We all know that fees eat into our savings and investments but how much of an impact do they really have? And, are investment fees worth it?

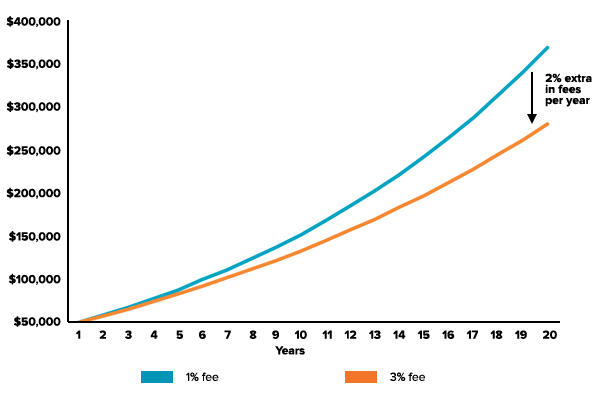

When we did the calculations, the difference in final amounts after fees ended up being hugely different.

Paying just few per cent per year in fees may not sound like much, but it could easily end up costing you more than $100,000 in the long run.

Let’s say you invest $50,000 in a diversified portfolio and top-up $5,000 each year after that. If you were to invest in a traditional managed fund which costs 3% per year in total fees (including adviser and platform fees), you would end up with a balance of $307,334. On the other hand, if you invested in a low-cost option with 1% in total fees, you would end with a balance of $419,907 after 20 years*.

That’s a $100,000 difference from paying just 2% less in fees over 20 years.

* Assuming an investment return of 8% per year

Why fees cause funds to underperform

In the debate over whether the past returns of managed funds can predict future returns, academics and fund managers agree on only one thing: On average, funds that charge higher expenses will have lower returns. Since you can never be sure which funds will end up with the best future returns, but you can be absolutely sure which funds will have high fee, you should avoid them.

The higher the fees you pay, the worse are your odds of outperforming.

The total fee you pay including product, platform, tax administration, brokerage, advice should be <1% p.a. and for larger balances even less. Even then it means that around 12% of your return gets paid away.

On average, the more you pay the less you get. Think of that the next time some hotshot fund manager tries to justify a price hike by citing their past investment results.

What are typical investment fees?

Fees come in all shapes and sizes. You might be asking what fees should a financial advisor charge? Or, what fee should an investment adviser charge?

That depends on the level of service you are getting and the product you are purchasing.

Traditional investment products generally include many layers of fees, which can easily add up to 3%.

The difference might not sound like much in the short-term but compounded over many years it means that 75% of your total wealth potential went to the financial services industry.

When we looked at the product disclosure statement (PDS) for retail managed funds offered by the banks and wealth managers, calculating the total fees proved a challenge in itself.

Typical managed fund fees include:

- Management fees: Ranging from 0.3% to 2.8% per year depending on the fund. The more actively managed the fund and the more complex the investment strategy, the higher the fee.

- Performance based fees: An additional fee of up to 25% of any outperformance over the market return to reward fund managers when they do well. Unfortunately no fund manager reimburses investors when they do badly!

- Transaction costs: The buy/sell spread covers the transaction costs incurred when a fund has to buy or sell assets as a result of an investor making an investment into or withdrawing from the fund. The buy spread and sell spread can be up to 0.5%.

- Other costs: This can range from operational costs, administrative costs and recovery for costs incurred by the fund (e.g. when there are changes in government regulations), which can be up to another 0.5% per year.

- Financial advice fee: If you’re using a financial adviser to invest in the fund, there may be initial and/or ongoing fees paid to the adviser.

Why fees should be lower

In most businesses, the more of a product you sell, the cheaper it becomes to produce and distribute. That’s because the firm becomes more efficient as sales volume grows, reducing the cost per item. This is known as economies of scale.

But such economies of scale don’t seem to exist for funds. Our super fund research has found that fees have barely budged for super funds, even when they have significantly increased in size.

Platforms take another cut

If your financial adviser decides to invest into a fund via a master trust or WRAP platform, that can mean additional one-off fees and ongoing admin fees for using the platform.

Our Fat Cat Funds Report found that platform fees hugely impacted investment returns to investors. For example, an investor putting their money in the ‘Suncorp Fidelity Australian Equities Fund’ was charged a management fee 0.85%. The same investor putting their money in the equivalent fund with ANZ, the ‘OneAnswer Fidelity Australian Equities Fund’, would end up paying 2.85%. Same fund but different platform with an extra 2% in fees.

Our Fat Cat Funds Report also found that if you are paying more than 1% in fees to your superannuation provider annually, then you are probably paying too much. Finding a super provider that charges just 1% less in fees than a similar fund will leave you $245,000 better off in retirement.

Why fees go unnoticed

Unlike other services like electricity or your mobile phone provider, fund managers including super funds neverr send you an invoice. Instead, their fees are quietly deducted from your investments. That’s why you may never have noticed how much you’re paying (or overpaying).

A simple, low fee structure

We believe that having many layers of fees is unnecessary and something investors shouldn’t have to put up with. The high fees charged by traditional investment products are also causing many Australians to leave their money in the bank and miss out on the benefits of owning shares and bonds.

This is one reason why Stockspot has a transparent fee structure and low fees. We don’t think people need to be paying high fees to get access to professional investment advice and have their portfolio managed for them.

We’ve made our fees simple and clear so our clients can understand exactly what they’re paying, have full visibility over their investments online and be able to make changes to their portfolio whenever they want without being penalised with extra charges.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.