspot’s key strengths that consistently comes up in client conversations is our ability to minimise this behaviour gap by promoting consistent investing over market timing, and stressing the benefits of diversification across different asset classes.

^Stockspot, morningstar.com.au comparison group of 330 surviving investment funds and their after-fee returns over the 10 years from 1 October 2014 up to 30 September 2024. Comparison is based on the after-fee returns of a Silver tier investment in either Stockspot Amethyst, Turquoise or Topaz portfolios (our most popular portfolio in each risk category) on the basis that they have similar exposure to growth assets to the moderate, balanced and growth multi-sector investment funds that have been compared. Past performance is no indication of future performance.