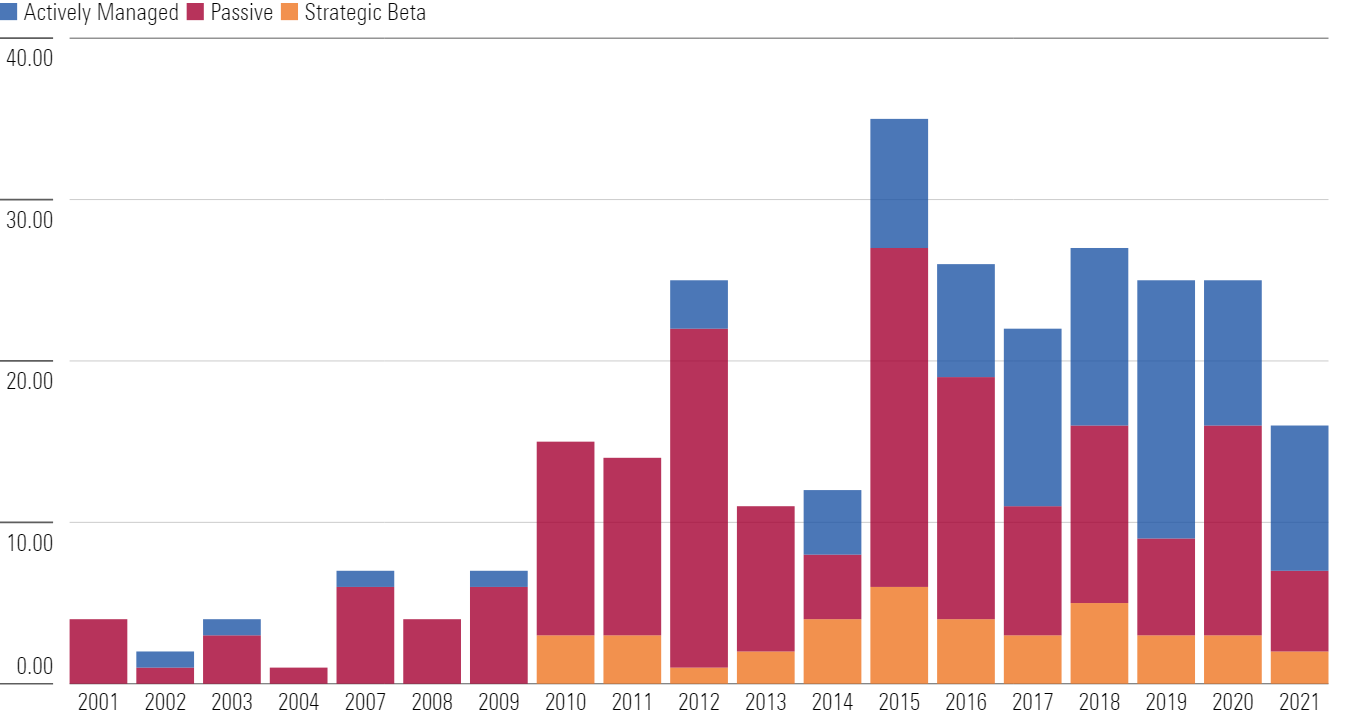

There are over 250 different ETF products listed in Australia. Around 20-30 new ETFs launch every year, with many of the recent listings centred around active and thematic ETFs.

Thematic ETFs follow a niche sector or sub group of companies such as Hydrogen energy shares or Cryptocurrency shares.

Thematic ETFs typically have higher fees compared to established broad market ETFs. The average fee of ETFs launched on the ASX this year is 0.77% p.a. which is 7 times higher than typical broad market ETFs.

With a new ETF launching in Australia every few weeks, we often get asked by clients whether they should invest into one of these newly listed ETFs.

In this article, we’ll explain why we avoid recently listed ETFs and why the odds are stacked against you when you invest into them.

New ETFs chase themes that have already performed well

New thematic ETFs are hard to miss. They launch with online ads, emails, whitepapers, newspaper articles, and sponsored content. The purpose of all of this is to drum up early interest in the ETF.

ETF issuers earn a management fee from money invested into an ETF so are strongly motivated to create a compelling narrative around why people should invest.

One reason new ETFs often get a lot of early buying is because they tap into areas of the market where there is already strong investor demand. Take, for example, several work from home themed ETFs launched in the U.S. in late 2020. Working from home was a hot topic at the time and this gave these ETFs a topical story to pitch to investors and the media alike.

Most new ETFs centre around themes that have enjoyed strong recent returns. New ETF marketing brochures show strong past performance (which usually do not incorporate fees). ETF issuers know that showing strong past returns usually leads to strong inflows after an ETF lists.

These strong returns rarely continue because the market information that led to these strong returns is already in the share prices of the companies within the ETF. In other words, these themes have largely played out by the time an ETF launches and thematic ETFs usually launch when retail interest is already near its peak.

The work from home ETF that launched in June 2020 has barely outperformed a broad market S&P 500 ETF since its launch, as the hype slowly vanished this year.

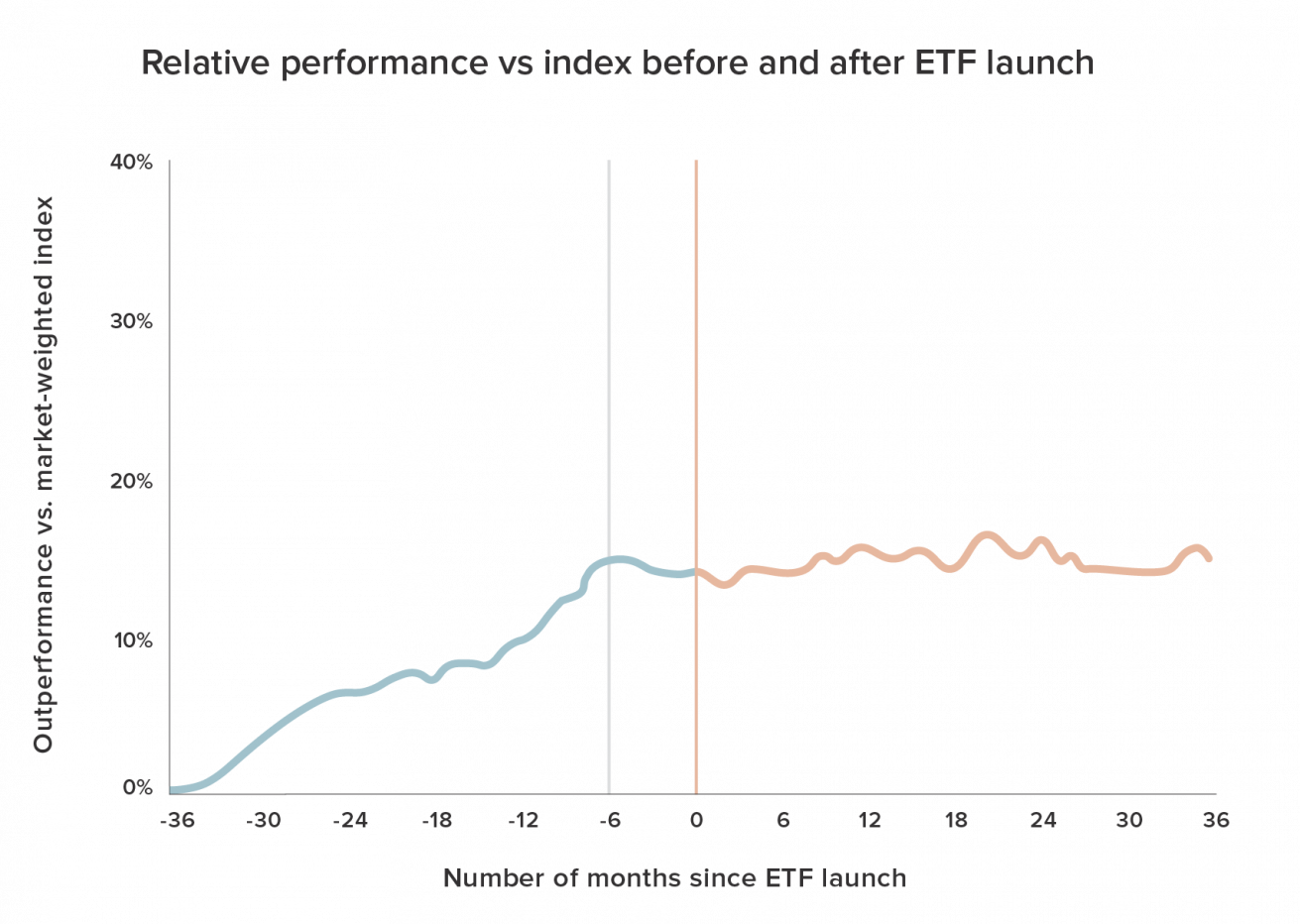

Unfortunately the data shows that new ETFs underperforming is not uncommon. Thematic ETFs tend to launch near the peak of investor interest and then suffer a period of underperformance after they list. Investor sentiment is sometimes a powerful contrarian predictor of returns. Academic research covering thematic ETFs launched in the U.S. between 1993 and 2019 found that they underperformed the broad market index by 4% per year for a period of at least 5 years after launch.

Historically you would have lost around 20% over 5 years relative to the broad market if you had invested into all thematic ETFs when they launched.

An extreme example of this was the iShares U.S. Home Construction ETF which launched in the U.S. in May 2006 following the U.S. property market boom. Three years later this ETF had fallen by 80%.

Another study found that the maximum point of outperformance is usually when the ETF product issuer lodges the application to launch an ETF (i.e. 3-6 months before listing).

Buyer beware: thematic ETFs often shut down

Given the large number of new ETF listings, fund closures are a new risk that investors face in Australia. If an ETF doesn’t attract enough funds to cover the operational costs, the issuer may decide to shut it down. In the U.S. of the 277 ETFs that shut down in 2020, one-quarter of them didn’t make it to their third birthday.

This is usually due to their limited take-up and underperformance. As time goes on, there is increasing riskiness that these funds may lag the broader market or subsequently shut down.

Once an ETF closes, investors face potential forced selling, triggering capital gains tax, and the problem of allocating their money elsewhere.

Thematic ETFs perform best… after they shut

One of the better times to buy a thematic ETF is, ironically, after it shuts. ETFs usually shut due to a lack of investor interest and this happens after a prolonged period of poor performance. An ETF shutting down is often a precursor to good future performance for the market theme it followed. There have been several recent examples of this on the ASX:

- The Betashares Commodities Basket ETF (QCB) shut down in December 2020 right before the underlying commodity basket rose 35%.

- The Russell Investments Australian Value ETF (RVL) shut down in May 2018 after the value factor faced a decade of underperformance. Value investing has since had a comeback.

- VanEck abandoned it’s VanEck Australian Emerging Resources ETF in July 2016, just before mid cap miners rallied more than 50% over the next 2 years.

Our observation is that ETFs tend to shut about 6-12 months after the trough of their relative underperformance versus the market.

Final thoughts

Thematic ETFs are a new and increasingly popular way to speculate on shares – the only difference is that you’re buying a basket of similar shares rather than just one.

If you’re going to venture into thematic ETF investing, be cautious of the ‘herding’ bias and ‘return chasing’ which is what makes the latest thematic ETF launch alluring, but also a risky bet.

Waiting a few years to invest into a popular theme reduces the risk of buying because of FOMO, and helps you avoid ETFs that shut down due to not attracting enough interest.

In our view, investing in broad market ETFs, paying lower fees, and avoiding chasing the newest thematic ETF will put you in a better position to achieve consistent investment returns.