One of the benefits with investing in the Stockspot portfolios is that they provide diversification not only across asset classes, but also across industry sectors and geographical regions.

The exchange traded funds (ETFs) chosen to make up the Stockspot portfolios provide clients with access to a large diverse range of stocks and bonds from around the world in a cost effective manner, including well known businesses like Apple, Google, Woolworths and Westfield.

Here is a summary of some of the underlying investments within the Stockspot portfolios as at January 2015.

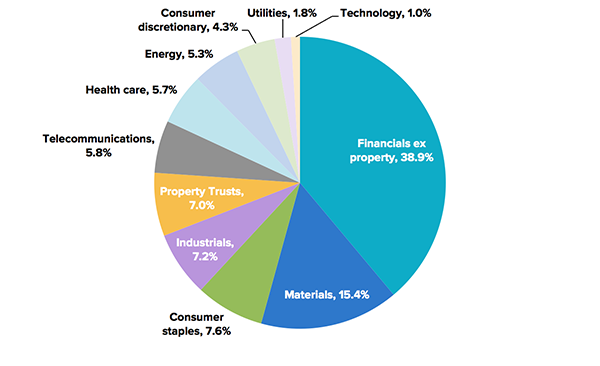

Australian shares

Selected ETF: VAS – Vanguard Australian Shares Fund

The Vanguard Australian Shares Fund tracks the S&P ASX/300 Index and provides exposure to approximately 290-300 of the largest companies and property trusts listed on the Australian Securities Exchange (ASX). Stocks are predominantly invested in financials, materials, consumer staples, industrials and property trusts.

Stocks within the fund include:

- Commonwealth Bank

- Westpac

- BHP Billiton

- ANZ

- NAB

- Telstra

- Westfarmers

- Woolworths

- CSL

- Rio Tinto

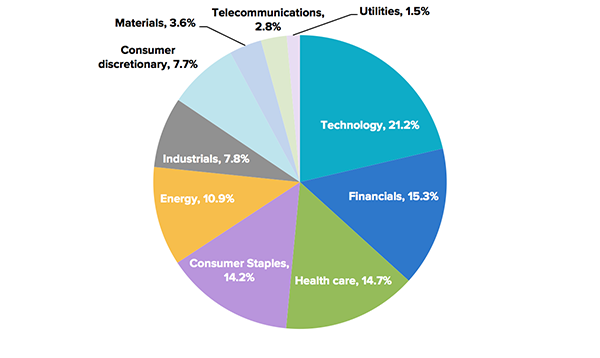

Global shares

Selected ETF: IOO – iShares Global 100 Fund

The iShares Global 100 Fund tracks the performance of 100 transnational companies of major importance in global markets with a minimum market capitalisation of US$5 billion.

Technology, financial, healthcare, consumer staples and energy stocks make up the biggest portion of the fund portfolio. Technology is a sector that most domestic Australian investors have very little exposure to so by investing in global companies, Stockspot enables Australians to increase the technology exposure of their portfolios.

Stocks within the fund include:

- Apple

- Microsoft

- Exxon Mobile Group

- Johnson & Johnson

- GE

- JP Morgan Chase

- Pfizer

- HSBC

- Toyota

- Coca Cola

- Citigroup

- 3M

- Vodafone

- Voltswagen

- L’oreal

- Canon

- Westfield

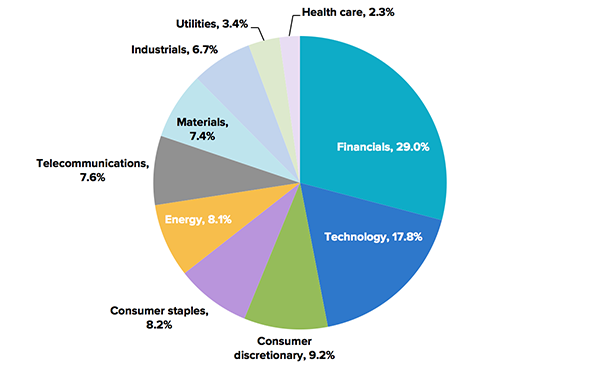

Emerging markets

Selected ETF: IEM – iShares MSCI Emerging Markets Fund

The iShares MSCI Emerging Markets Fund tracks the performance of large- and mid-capitalisation equities in emerging markets such as China, Korea, Taiwan, Brazil, South Africa and India. Financial and technology stocks make up the biggest 2 sectors in the portfolio.

Stocks within the fund include:

- Samsung (Korea)

- Taiwan Semiconductors (Taiwan)

- China Mobile (China)

- Bank of China (China)

- Itau Unibanco (Brazil)

- Infosys (India)

- China Life Insurance (China)

- Gazprom (Russia) – gas company

- Naspers (South Africa) – ISP

- KB Financial Group (Korea)

- KIA Motors (Korea)

- Sanlam (South Africa)

- Walmart de México (Mexico)

- Qatar National Bank (Qatar)

- AmBev Brewing Company (Brazil)

- Tata Consultancy (India)

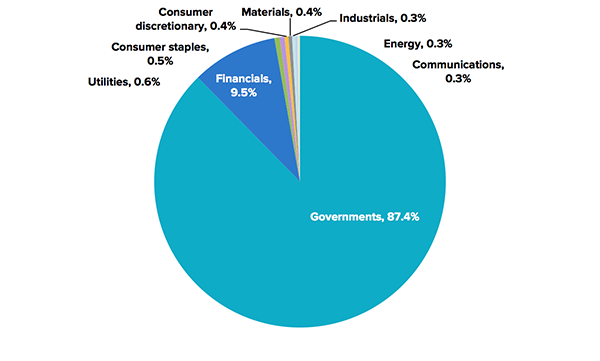

Bonds

Selected ETF: IAF – iShares UBS Composite Bond Fund

The iShares UBS Composite Bond Fund invests primarily in investment grade fixed income securities issued by the Australian Government, state governments, supranational and sovereign agencies, and corporate debt issues.

Bond securities within the fund include:

- Australian Government

- Queensland Treasury

- NSW Treasury

- Treasury of Victoria

- European Investment Bank

- Asian Development Bank

- ANZ

- ING Bank

- Goldman Sachs

- WA Treasury

- Export Development Canada

- Commonwealth Bank

- BHP Billiton

- Wells Fargo

- Lend Lease

One of the main benefits of diversification is that individual stock risk can be drastically reduced. The Stockspot portfolios spread investments across over 1,400 different companies from around the world and there are only a handful of companies which make up more than 1% of the portfolios. Even billionaire investor Warren Buffett agrees that diversification via low-fee index funds is the smartest way to access market returns.1

Find out how Stockspot makes it easy to grow your wealth and invest in your future.