For Australians wanting to invest in the largest U.S. companies, there is no better way to do it than through the S&P 500.

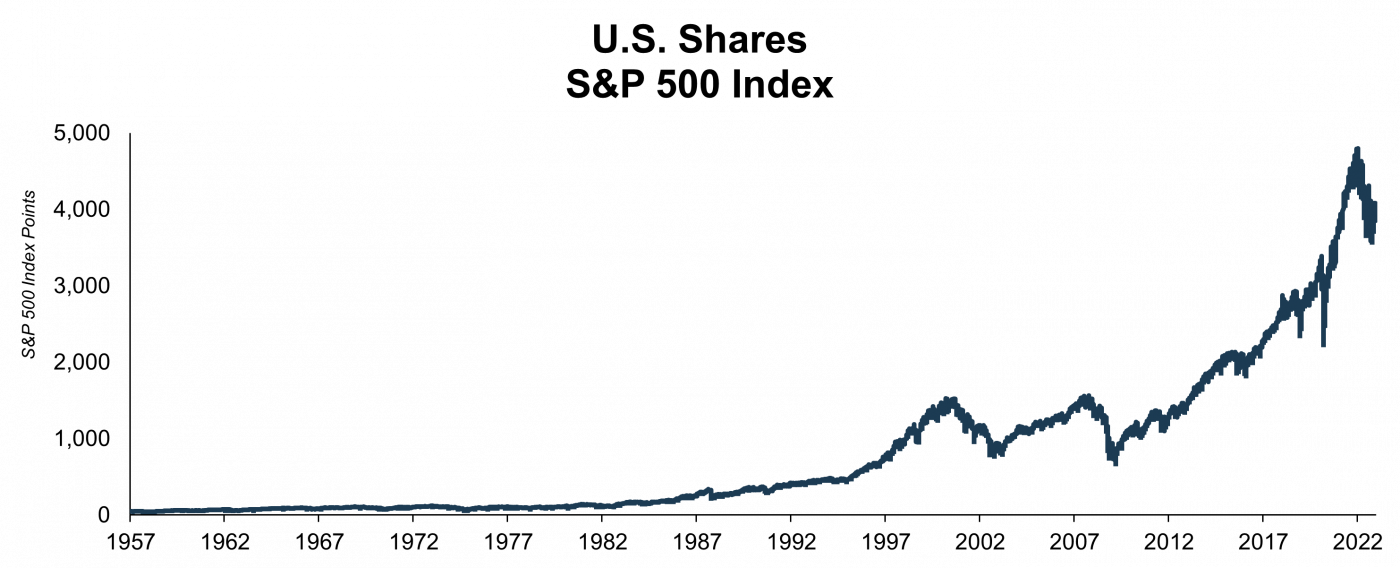

The S&P 500 index has been one of the best ways to invest and grow your wealth. Since its inception in 1957, the S&P 500 has averaged returns of about 10% per year. Understanding how to invest in the most common share market index in America is important for any savvy investor.

In this article, we explain what the S&P 500 index is, what’s inside it, the best strategies to invest in it, and how it’s performed over different time periods.

- What is the S&P 500?

- How do I invest in the S&P 500?

- Why should I invest in the S&P 500?

- When is the best time to invest in the S&P 500?

- Which is the best U.S. index?

- Which companies and shares are inside the S&P 500?

- What sectors are inside the S&P 500?

- What returns has the S&P 500 earned?

- How Stockspot helps you invest

What is the S&P 500?

The S&P 500 is a stock market index of the largest 500 companies listed in America, including household names like Apple, Amazon, Microsoft and Tesla.

The index is managed by Standard & Poor’s (a rating agency and index provider) who are well-regarded experts in share market performance.

An index is a measure to track the performance of an investment strategy or particular market. Investors cannot invest directly in an index, but can do it via index-linked products like ETFs.

How do I invest in the S&P 500?

In the past, to invest in U.S. companies meant you had to open up a brokerage account that had access to international securities. You then had to deposit Australian dollars, convert this into U.S. dollars and then buy the securities including paying high brokerage and foreign exchange fees.

Today, it’s as simple as buying shares on the ASX. In fact, you can invest in the S&P 500 via the ASX.

Exchange Traded Funds (ETFs) are the easiest way to invest in a share market index like the S&P 500 index. ETFs invest in a market ‘index’, which is cheaper and less risky than picking individual shares because of the diversification (spreading your money across lots of assets) they give you.

At Stockspot, we invest in ETFs for clients that track different market indices so within any portfolio there is a wide range of companies.

Why should I invest in the S&P 500?

Investing into the U.S. share index has provided returns of 10% per year since it started in 1957. It also has a few key benefits over active investing (picking individual shares):

- Fees tend to be much lower with index investing.

- Buying the entire market index tends to be more tax efficient than paying someone to actively buy and sell shares.

- The index tends to be less risky than buying individual shares and isn’t reliant on a fund manager guessing when to buy or sell.

When you invest in the index with ETFs, you directly benefit from the market index rising over time, and from the dividends from the companies inside the index

In Australia there are three ETFs that invest in the S&P 500:

- iShares S&P 500 ETF (ASX: IVV)

- iShares S&P 500 AUD Hedged ETF (ASX: IHVV)

- SPDR S&P 500 ETF Trust (ASX: SPY).

When is the best time to invest in the S&P 500?

There is no “best time” to invest.

We recommend clients dollar-cost average (i.e. top up your investments regularly) when they invest into the index. Dollar-cost averaging is one of the most powerful ways to get ahead when you invest. It is quite a simple investment strategy that involves making small, regular, contributions to your investment portfolio.

If you invest small amounts regularly over a period of time you’ll buy into the market index at an average price over time. That way you get to take advantage of any market dips (and pay a lower price) or gains if markets rise.

Which is the best U.S. index?

Here are four major U.S. market indices you might consider investing in.

S&P 500

The S&P 500, founded in 1957, is the index most commonly used by retail investors. It contains 500 of the largest companies listed on the New York Stock Exchange (NYSE) and NASDAQ and covers about 80% of the entire U.S. share market by size.

Russell 2000

The Russell 2000 tracks the performance of 2000 small companies (often referred to as small-caps) listed on the NYSE and NASDAQ.

NASDAQ 100

The Nasdaq 100 tracks the performance of 100 of the largest non-financial companies listed on the NASDAQ, most commonly including many of the leading technology-related companies

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average tracks the performance of 30 large publicly traded companies listed on the NYSE and NASDAQ. Unlike the above indices, the DJIA is a price-weighted index, meaning that the share price of each company, rather than the size of the company, determines its impact on the index.

Which companies and shares are inside the S&P 500?

The S&P 500 is market-size based which means that a company’s weight within the index is relative to its total market value (i.e. share price multiplied by the number of tradable shares on issue).

Interestingly, the number of companies actually in the index isn’t always exactly 500. For example, Alphabet Inc. (the parent company of Google) has two types of share classes included in the S&P 500 but it is still considered one company.

Every quarter, new companies enter and exit the index based on their market size. This helps to ensure that poor-performing companies that get too small are removed.

As of December 2022, these are the largest 10 companies in the S&P 500 index and their relative size in the index.

| Company | Share Code | Weight in S&P 500 |

| Apple | AAPL | 6.2% |

| Microsoft | MSFT | 5.6% |

| Amazon | AMZN | 2.4% |

| Berkshire Hathaway | BRK | 1.7% |

| Alphabet Class A | GOOGL | 1.7% |

| United Health Group | UNH | 1.5% |

| Alphabet Class C | GOOG | 1.5% |

| Johnson & Johnson | JNJ | 1.4% |

| Exxon Mobil Corp | XOM | 1.3% |

| NVIDIA | NVDA | 1.3% |

What sectors are inside the S&P 500?

When you invest in the market index you get access to the many different sectors that drive the economy. In the U.S., technology and healthcare dominate the share market index. However, you also get to invest in a range of other sectors like financials, industrials and energy.

What returns has the S&P 500 earned?

The U.S. share market index has enjoyed strong returns of around 10% p.a. (in USD terms) over 20 years even with some bumps along the way including the global financial crisis.

Provided you’re investing for at least a few years, the S&P 500 is more likely to give you a better return than leaving your money in the bank.

When investing in the U.S. share market index, we encourage clients to think long-term and make sure they’re combining U.S. shares with other investments like gold, bonds and Australian shares.

These other assets can also be accessed using index ETFs. Adding other ETFs also improves your diversification and gives you a smoother ride when you invest, buffering against inflation and market volatility.

Performance of popular U.S. share market indices

| INDEX | 1 YEAR | 3 YEARS (P.A.) | 5 YEARS (P.A) | 10 YEARS (P.A.) | 20 YEARS (P.A.) |

| S&P 500 | -9.2% | 10.9% | 11.0% | 13.3% | 9.8% |

| Russell 2000 | -13.0% | 6.5% | 5.5% | 10.1% | 9.4% |

| Nasdaq 100 | -26.2% | 9.8% | 10.8% | 14.3% | 10.8% |

| Dow Jones Industrial Average | 0.3% | 7.2% | 7.3% | 10.3% | 7.0% |

How Stockspot helps you invest

Stockspot’s easy-to-use platform for investing gives you access to a portfolio of low-cost index funds (known as ETFs) that’s specifically matched to you.

We manage a proven, highly successful wealth strategy based on Nobel Prize winning research and championed by global investment sages such as Warren Buffett.

Our philosophy is simple: invest in a broad mix of low cost, low-risk products to harness the long-term power of compound growth.

We allow clients to invest in the S&P 500 through Stockspot Themes via the iShares S&P 500 ETF (ASX: IVV).