Playing 2-up this Anzac Day? Here’s something you can throw back at anyone who questions your judgement to take part in this Aussie tradition.

You’ve got a better chance of success at 2-up than you do making money on picking shares. Your chance of making money buying shares is 43%. At least in 2-up you have a 50% chance of walking away ahead.

How can investing in shares be worse than actual gambling?

It all comes down to the numbers.

A recent university study from Hendrik Bessembinder of Arizona State University analysed one month returns of every U.S. share traded on the major US stock exchanges since 1926.

That’s a lot of analysis: 25,782 different shares and 3,524,849 monthly returns from July 1926 through December 2016.

What he found may surprise those who think the odds are on your side when investing in shares. Only 43% of all the share returns were even positive compared to leaving money in Treasury bills. Most shares lost their investors money both on a monthly basis and for as long as a share was listed.

How can the share market go up if only 43% of shares rise?

The reason that the market rises overall in the long-run is statistical: A stock (like CSL, Apple or Alphabet) can rise by thousands of percent, while a loser can only fall by 100%.

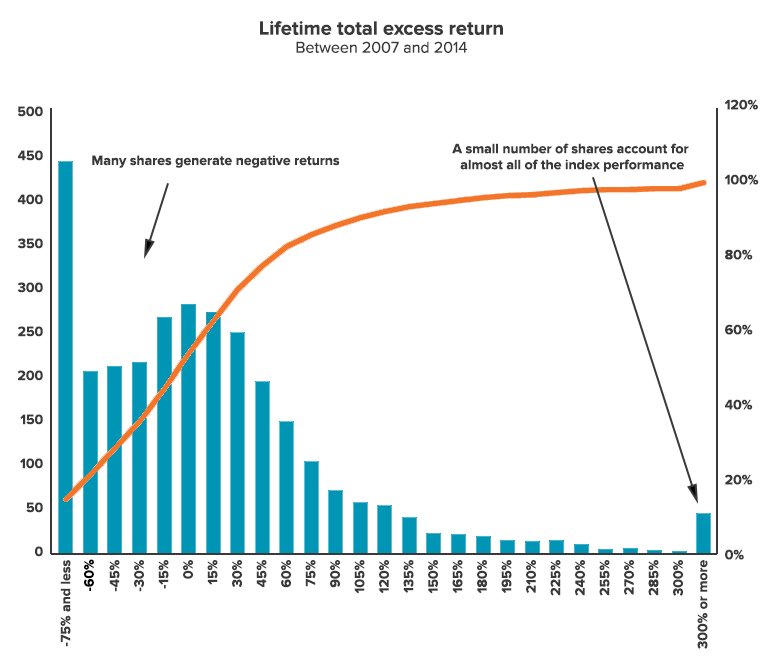

According to the Bassembinder study, the best-performing 2.4% of listed shares accounted for the entire wealth creation of the U.S. stock market since 1926.

A similar study from J.P. Morgan showed almost identical results. Two-thirds of stocks underperformed the broad market index between 1980 and 2014. The huge majority of overall index returns came from less than 7% of shares.

Anyone who buys shares, including professionals expect the ones they pick to be winners. The reality is that most are not. That’s why picking individual stocks relies heavily on luck. Picking stocks might mean you avoid some losers, but what’s worse is you’re likely to miss the small handful of shares that drive all of the market’s returns.

That handful of shares is always changing too – over the past 5 years it’s been Apple, Alphabet, Nvidia and Amazon. In the 90s in the US it was Dell, Lucent, Pfizer and Walmart.

Nobody has been able to repeatedly predict them in advance. Even the great Warren Buffett completely missed Alphabet and Amazon and only started buying Apple in 2016.

The lesson?

If you invest in a few shares you’re really just relying on dumb luck. Statistically speaking you’re better off playing 2-up where at least the odds are fifty fifty.

If you want to harness the long term growth of the share market, broad diversification is the only consistent way to do it. It ensures you own all of the winners and earn a decent return. Thanks to ETFs it’s easy and inexpensive to do.

Owning the entire market via an ETF guarantees you don’t miss the small group of stocks that are generating all of the market returns. It skews the odds back in your favour.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.