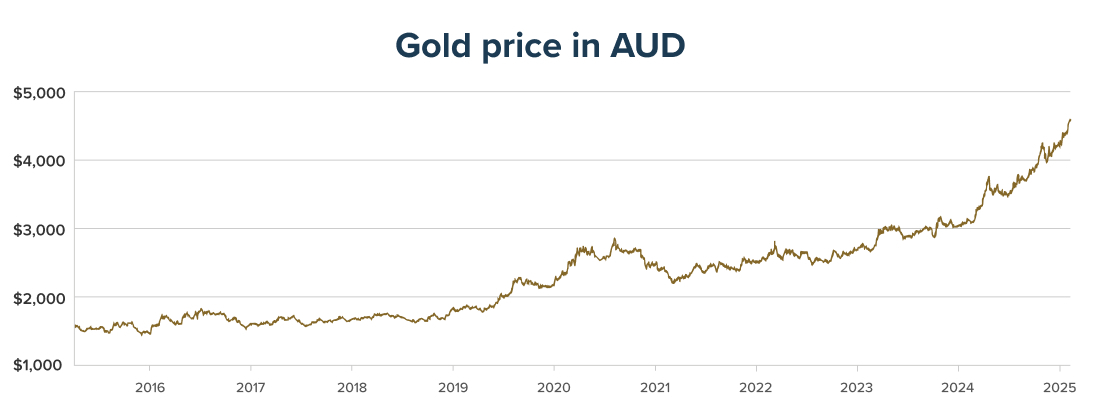

Gold has surged 44% over the past year to a record high of AU$4,630 (as at 10 February 2025). This has surprised many, as gold is often expected to struggle when interest rates rise and the U.S. dollar strengthens.

Since gold doesn’t pay dividends, it can become less attractive when interest rates are higher, as investors tend to favour income-generating assets like bonds and high-dividend shares. This lack of yield is the most common concern we hear from Stockspot clients about owning gold. Additionally, a stronger U.S. dollar can make gold more expensive for international buyers, limiting demand.

Yet despite these headwinds, gold continues to soar.

Let’s examine what’s driving this trend and what it means for portfolios.

Global uncertainty is driving gold higher

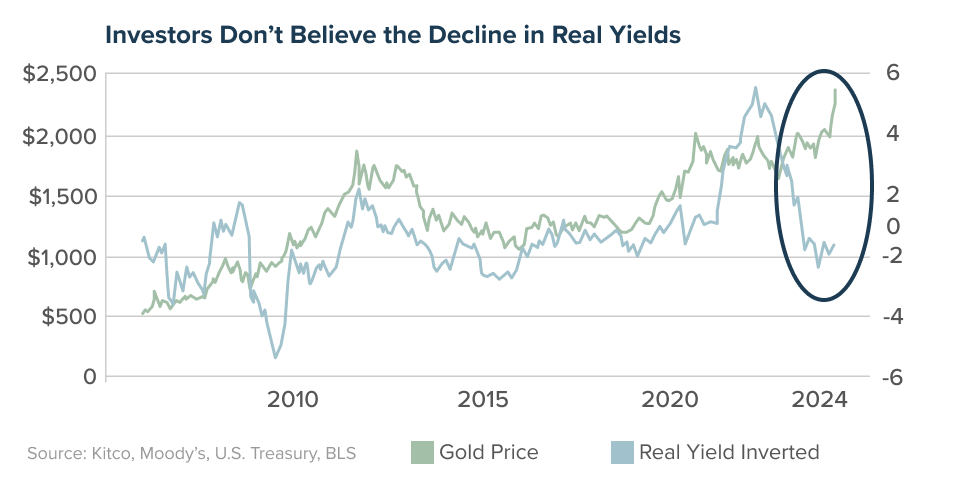

While China grapples with deflation, the U.S. faces persistent inflation and record deficit spending. The U.S. government needs to issue more bonds to finance its spending, pushing yields higher, yet gold remains resilient.

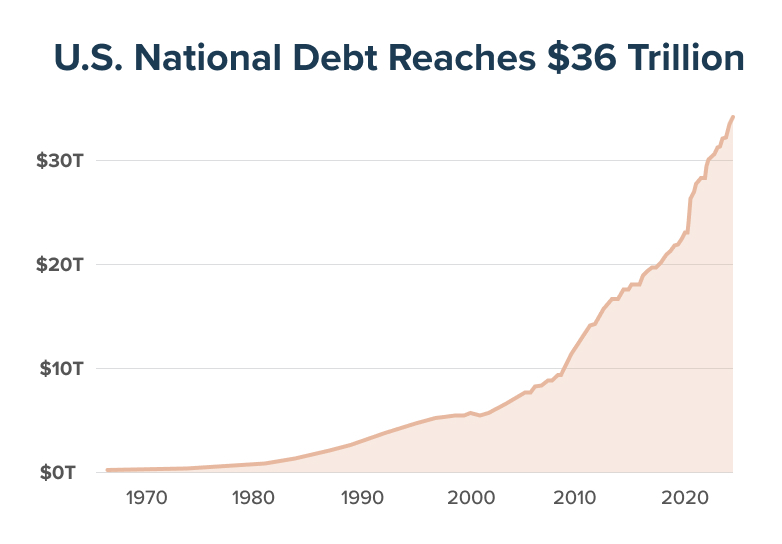

This signals growing investor concerns over inflation risks and long-term government debt sustainability. Gold is no longer just reacting to interest rates and currency movements, it’s acting as a hedge against a potential government spending crisis. U.S. government debt has grown from US$23 trillion to over US$36 trillion in just five years. High levels of U.S. debt are putting pressure on the Federal Reserve’s ability to fight inflation over the long run, with major implications for markets.

Rather than maintaining high rates, the U.S. may instead allow inflation to remain elevated for years. This strategy, sometimes referred to as “inflating away” debt, reduces the real value of what the government owes over time.

This strategy benefits governments but hurts savers and retirees as it erodes real yields. This is a key reason Australian retirees and SMSFs relying on fixed-income should consider gold as a portfolio safeguard, despite gold paying no dividends.

Why anyone with super should care

Many super funds and Australian investors are heavily invested in property, ASX50 shares, and cash. These assets have struggled in real terms over the past few years due to rising interest rates. Gold by contrast, has delivered much stronger performance and offers key benefits for Australian portfolios.

It acts as a hedge against inflation, maintaining its purchasing power, unlike cash and bonds, which tend to lose value in real terms during secular inflationary periods. Gold also provides diversification benefits, as it has historically had a negative correlation with Australian shares, helping to reduce overall portfolio risk.

Over the past five years, gold has significantly outperformed government bonds, establishing itself as a compelling option for defensive investors seeking strong long-term returns. Notably, gold is also much more liquid and lower cost compared to other popular asset classes like private credit, making it an efficient and accessible choice for portfolio diversification.

The case for gold in super portfolios

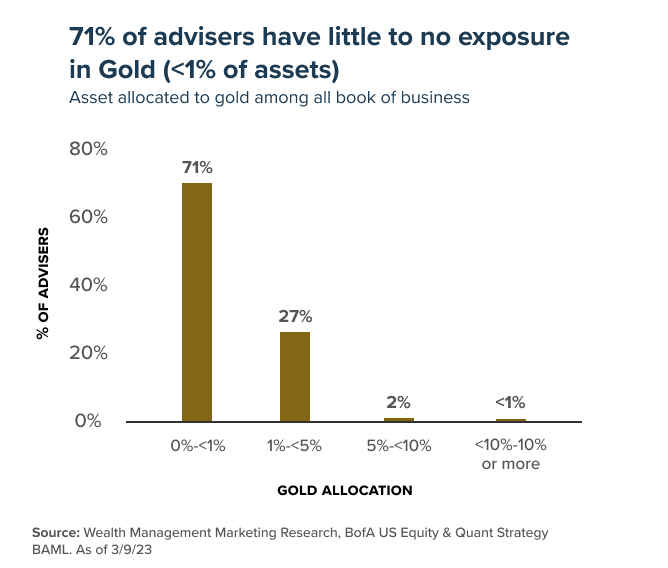

Despite gold’s strong performance, most investors and super funds have minimal exposure to it. Research from Bank of America shows that 71% of investors hold 1% or less of their portfolio in gold. This is particularly concerning for SMSFs, where asset concentration in property and shares can lead to significant downside risk in volatile markets.

At Stockspot, we increased our portfolio allocation to gold to 14.8% in early 2021. Since then, gold has surged 90% while government bonds have struggled to keep up with inflation. Our data shows that allocating at least 10% of a superannuation portfolio to gold significantly enhances a portfolio’s risk-adjusted returns over the long run, without sacrificing performance.

If your super fund lacks a meaningful allocation to gold, now is the time to question why.

Our recently launched Stockspot Super portfolios reflect this conviction, with the highest gold allocation of any super product in Australia. As gold continues to rise, we expect more super funds to shift from government bonds to gold in search of a stronger hedge against inflation and economic uncertainty.

Best ways to invest into gold

There are several ways for investors including those with superannuation or a SMSF to gain exposure to gold:

- Gold ETFs: ASX-listed funds such as GOLD and PMGOLD provide a simple way to invest in gold without the hassle of physical storage. Our preferred ETF is GOLD, which recently surpassed $4 billion in AUM. Its growth has been driven by both the strong gold price and weak Australian dollar.

- Allocated and unallocated bullion accounts: Providers like ABC Bullion and the Perth Mint offer direct ownership options.

- Physical gold: Investors can buy and store gold bars and coins, though you should consider storage and insurance costs.

Check your super fund gold allocation

Most Australian super funds have little to no exposure to gold, meaning many investors are missing out on its returns and diversification benefits. With inflation risks and debt concerns mounting, now is the time to review your portfolio and consider increasing your allocation to gold.

If your super fund lacks a meaningful allocation to gold, now is the time to question why.

This article by Chris Brycki was originally published in the Australian Financial Review on February 11 2025: Why you should consider gold over faddish private credit.