It’s been a bumpy start to 2025 for investors. Share markets dropped sharply in February and March, driven by geopolitical tensions, sticky inflation and tariff threats from the U.S. administration. But as we’ve seen many times before, diversified portfolios have proven resilient.

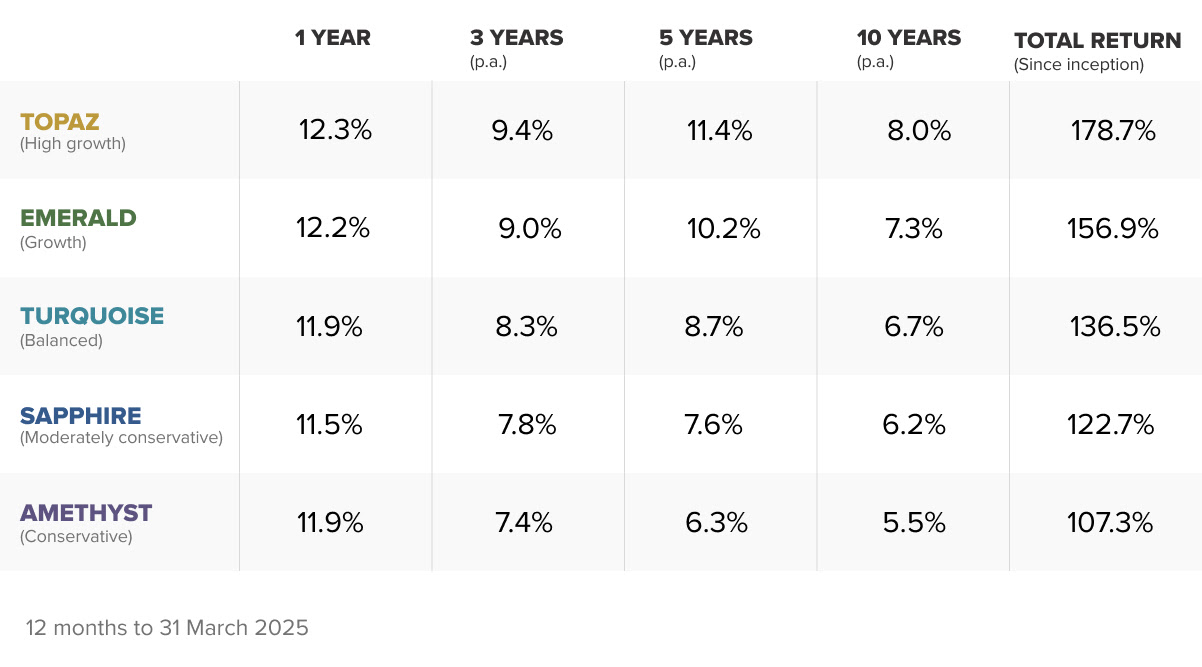

Over the 12 months to 31 March 2025, all five Stockspot Model Portfolios delivered strong after-fee returns between 11.5% and 12.3%, while our Sustainable Portfolios returned between 8.9% and 9.8%.

Returns were relatively even across conservative and growth portfolios. Australian shares and bonds both delivered modest returns of around 3% over the year. What made the real difference was our full exposure to unhedged global shares, which gained from a falling Australian dollar, and our strategic allocation to gold.

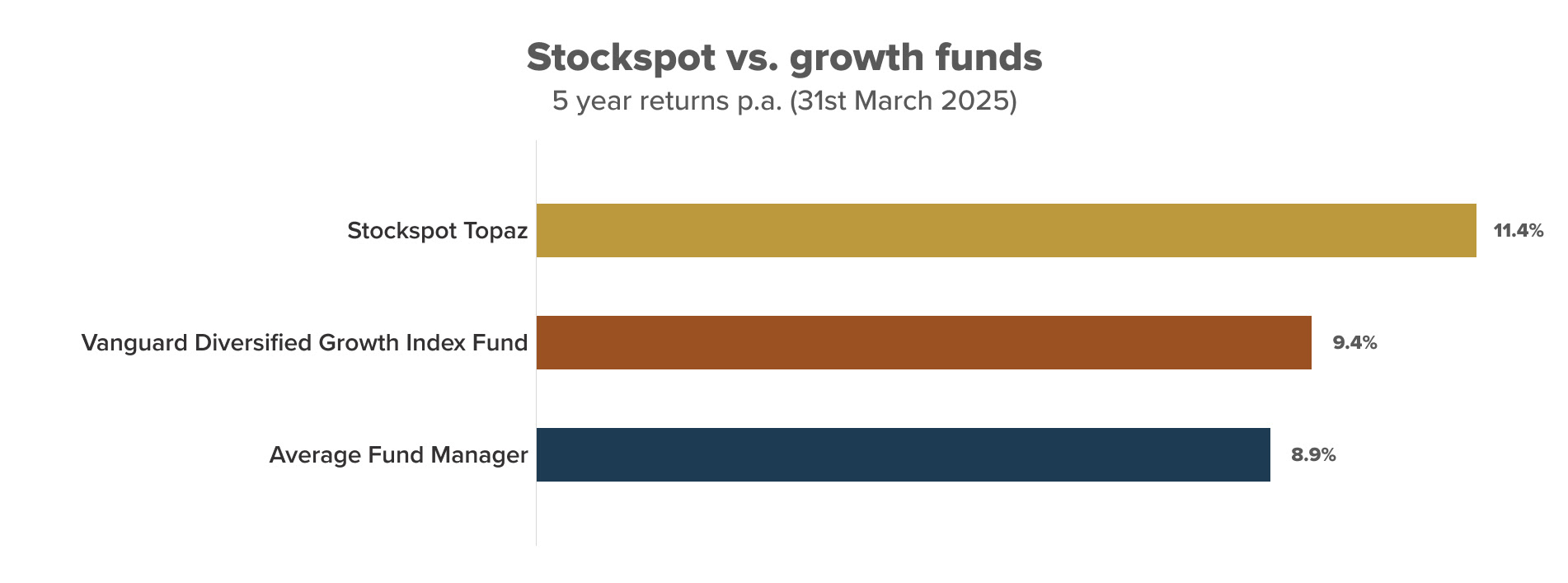

Over five and ten years, our portfolios across growth, balanced and conservative risk levels have outperformed 99% of comparable diversified funds, including those from Vanguard.

Over the past decade, our model portfolios have outperformed 331 out of 332 comparable diversified funds (99.6%)^

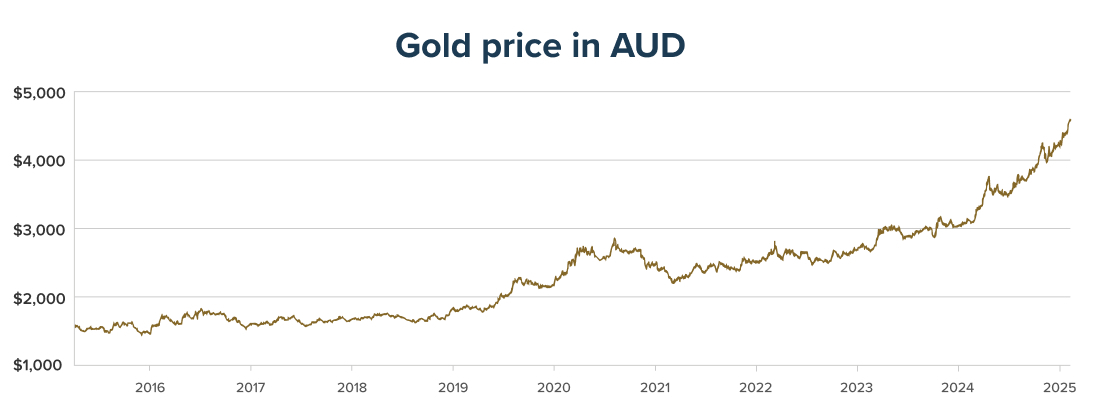

Gold shines again

Gold has been the standout performer. It rose 46% over the past year, reaching a record high of AU$5,000 per ounce by the end of March. That’s surprised many, given the usual headwinds of high interest rates and a strong U.S. dollar.

So why is gold still surging?

It’s largely down to concerns about inflation, ballooning government debt, economic uncertainty and a shift by central banks away from U.S. Treasury bonds. While most super funds hold little or no gold, our conviction hasn’t wavered. We’ve maintained a 14.8% allocation to gold in all client portfolios since early 2021. That decision continues to deliver meaningful benefits.

In fact, gold has risen over 110% since we increased our allocation. Over the same period, traditional defensive assets like bonds have struggled to keep up with inflation.

Rebalancing in action

This quarter, our automated rebalancing system kicked in for some portfolios. With gold outperforming and Australian shares falling, the portfolios had drifted out of alignment. Rebalancing helped trim gold and buy more shares at lower prices. That keeps risk at the right level based on each client’s goals.

It’s a simple but powerful process. And it works especially well during periods of market stress, when emotions tend to take over.

Indexing under fire… again

During times like these, critics often point the finger at index investing. Some argue that ETFs and passive funds distort markets or amplify volatility. But the data just doesn’t support that view.

Index funds still make up a small share of overall trading activity and are mostly buy-and-hold investors. If indexing really distorted prices, large-cap shares would move in lockstep. That’s not happening.

Despite all the noise, over 80% of active fund managers continue to underperform the market. That’s why we continue to focus on what works: broad diversification, low fees and staying invested through ups and downs.

Strong returns for our Income and Inflation portfolios

Our two specialist portfolios also delivered strong returns over the past year.

- The Topaz Income Portfolio returned 11.5%, led by strong gains in international property and high-yield assets.

- The Topaz Inflation Portfolio was the standout, returning 25.1%, with strong performance from gold, gold miners, silver, infrastructure and commodities.

These portfolios are built to manage specific risks — whether it’s generating reliable income or protecting against rising prices. Over the past year, they’ve done exactly that.

A new approach to super

This quarter also saw major cyberattacks targeting some of Australia’s largest super funds. Stolen member money was covered using other members’ fees. That should concern anyone who cares about how their retirement savings are managed.

It’s another reminder of why we built Stockspot Super – to offer a more transparent, and efficient way to grow your retirement savings.

Stockspot Super now has the highest gold allocation of any super product in Australia, offering a genuine hedge against inflation and economic risk. If your current super fund has little or no gold exposure, it’s worth asking why.

Coming soon: Stockspot Pension

We’ve just opened waitlist access for Stockspot Pension, our new retirement income solution launching later this year. It’s designed to help Australians draw income from their super in a smarter, more cost-effective way.

If you’re thinking about retiring in the next few years, this could be worth a look.