Taking charge of your finances, setting goals for saving and being smart about spending your hard-earned money are things everyone knows you should do.

However, getting started or taking the next step can easily be delayed in our busy lives. We’ve looked at few apps and websites that can really help you take the next step.

1. Hashching

Australia’s property obsession puts mortgages at the forefront of financial concerns for many and Hashching has created a platform to bridge consumers’ wants for lower mortgage rates to finding verified mortgage brokers.

There is great transparency in its free online marketplace with all the key figures for home loan deals upfront and it has experts quickly answering questions about home loans. Customer reviews for the mortgage brokers across Australia are also available, as well as several financial calculators to give you a better idea about your situation.

Best for: Anyone looking to buy a home, invest in a property or reduce the interest rate on a mortgage.

Website: www.hashching.com.au. An app is available on iOS and Android for the Verification of Identity (VOI) between brokers and customers.

2. Pocketbook

With all the card tapping and automatic payments, it is easy to avoid reality and not realise where your money is actually ending up.

As one of the earlier and most popular budget planners, Pocketbook is integrated with many local banks for a real-time view of your spending habits. Recent new features include tax return reviews, being able to check eligibility for tax deductions and an analyse feature for your spending that can be unlocked.

Best for: If you want to track and be able to sort all your transactions to get an overall view of your budget. For those concerned about overspending, a ‘safety spend’ measure can be set-up and notifications can also immediately alert you to potential security problems.

Website: getpocketbook.com. New apps for tax are now also available on iOS, but only the original budget planner on Android.

3. Moneysmart by ASIC

There is often a lot of conflicting information about personal finances and parts of the industry’s track record might make consumers skeptical about free tools and calculators offered by banks.

The Australian Securities and Investment Commission has created source for a wide range of general information and factors to consider about your finances for life events.

The simple explanations are easy to understand and it answers all the basic questions you might be afraid ask. It can help you gain confidence about common topics such as superannuation, investing and borrowing as well as show how to identify investment scams.

Best for: When you want trusted, unbiased information to help shape your financial decisions.

Website: www.moneysmart.gov.au. A suite of apps are available on iOS and Android, including the popular TrackMySPEND and TrackMyGOALS.

4. Spriggy

Like most habits, financial ones are most powerful when ingrained from a young age. But the digital age has significantly impacted the way we interact with money – it’s almost invisible.

Spriggy provides a card and mobile app for children to help them learn about money management with parents. It’s like a preloaded debit card for those aged 8 to 17 and allows separate logins for parents to deposit money or block the card if needed. This twenty-first century piggy bank can help set foundations for budgeting pocket money from the ever present mobile phones.

Best for: Anyone looking for a safe way to give children some responsibility with their own savings and spending. It will also help prepare them for the growing preference for online payments and a cashless future. Parents may also want to consider investing for their kids.

Website: www.spriggy.com.au. Spriggy is available on iOS and Android.

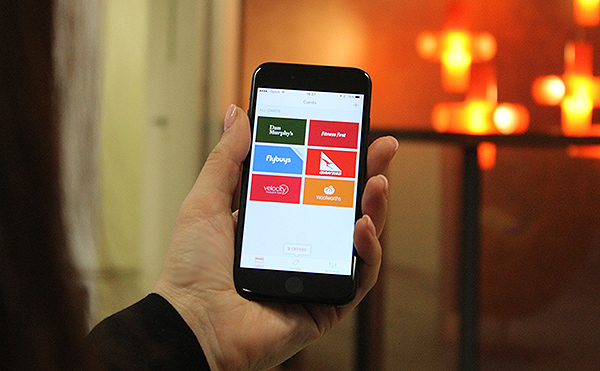

5. Stocard

We know that it’s unrealistic to completely stop spending, but there now apps to help you stretch your savings further.

Taking advantage of loyalty programs and new deals is no longer about gathering then quickly forgetting about a pile of plastic cards and coupons. Stocard allows you to store all these cards with barcodes in your smartphone in the app. It can also provide notifications about special offers and discounts from popular loyalty programs including Qantas, Flybuys and Woolworths.

Best for: Anyone with who has the wrong type of fat wallet. It is a good feature for those wanting a complete digital wallet and can also be used on wearables.

Website: stocardapp.com. App available on iOS and Android.

Keep an eye out for…

Other websites and apps to watch out for in the near future…

Handled

Part of a household’s money management plan includes insulation against rises in the basic costs of living. Increased prices for necessities, such as electricity, can quickly have a major impact on the Australians’ savings. By doing a full comparison with your current energy bill Handled can provide insight into whether there are better deals available.

Best for: If think you could be overpaying for energy and would like to monitor monthly costs. The personalised nature of the service can also provide more accurate assessments than a general comparison site.

Website: handled.com.au/. Apps for iOS and Android are available.

Carrots Money

Despite the best intentions and good planning, always sticking to your budget is a challenge. It can be easy to justify an occasional avocado brunch as insignificant versus big picture savings goals.

Carrots aims to break down your goals into bite sizes with automated savings, personal tips and notifications on your smartphone to stay on track. There are extra incentives to stay accountable with challenges, where your friends can help stop you overspending.

Best for: When you need some encouragement and a gentle nudge to stay on track.

Website: www.carrots.money.

If you’re saving up for a long-term goal, you could also consider whether it’s better to leave your money in the bank or look at other options like investing which can boost your savings even further.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.