- Mistake 1: Trying to time the market

- Mistake 2: Listening to the news

- Mistake 3: Not paying attention to asset allocation, and failing to rebalance

- Mistake 4: Not doing due diligence on ETF products

- Mistake 5: Trading

Mistake 1: Trying to time the market

If you try to pick the best time to buy and sell your shares you’re almost certain to underperform over the long run. ‘Time in the market is better than timing the market’ isn’t just an annoying tongue twister.

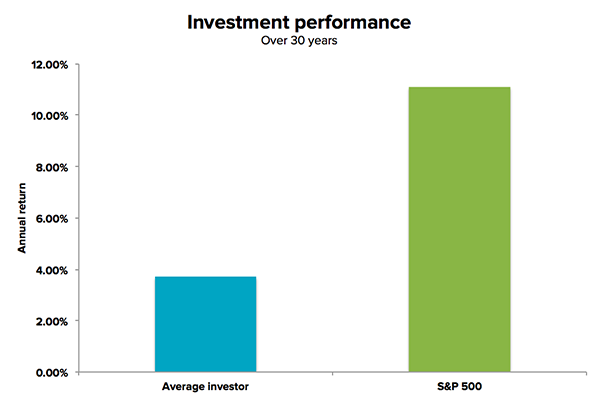

Over the past 30 years, the average share market investor in the US earned a return of just 3.7% per year compared to an annual return of 11.1% for the market.1

Research shows that missing the best market trading days can significantly impact your returns. For example, if you missed the best 20 days of the Australian sharemarket over the last 22 years, you would have almost halved your overall return if you had been fully invested in the market.2

The blue bar charts represent the annualised return over the last 22 years. The blue line represents the growth of $10,000 invested over that period.We believe philosophy, discipline and strategy are 3 key ingredients for success. Staying invested can yield better returns than timing the market.

Mistake 2: Listening to the news

What reads better – “Invest in the market over the long term in a boring fashion to achieve 8% return p.a.” or “Recession is coming! Sell now!” – of course the latter will be a better sell. The media love a dramatic news story as it’s all about how to get more clicks and views to grab your attention.

You don’t need to religiously follow share market gurus for your investing advice. Adopt a long term strategy and keep calm during periods of market volatility.

Paul Andreasan’s psychological work in the late 1980’s showed that the more attention investors paid to financial news, the more often they traded and earned lower returns than those who tuned out the news.

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.” – Bill Gates

Mistake 3: Not paying attention to asset allocation, and failing to rebalance

Investment selection and market timing (i.e. active managers) is not as important as your asset allocation, with research showing that asset allocation explains over 90% of the return variability of portfolios.3

ETFs are an excellent investment to tailor your asset allocation, but many investors do not think about their asset allocation when buying an ETF. Rather, they look at individual ETFs on a stand alone basis and not how it fits into the context of their entire portfolio.

We also believe there is too much focus on investing in shares with ETFs, given over 80% of Australian ETF FUM is in ETFs that track either Australian or global shares. Good investors diversify their portfolios across multiple asset classes (including bonds and gold).

Portfolio rebalancing is one of the most important jobs when managing a portfolio of investments.

It involves selling the investments that have grown faster (ie made money) than others in your portfolio and buying more of the investments that have fallen behind. It helps reduce the risk you need to take to earn a certain level of return.

Portfolio rebalancing can be expensive, time consuming and emotionally exhausting to manage yourself. This is why rebalancing is hard to get right as a DIY investor.

“The investor’s chief problem – and even his worst enemy – is likely himself.” – Benjamin Graham

Using a robo adviser like Stockspot who has automated investment processes, such as portfolio rebalancing and dividend reinvestment, can be beneficial as these are commonly prone to human emotions and mistakes. Automation not only saves time and cost, but also removes many of the emotional investment temptations that are likely to harm returns.

Stockspot does the asset allocation and rebalancing for you, using proving investment strategies and smart algorithms (taking out the human emotion).

Mistake 4: Not doing due diligence on ETF products

Just because a fund has “ETF” in the name does not mean it’s a safe investment. Many investors think these three letters are a stamp of approval, however, there are ETFs with high and complex fee structures, low liquidity, limited transparency, and conflicts of interest (due to internal market making).

Top 5 checklist to help you do your due diligence when selecting ETFs:

- Benchmark and methodology – investors need to understand what the ETF does and its objective. Look at the underlying index, how long it has been around for, and the methodology behind its holding selection criteria. Be wary of things like leveraged ETFs as these are toys for traders/speculators which long term investors should stay clear of.

- Fees – The Management Expense Ratio (MER) is not the only thing investors should pay attention to. Unfortunately, some ETF and Fund Managers bury all hidden costs in their Product Disclosure Statements. Think very tiny writing and lots of pages. This is why it is important to consider the Indirect Cost Ratio (ICR), which incorporates all necessary transactional and operational costs to run the fund. Investors also need to examine the slippage (buy/sell spreads) of each of the ETFs. This refers to how much you lose when buying/selling the ETF. It is calculated as the average percentage difference between the best buyer and seller during market hours.

- Liquidity – Investors need to look at the daily volume traded and how liquid the underlying holdings are. Larger and more liquid markets generally have a lower bid/ask spread.

- Fund size – ETFs larger in size can have lower bid/ask spreads and reduces the risk of an ETF closure.

- Performance and tracking error – Look at the long term returns (e.g. 1, 3 and 5 year) net of management fees (i.e. after costs). Examine the tracking error, which is the performance difference between the ETF and its underlying index.

Mistake 5: Trading

Given ETFs trade on the sharemarket, executing your buy and sell orders at the best possible price is important.

Common principles we practice when trading ETFs for clients include:

- Using limit orders – market orders will prioritise volume over price meaning you could fill your order at an inferior price. Limit orders can help control pricing. The market depth chart you may see on the screen is not the full list of buyers and sellers, as a market maker can create or redeem new ETF units.

- Don’t trade near the market open or close – that’s when a lot of those spread widening events occur. This is because of over or under supply causing more price volatility and the ETF trading away from their underlying value. Aim to trade after 10:15am or before 3:45pm in Australia.

- Time differences – other markets trade in different time zones, so there may be delays in trades/pricing which can affect spread levels. Where possible, it is better to trade international share ETFs at times that coincide with the trading hours of underlying shares’ local market.

- Trading too often – Trading too often will also incur brokerage costs (avg of $20 per trade) which can eat into your returns.

Sources:

1 DALBAR’s 22nd Annual Quantitative Analysis of Investor Behavior (2016)

2 Zenith: IMAP Roadshow March 2019

3 Ibbotson and Paul D. Kaplan (2000) and BHB’s Determinants of Portfolio Performance (1986)