When planning for your big day, it’s completely normal to get overwhelmed by the onslaught of decisions and planning you need to make leading up to the wedding.

The cost of weddings in Australia continues to rise, with couples paying an average of $36,000 for their big day. (Source: https://moneysmart.gov.au/getting-married.)

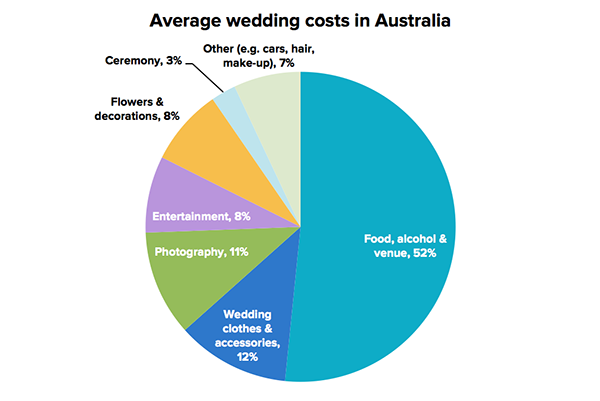

According to market research by IBISWorld, more than half of the cost of a wedding goes to entertaining guests at the reception, with food, alcohol and venue costs averaging $18,683 per wedding.

Source: ASIC, IBISWorld April 2012

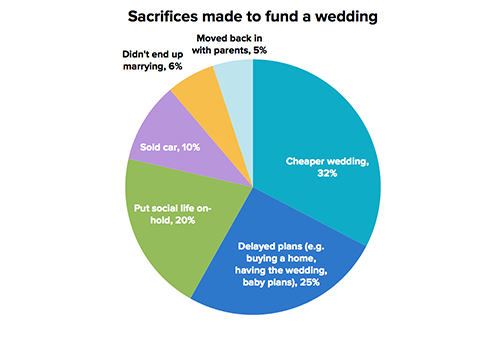

Most couples have had to make financial sacrifices in order to afford such a large sum of money, including putting their social life on-hold (20%), delaying plans of buying a home (25%) or remaining unmarried (6%).

Source: ASIC MoneySmart survey, December 2013

Top tips for saving on the cost of a wedding

To help couples prepare for their wedding, we reached out to our network of friends and Stockspot clients to ask them for their money tips based on their experience.

Here are some ideas and tips to help you plan and save for your wedding and to reduce the stress and make the process enjoyable:

- Figure out your budget and decide on how much you have to spend on the day, which could include contributions from family members, as well as from your own pocket. If you’re getting help from family, it’s best to have these conversations early on so you know how much you have to work with.

Think about what you want the day to be like and estimate costs for the following:

-

- Ceremony and reception venue

- Outfits

- Wedding Celebrant

- Decorations and flowers

- Food and drinks (including wedding cake)

- Music

- Photography / Videography

- Honeymoon

Based on this budget, work out how much you both need to save and how long it would take you to get there. Most banks will have a savings calculator to help you figure this out.

- Avoid the ‘W’ word when getting quotes. As you collect quotes and estimates avoid mentioning the word wedding. Instead insert words like celebration, party or gathering of friends. Florists, car hire and photographers all charge a premium to be a part of your wedding.

- Automating funds into a dedicated wedding account from each pay cheque, makes the saving process easy and guarantees that money is kept separate from your everyday spending account. You could use a dedicated saving account or an investment account. If you’re thinking about investing the money, the Stockspot investment calculator can help you work out how much you could earn over a period of time and the Stockspot goal tracker can help you keep on track with your wedding savings goal.

- Use an e-invitation as printing wedding invites can be costly, particularly if you have a large number of guests. Canva or Paperless Post have lots of virtual save the date and wedding invite templates, or you can design your own to email out to guests. You could also create your own wedding website and link this in the invite. This way you can update information dynamically with any important information as the big day approaches!

- Save on the dress. There are many online second-hand dress websites or you could even consider renting a dress. You can also look at sample sales or trunk shows to snag a discount from bridal boutiques. Sign-up to their newsletters so you are notified of any sales or trunk shows for the designers you love. You can even sell your dress after the wedding and get some money back – to invest in Stockspot, of course!

- Reduce the number of bridesmaids. The bigger the bridal party, the bigger the cost. Between hair and makeup, dresses, shoes and jewellery, the cost of your bridal party can quickly add up, so you may want to consider reducing your bridal squad!

- Instead of gifts from family and friends for birthdays, you could ask for a gift card which could go towards purchases for the wedding such as shoes or jewellery.

- Leverage your contacts and use your network of family and friends to help with things like table arrangements, flowers, and car hire. There is always someone you know, or someone you know that knows someone else that can give you mates rates.

- Only use a photographer for a special wedding shoot instead of pre-wedding shoots. With the quality of phone cameras and superb Instagram filters these days, you can start a hashtag for the wedding and encourage everyone to post photos using the hashtag. You can then use an online Instagram printing service like Printstagram to print off a wedding album and thank you cards to guests. The best photos are taken by family and friends anyway as they capture people off guard.

- Save money by not having a sit down dinner. Cocktails and finger food are a popular (and cheaper) option. It also means it’s easier to mingle with everyone and gives you more flexibility with venues/caterers.

- Décor is one of the most expensive things. Try and pick a venue that doesn’t need too much theming. Remember less is more sometimes – instead of fresh flowers use candles, tea lights and fairy lights for an evening reception. Always ask what the venue provides e.g. draping, table clothes, chair covers, before you order anything.

- Make your own place cards, menus etc. Shabby chic is all the craze right now so handmade looks fab, not tacky.

- Buy alcohol when there’s a deal. You can often find specials on alcohol throughout the year so if you purchase in advance you can save yourself some extra funds! Some liquor stores such as Dan Murphy’s offer return policies as well, so you can always take any leftovers back for a refund.

- Serve the cake for dessert otherwise it is a waste. Most people are drunk by the time the dessert comes around anyway so you don’t want to pay for a cake and dessert.

- Have a DJ and brief them on the type of music you want to play. Bands are great but DJ’s are cheaper. Most people just want to boogie at the end of the night. Avoid playing Nutbush City Limits unless you have a mullet.

- Try not to allow family to pressure you into inviting (and therefore paying for) distant family members who you haven’t really had much contact with in years. A good rule, if you haven’t spoken to a person for more than one year, don’t invite them.

- Consider an off-season wedding, like a winter wedding, a weekday wedding or a Sunday wedding. A lot of venues have deals for non-weekend and out of season weddings. Even a Friday wedding can save you thousands on venue hire.

- Always negotiate! If you don’t ask, you don’t get. You can try negotiating a lower price for paying cash. You could see if your venue will let you bring in your own alcohol.

- Get married in Hawaii with a few close friends or family and leave it at that.

Start saving early…

We suggest that anyone looking to save up for a large expense should start as early as possible. That way, you’re able to maximise the time you have to accumulate the required amount and take advantage of the benefits of compounding to give your savings a boost.

If you start having conversations with your partner about eventually getting married, that could be a good time to start putting savings aside rather than waiting for when you get engaged.

As you can see below, your savings timeframe dramatically affects how much money you need to put aside each month to reach the goal of $36,000:

| Timeframe | Amount to save per month |

| 1 year | $2,996 |

| 2 years | $1,487 |

| 3 years | $984 |

Assumes an after-tax interest rate of 1.5% p.a.

Consider options…

With interest rates at the lowest level in over 50 years, make sure to shop around for the best rate if you decide to put your money into a savings account. A higher rate will mean you have a better chance of keeping up with inflation.

If you can start setting aside money at least a couple of years before the wedding, you could consider investing some of that money into a portfolio of shares and bonds. There is more risk involved with this option but this can be reduced through diversification and by having a timeframe of at least three years.

A diversified portfolio has historically achieved higher returns than bank deposits over the medium term which means you might be able to set aside less money each month than with a savings account.

| Timeframe | Amount to save per month |

| 2 years | $1,410 |

| 3 years | $907 |

Assumes an after-tax return of 7% p.a. based on performance of diversified portfolios over the past 20 years.

Hopefully you’ve managed to find some useful tips. Weddings can be a lot of work so make sure to enjoy your big day!

Image: unsplash.com

Related posts

- Money tips for your next holiday

- Generation rent – get ahead while renting

- Apps and websites that help you save and spend smarter

- What to consider when getting a mortgage