Not surprisingly, questions around switching portfolios and sitting on the sidelines come up most often when markets have fallen or risen fast.

Our gut instinct naturally makes us want to increase our risk tolerance when markets are up and decrease it when markets are down. But like most things when investing, the right thing to do is probably counter-intuitive.

There are certainly some good reasons to update your risk profile but there are also bad reasons to change your portfolio risk that you should be careful to avoid.

Good Reasons: Changes in your personal situation

There are all sorts of significant life events that can change your risk tolerance and therefore your optimal investment strategy. That’s why we profile all of our clients when they sign-up, ask them to let us know of any changes during the year and offer an annual review where they can let us know of any changes in their lives.

Events that could result in a change in investment strategy include:

- A major life change (i.e. having a child, or retiring)

- A significant change in your cashflow needs (needing money to buy a house)

- A significant change in your income, expenses, assets or liabilities

For example, if you had planned to buy a house in 7 years and now want to buy it in 3 years, that would be a good reason to reduce your investment risk to improve your chances of a positive return over the shorter timeframe.

Moving from working into retirement may also lower your risk tolerance if you need to draw a steady income and no longer rely on the growth of your capital. On the other hand, an inheritance or bonus may allow you to increase the level of risk in your portfolio since you now have a larger amount to safely invest.

As you can see, good reasons to change your portfolio risk are all related to changes in your personal circumstances and are completely irrespective of whether markets are up or down. This is why our initial questionnaire is all about you – where you are in life, when you plan to use your savings and what tolerance you have for market movements.

Bad Reasons: Market Timing

It may not seem like it, but changing your portfolio risk (or whether to keep investing) in reaction to market performance is a subliminal form of market timing.

It’s a common human reaction to want to lower your investment exposure after you have incurred a loss, just as it is a common response to raise your tolerance for risk after benefiting from a rising market. Unfortunately this is exactly the opposite of what you should do.

Lowering your risk tolerance after markets have fallen results in the sale of investments that have fallen the most. This is typically the worst time to be selling those investments.

For instance, someone changing from the Stockspot Topaz to Amethyst portfolio would be selling Australian shares and buying Australian bonds. Doing this after a market fall would be selling shares relatively low and buying bonds relatively high.

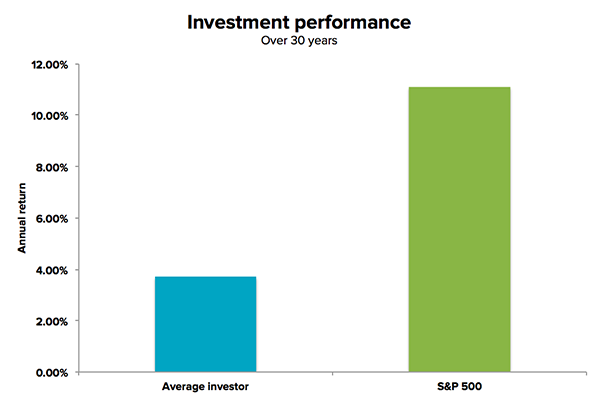

As we showed in retrain your investment brain, giving in to behavioural biases like this cost “Do-it-yourself” (DIY) investors up to 4% per year in lost returns.

A properly rebalanced portfolio implements the opposite strategy – buying assets that suffered the biggest loss and selling the biggest winners.

Research conducted by Vanguard found that rebalancing in this way can add 0.35% of returns per year.

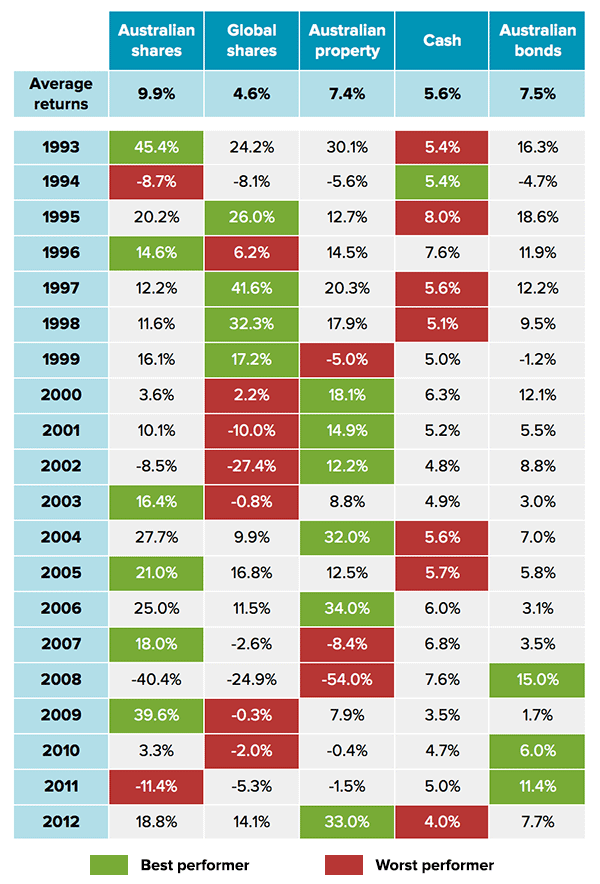

People who buy when assets have fallen and sell when they have risen usually make the best long-term investors. That’s because over the long run, most investment returns revert to their average returns – the worst performing asset in one year often becomes the best performer in the next.

When it comes to broad assets, buying the biggest losers and selling the biggest winners leads to higher long-term returns. Acting contrarian in this way is incredibly hard to convince your mind to do because it’s counter to human nature.

That’s how Stockspot can help. We do it for you and by investing on autopilot, you can avoid costly behavioural mistakes and make the most of market dips when they happen.

Stick to your strategy

Research has consistently shown that attempting to time the market or changing investment strategy in reaction to market movements leads to lower returns than a diversified portfolio of low-cost index funds that is periodically rebalanced.

Once you’ve set up your risk profile, we do recommend reviewing it when your circumstances change, however, switching portfolios – or exiting the market altogether in response to market falls is likely to cost you returns over the long-term.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.