There are generally two styles of investing – value investing and growth investing – and consequently, growth ETFs and value ETFs that suit both options.

Value investing, which was popularised by investor Benjamin Graham in the 1930s, involves buying stocks that appear underpriced or undervalued as well as focusing on companies that pay good dividends.

Growth investing, on the other hand, involves buying stocks that have higher expected growth in sales, earnings or cash flows.

These stocks choose to reinvest profits back into the company rather than paying it out as dividends to shareholders and generally have higher valuations than value stocks.

What is a growth ETF?

There are tens of thousands of companies around the world that could be considered growth stocks, which is why growth ETFs, which invest in an index of such companies, have become popular.

Growth ETFs look for companies that display growth characteristics, such as rising sales and high valuations, and tend towards those in high growth sectors such as tech.

A good growth ETF can identify companies with strong earnings potential, and most of the returns gained will come from capital growth rather than dividends.

What are the best growth ETFs on the ASX?

There are no ETFs on the ASX that exclusively track a growth share index. However there are active ETFs focused on identifying growth stocks and other index ETFs that have a high proportion to growth companies.

Below are 15 ETFs on the ASX with the high exposure to growth companies.

| ASX code | ETF Name | Growth companies exposure | Management fee |

| HYGG | Hyperion Global Growth Companies Fund (Managed Fund) | 95% | 0.70% |

| MCGG | Munro Concentrated Global Growth Fund (Managed Fund) | 90% | 0.70% |

| FANG | ETFS FANG+ ETF | 89% | 0.35% |

| MAET | Munro Global Growth Fund (Hedged Fund) | 85% | 1.35% |

| RBTZ | BetaShares Global Robotics and Artificial Intelligence ETF | 81% | 0.57% |

| WCMQ | WCM Quality Global Growth ETF (Quoted Managed) | 81% | 1.25% |

| ATEC | BetaShares S&P/ASX Australian Technology ETF | 76% | 0.48% |

| CLDD | BetaShares Cloud Computing ETF | 66% | 0.67% |

| NDQ | BetaShares NASDAQ 100 ETF | 61% | 0.48% |

| OPPT | Magellan Global Opportunities Fund – Active ETF | 59% | 1.50% |

| MKAX | Montaka Global Extension ETF | 54% | 1.25% |

| CRYP | BetaShares Crypto Innovators ETF | 50% | 0.67% |

| HGEN | ETFS Hydrogen ETF | 40% | 0.69% |

The majority of high growth ETFs listed on the ASX hold global companies, as the Australian market has fewer growth-focused sectors, such as technology and biotech.

Still, global share ETFs have been some of the most popular ETFs on the ASX.

Just because an ETF has high exposure to growth companies however, it does not mean they give you the best returns.

Many of the above ETFs are thematic ETFs that have experienced large swings.

There are also active ETFs, which aim to outperform an index, but as our research has shown, more than 80% of active fund managers underperform.

Returns

| ASX Code | 1 Year Returns % | 3 Year Returns % (p.a.) | 5 Year Returns % (p.a.) |

| HYGG | 40.8% | 34.2% | N/A |

| MCGG | 36.2% | 30.0% | N/A |

| FANG | 49.9% | 49.4% | 26.7% |

| MAET | 24.9% | 20.1% | N/A |

| RBTZ | 14.5% | 24.0% | 6.7% |

| WCMQ | 43.2% | 30.1% | 16.5% |

| ATEC | 23.0% | 30.5% | 13.0% |

| CLDD | 20.9% | 13.0% | N/A |

| NDQ | 29.7% | 29.6% | 19.0% |

| OPPT | N/A | N/A | N/A |

| MKAX | 22.5% | 29.6% | 10.5% |

| CRYP | 78.5% | 48.1% | N/A |

| HGEN | 52.3% | -2.1% | N/A |

The best-performing long-term growth ETF has been the Global X FANG+ ETF (FANG) returning 26.7% over the past five years. The second best performing ETF was BetaShares NASDAQ 100 ETF (NDQ), which has returned over 7.7% p.a. less at 19.0% p.a. over the five years to 30 September 2025.

NDQ, which tracks the U.S. technology sector, is offered to Stockspot clients as a Stockspot Theme.

The best performing growth ETF over a 1 year period was the Betashares Crypto Innovators ETF ASX: CRYP which returned 78.5%, followed by Global X Hydrogen AUD ETF (HGEN), which generated 1 year returns of 52.3%. The volatility of cryptocurrency returns can be seen with CRYP posting almost 78% 1 year returns as at 30 September 2025, while the ETF posted 1 year returns of -11.7% in the 12 months to 31 March 2025, illustrating the swings the ETF experiences.

Should you invest in Growth ETFs?

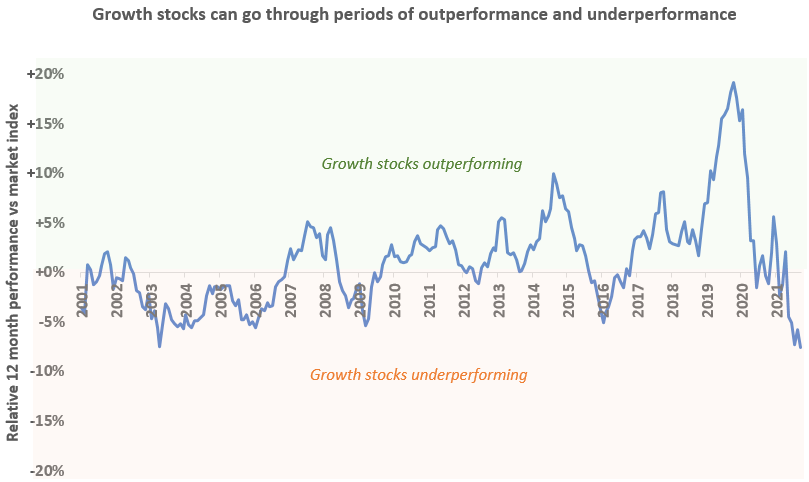

Growth ETFs have the ability to produce high capital growth returns, but they also come with more volatility.

If you can’t handle volatility, including large daily price falls or drawdowns of more than 50%, then it might be better to stick with a simpler investing strategy.

Stockspot recommends investing in simple ETFs such as the broad Australian and global shares ETF (ASX: VAS and ASX: IOO).

Are high growth ETFs a good investment for 2025?

Growth ETFs can enjoy better returns than other strategies, but there are times when growth does well and times when it performs poorly.

In 2024, growth ETFs rose more due to rising interest rate and inflation expectations, whereas value ETFs have underperformed due to their high weighting to commodities.

Our advice is that instead of focusing on either growth or value ETFs, the best option is to pick ETFs that have a combination of growth and value. This is often known as a blended approach or style to investing.

This way you diversify yourself across a wider range of companies and maximise your chance of owning the best stocks across different market environments.

We prefer simple broad market ETFs that choose companies based on size instead of growth or value styles.

It means you don’t have to predict what’s going to be the most popular stock next year or whether growth or value is going to outperform and instead, own a portfolio that can handle all market conditions.