Why Age Matters in Your Super Investment Strategy

When it comes to building a strong retirement plan, one of the most important but often overlooked factors is your age. Age plays a critical role in shaping your superannuation strategy – determining your risk capacity, investment horizon, and the appropriate mix of growth and defensive assets.

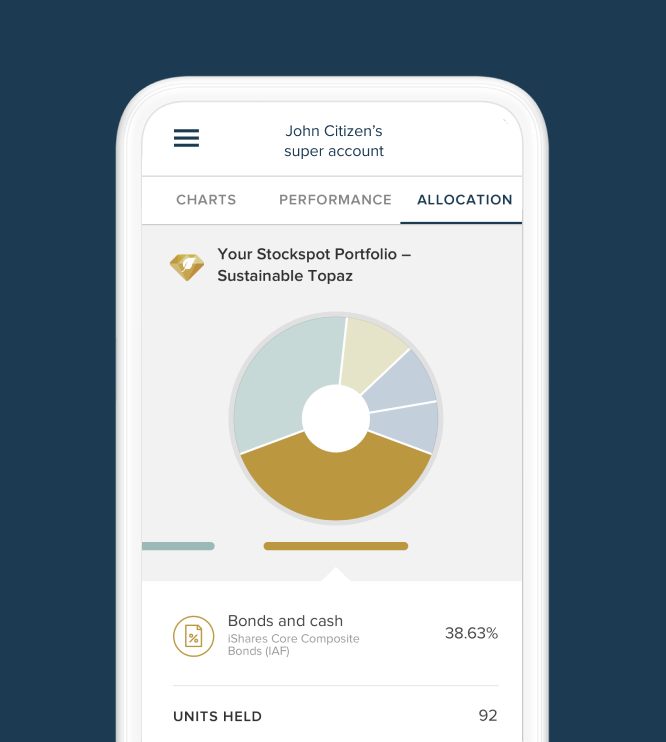

At Stockspot Super, we tailor investment strategies to align with your age, ensuring your super grows efficiently while managing risks. But there are some common pitfalls to avoid along the way. Here’s why age matters and how our approach adapts as you move through different stages of your life and financial journey.

Early Years (20s to 40s): Time to Embrace Risk and Growth

In your 20s, 30s, and early 40s, time is your biggest advantage. With decades before retirement, you can afford to take on more risk in exchange for higher potential returns. Growth assets such as shares and property are ideal at this stage because they tend to outperform over the long term, despite short-term volatility.

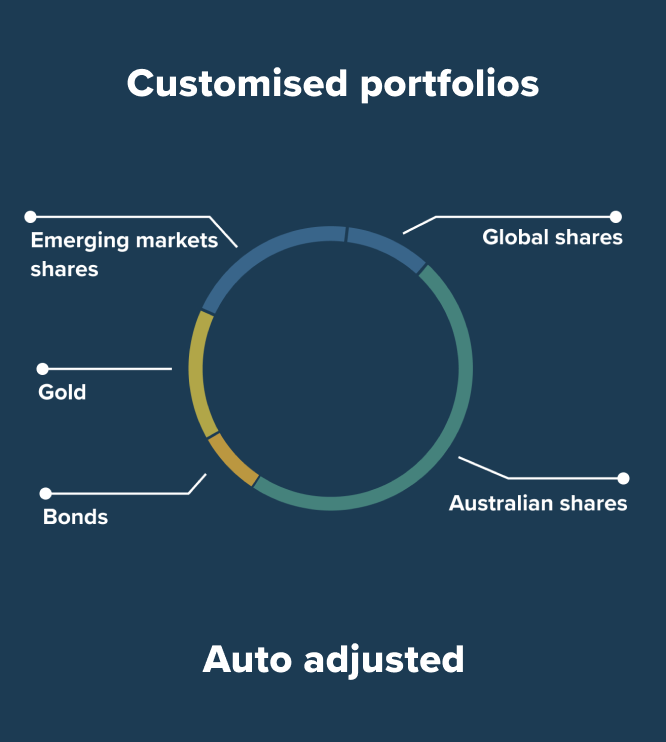

At Stockspot, we recommend our Aggressive Growth or Growth portfolios for younger investors, which allocate between 70% and 89% of the portfolio to growth assets. This heavy focus on growth assets, including both Australian and global shares, helps younger investors maximise their returns over time, capitalising on the power of compounding.

One of the most common mistakes younger investors make is choosing a portfolio that’s too conservative. Some people feel more comfortable with less risk, but investing heavily in defensive assets like bonds or cash too early in life can significantly limit long-term growth potential. If you’re not taking enough risk, your super may struggle to outpace inflation, leaving you with less purchasing power when you retire.

Middle Years (50s to Early 60s): Balancing Growth with Protection

As you move into your 50s and early 60s, your strategy needs to evolve. You’re getting closer to retirement, meaning you have less time to recover from any market downturns. However, you still need some exposure to growth assets to ensure your savings outpace inflation, so balance becomes key.

At this stage, Stockspot Super recommends transitioning to more Balanced or Moderately Conservative portfolios. These portfolios typically have between 50% and 79% allocated to growth assets, with the remainder in defensive assets like bonds and cash. This mix allows you to continue growing your super, but with a greater emphasis on protecting the wealth you’ve built.

It’s important to note that not all super funds define “balanced” in the same way. Some balanced funds may have up to 98% in growth assets, while others may only allocate 60% to growth assets. This inconsistency can lead to confusion and poor decision-making. You could end up with a portfolio that’s far riskier than you intended or too conservative to meet your retirement goals. At Stockspot, we clearly define the risk level of each portfolio so you know exactly what you’re getting.

Approaching Retirement (65+): Preserving Wealth

By the time you reach your mid-60s, your superannuation strategy should focus on preserving the wealth you’ve accumulated. With retirement just around the corner – or already here – your priority is to safeguard your nest egg and ensure it lasts throughout your retirement. Stockspot Super’s Conservative portfolios are specifically designed for this phase of life, focusing on defensive assets like bonds and cash to minimise risk.

In retirement, you may also start drawing down on your super, meaning you’ll need stability to ensure your savings can cover your living expenses. Defensive assets provide more certainty and protection during market downturns, which is essential at this stage.

Some retirees maintain an aggressive growth portfolio even as they begin withdrawing funds. While a portion of growth assets is important to outpace inflation, too much exposure to shares or property can lead to severe losses if the market takes a downturn, like it did in 2008. This can be particularly damaging when you’re depending on your super for day-to-day expenses. By transitioning to a more conservative portfolio with Stockspot Super, retirees can reduce the risk of shortfalls during market volatility.

Age-Based Investment Strategies: A Proven Approach

Superannuation is not a one-size-fits-all strategy. Age-based investing ensures that your portfolio evolves as your needs and risk tolerance change over time. By gradually shifting from aggressive growth in your younger years to more balanced and conservative approaches as you age, you can achieve long-term growth while protecting your nest egg when it matters most.

Stockspot’s approach is similar to glide path strategies that have become increasingly popular in target-date funds, a type of superannuation fund where investments are adjusted based on the expected retirement date. These funds have gained widespread adoption because they provide a simple, hands-off way to manage retirement savings, especially for people who prefer a set-and-forget investment approach.

At Stockspot Super, we help you avoid common pitfalls by providing clear, transparent, and personalised investment options tailored to your age. Whether you’re just starting out or approaching retirement, our portfolios are designed to grow and protect your super at every phase of life.

Ready to make your super work harder for you?

How to join Stockspot Super

Learn more about Stockspot Super here.

Before opening an account please read the Stockspot FSG, Stockspot Super MDA Guide, and the Super Simplifier PDS and Supplementary PDS, along with other relevant disclosure documents including your personalised Statement of Advice (SOA) and Investment Agreement.