It’s easy to get swept up in the hype of a hot sector, but there are big dangers when the music stops.

Investing in the hot stock or sector de jour is a always strong temptation, especially in markets where there are very clear winners and losers. These days global technology is that hot sector – particularly the big US tech giants.

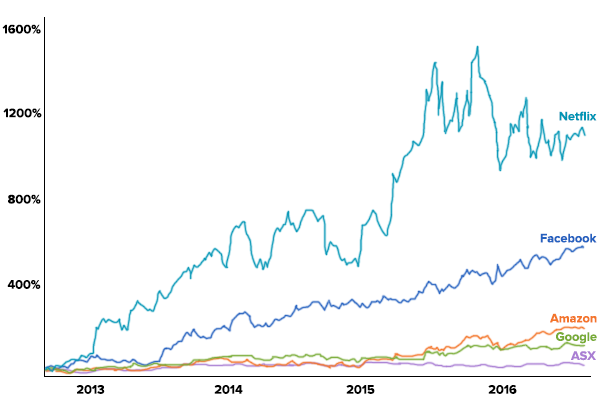

They’ve all doubled, tripled or quadrupled since 2012 so have easily beaten the broad market. Their returns have trounced Telstra, BHP and Woolworths.

Tech stocks Facebook, Amazon, Netflix and Google have risen 116% to 1,087% since 2012 compared to the Australian share market which is up 22%.

Unfortunately there is a collective amnesia when it comes to investing and what is rarely mentioned is stocks and sectors tend to reach their peak when people are talking about them most. So if you’re seeing a certain sector in the news day after day, at best you’re late to the party… and worst case you’ve completely missed the boat!

The media and market commentators tend to reinforce this way of thinking. Pull up any financial press and you’re likely to find glowing articles about the future of technology companies like Facebook, Apple, Netflix, Alphabet (Google), Tesla, Uber and Amazon.

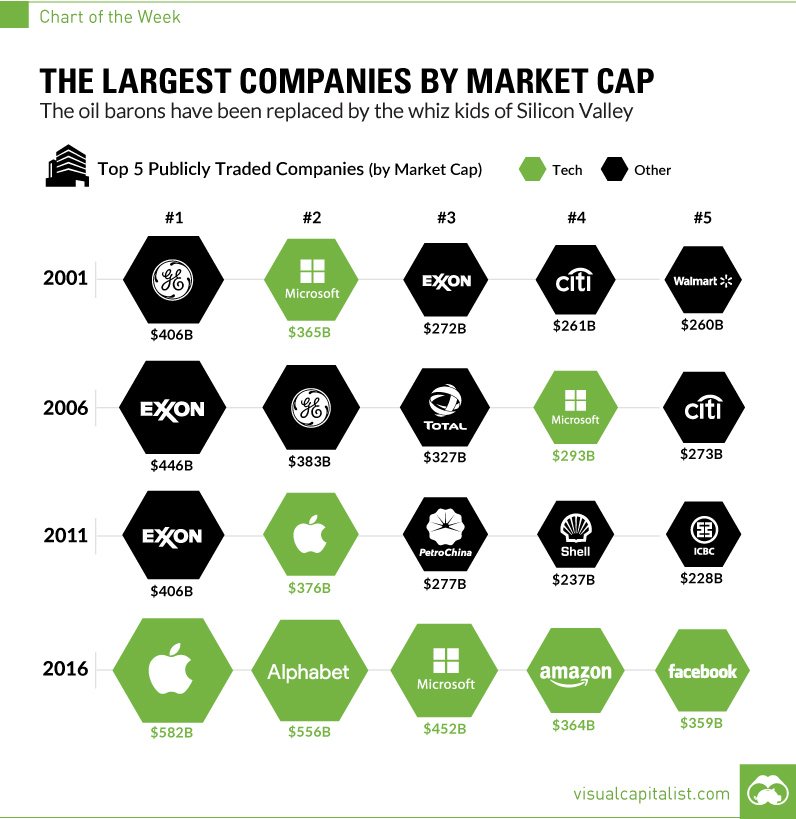

Tech stocks now make up all of the largest five companies in the world and it’s human nature to want to buy them because of hindsight bias and FOMO (fear of missing out). We think: “If only I’d bought them a few years ago I would have made big bucks … I better invest now so I don’t miss out!”

Source: Visual Capitalist

While it’s tempting to extrapolate recent performance into the forseeable future, sectors inevitably revert to the mean. This means that after a period of very strong returns, a sector is prone to have a period of weak performance.

That period of weakness can last years or even decades, so for people who bought late in the cycle it can mean a long wait before making back the money you’ve invested. And while you wait… you miss out on positive returns in other sectors.

Those who invested in oil stocks five years ago know how this feels. In 2011, Exxon Mobil, PetroChina, and Royal Dutch Shell were on top of the world. The three oil companies had all made it into the largest five companies in the world and with oil at $100 it was tempting to believe that “peak oil” was real and that the oil sector was going to continue rising higher and higher …

Five years on, oil prices have halved and their shares have all crashed back to earth. Anyone who had focused their investments into oil shares five years ago would have seen their investments devastated. They have missed out on great returns in sectors like technology, healthcare and property.

Are we in a technology bubble?

While every bubble is different, there are often common traits. Here are 6 I look out for when when assessing whether a frothy sector is close to the top:

-

Is everyone talking about investing in the sector, including people you wouldn’t associate with being investment experts?

-

Are many new stocks listing in the sector, and funds being created to invest in those stocks?

-

Are capital markets and media getting behind the sector – feeding consumer demand with new stories, research and investment products as profits gain momentum?

-

Do you feel stupid to be missing out as everyone else seems to be making easy money?

-

Has the sector become the biggest source of new ultra wealthy Rich Listers?

-

Are terms like ‘new paradigm’ being bandied about? Are people justifying prices rising beyond reasonable valuations suggesting that ‘things are different this time’ and ‘this sector is the future’?

Money flowing into bubble sectors tends to be highest at the top (after they’ve already done well). Returns tend to accelerate towards the peak as people jump over each-other to get involved. It becomes too easy to make money and it seems almost silly to be missing out.

The peak is also when it’s easiest to buy into the narrative behind a booming sector – in 2011 that story centered around fears of peak oil – today it’s that tech companies are taking over the world.

What causes bubbles to pop?

Commodity prices, interest rates, currencies, government policies, consumer preferences and relative competitiveness between countries can all play a part in shaping what causes a sector to grow and decline.

The reality is there are limits on how big any company or sector can get relative to the rest of an economy. It’s simply not possible for a sector to deliver above-market returns for an extended period… otherwise that sector would become the whole economy.

However, predicting exactly what will cause a hot sector to deflate is always a tricky one. That’s what makes it a bubble in the first place. Typically the story of everlasting growth becomes so ingrained that people can’t think of any reasons to sell.

Sectors usually peak for one simple reason… they run out of new buyers to drink the kool aid.

What does it all mean?

Does this mean that today’s hottest tech companies won’t be successful or continue to grow? Absolutely not – Apple isn’t going anywhere.

However anyone looking to start investing in this sector now should be ask themselves if it’s the right time to be focused in tech stocks? History suggests that other sectors are more likely to be the big winners of the next 5 years.

Which sectors will they be? It’s hard to know in advance, but a good place to start looking would be sectors that have haven’t done so well over the past decade and are due for ‘mean reversion’.

People who have made money in technology would be well placed to diversify their wealth out of the tech sector and into other areas of the economy.

Otherwise they risk ending up like mining magnate Nathan Tinkler who topped the BRW Young Rich List in 2010 and 2011 with over $1 billion but lost it all and declared bankruptcy in 2016 because he didn’t diversify out of the mining sector.

When you invest in the broad market index, like we encourage clients to do, you avoid the dangerous temptation to chase hot sectors. Rather than chase the sexiest stocks, we rebalance client portfolios out of countries and sectors that have performed well into those that haven’t.

This helps to avoid overexposure to a single sector and prevents long periods of poor returns after sectors grow too fast and then inevitably decline. Buying into the broad index also ensures that you never miss out on the next sector to thrive.

Investing into today’s hottest sector might be tempting, but it’s a strategy proven to be hazardous to your long-term investing success.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.