The 2025 financial year was another clear reminder that diversification and discipline work.

Despite constant noise from markets, politics and the media, our clients who stayed invested were rewarded with excellent results.

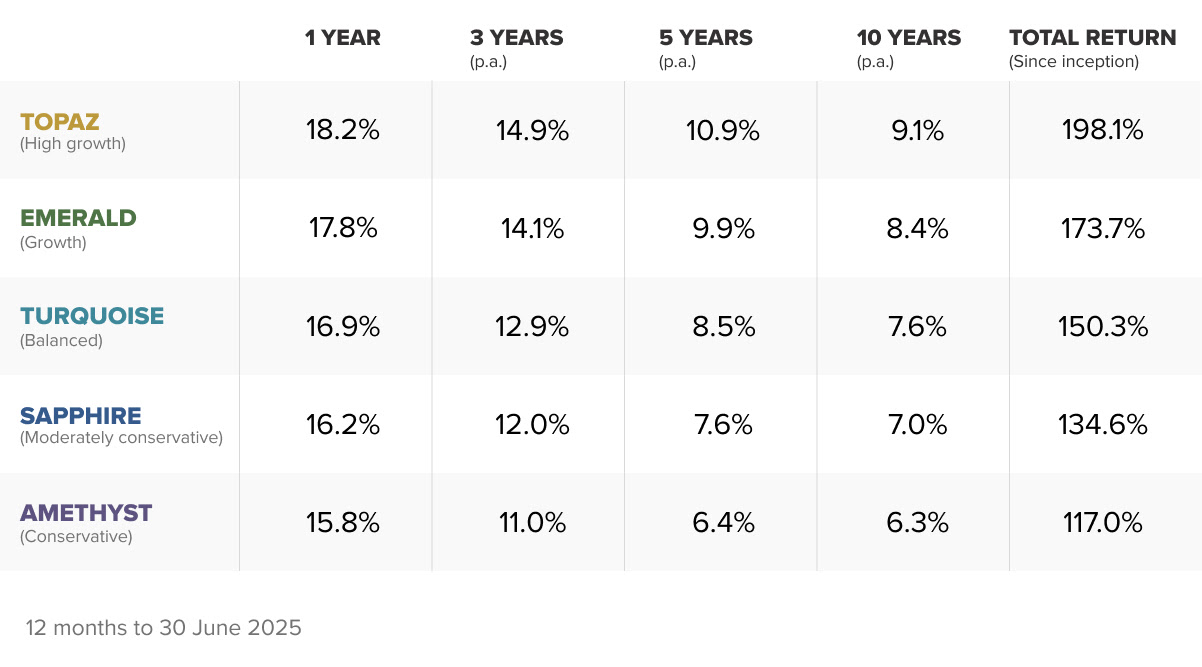

Our five Model Portfolios returned 15.8% to 18.2% after fees, while our Sustainable Portfolios gained 15.1% to 17.7%.

Over the past decade to 30 June 2025, our model portfolios have outperformed 336 out of 336 comparable diversified funds (100%)^

Our goals-based portfolios also had a standout year. Topaz Income returned 15.9%, while Topaz Inflation jumped 22.3%, boosted by strong performances from gold, silver, commodities and infrastructure.

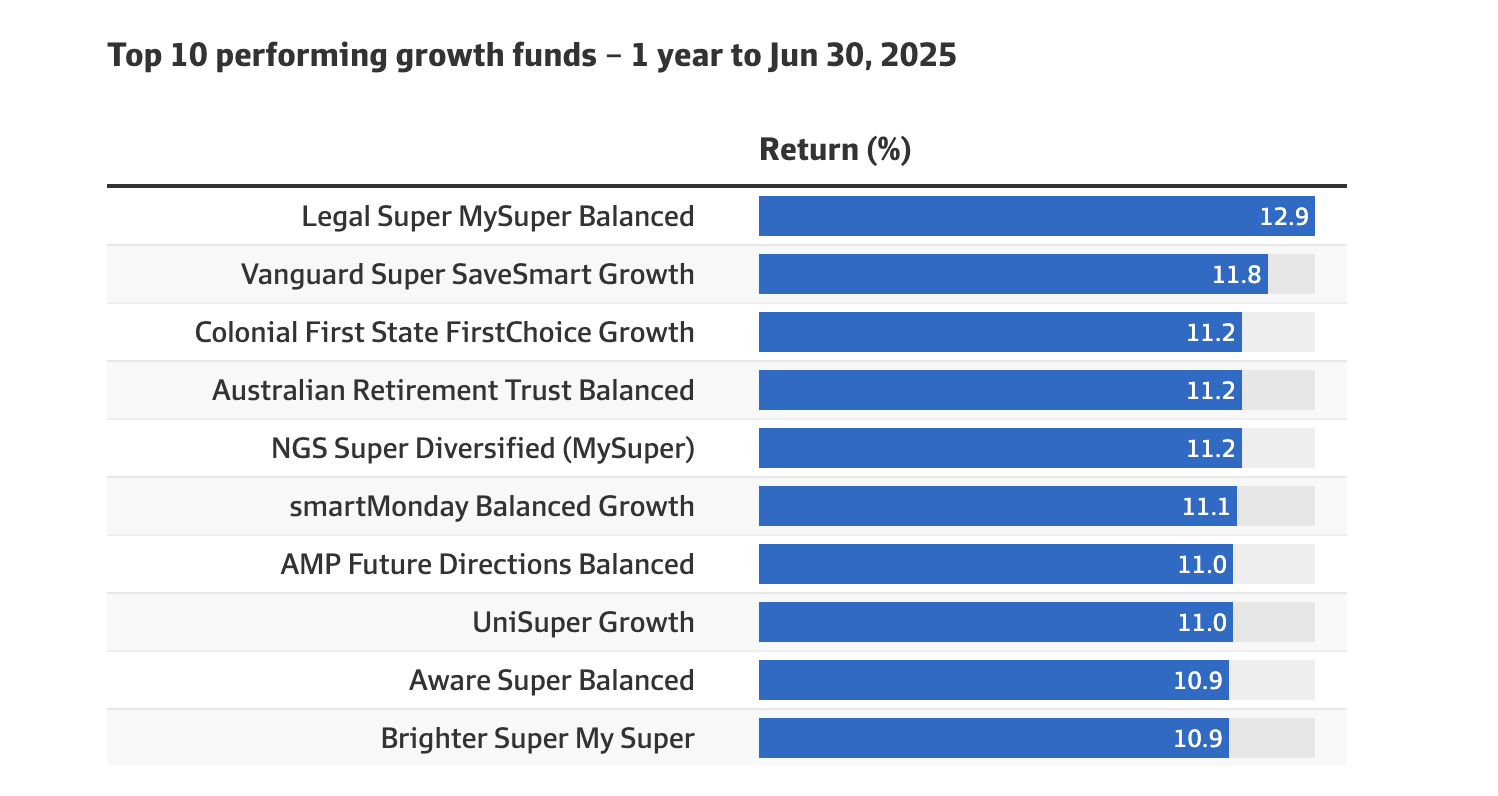

Outpacing the big super funds

These results compare favourably to the broader market. The top performing diversified super funds with 61-80% growth assets have reported returns of just 10.9% to 12.9% over the same period.

Even after factoring in the 15% super tax on income, which typically reduces super fund returns by about 0.45% per year, Stockspot portfolios still outperformed all default super funds that have reported so far.1

It means a self-managed super fund client with $300,000 invested through Stockspot would have done significantly better than Australia’s biggest super funds managing hundreds of billions.

This raises some big questions. Why are super funds spending billions each year on active stock picking and asset consultants when a simple, low-cost ETF strategy delivers stronger results? And why have big super funds been chasing the latest fads in venture capital and private credit while completely missing the outsized returns from more liquid and transparent assets like gold?

We unpack this in more detail in Active managers are confessing again – and missing the real lesson

Navigating the ups and downs

The year wasn’t without drama. Early 2025 was shaped by tariff uncertainty, geopolitical risks and volatile inflation data. Markets swung sharply after new U.S. tariff threats rattled investors. Confidence then returned.

Global shares rallied as trade worries eased, while Australian shares rose on the back of a surprise RBA rate cut and a clear Federal Election result. Gold, a core part of our portfolios, climbed to record highs and returned 42.5% for the year..

Other major asset classes also contributed positively:

- Australian shares gained 13.7%, helped by easing inflation and expectations of further rate cuts.

- Global large shares rose 13.0%, supported by strong U.S. earnings and record highs for the S&P 500 and NASDAQ.

- Emerging markets climbed 16.5%, boosted by looser monetary policy in China and improving export demand across Asia.

- Australian bonds added 6.9%, with falling yields lifting fixed income returns late in the year.

Why diversification matters

A diversified portfolio ensures not all assets move together. When shares dipped earlier in the year, gold helped protect portfolios.

After gold’s rally pushed it above target levels, Stockspot’s automated rebalancing trimmed profits for many clients and added more shares while they were cheaper.

Rebalancing at the right time is hard. It means buying what feels uncomfortable and trimming what feels safe. Automation removes that emotion, keeping portfolios aligned to your goals.

Making investing even more accessible

The start of a new financial year is a good time to revisit your savings plans and set yourself up for the future.

We’ve launched Stockspot Consultation, a free 30‑minute chat with one of our experienced advisers to help you understand your options and feel confident about your next step.

And to make it easier than ever to get started, our minimum investment is now $1,000 (down from $2,000). Clients with balances under $200,000 can now top up from just $500, so your money is put to work sooner.

Looking ahead

The second half of the year will bring more headlines and unpredictable market swings. For active traders, that’s a nightmare. For long-term investors, it’s just noise.

History shows markets reward those who stay invested through uncertainty. With sensible asset allocation, low-cost ETFs, smart rebalancing and a long-term mindset, Stockspot portfolios are designed to grow in line with markets while avoiding the risks of picking individual shares or trying to time the market.

The best results come to those who stay patient, stay diversified and stay invested.

^ Stockspot, https://morningstar.com.au comparison group of 336 surviving investment funds and their after-fee returns over the 10 years from 1 July 2015 up to 30 June 2025. Comparison is based on the after-fee returns of a Silver tier investment in either Stockspot Amethyst, Turquoise or Topaz portfolios (our most popular portfolio in each risk category) on the basis that they have similar exposure to growth assets to the moderate, balanced and growth multi-sector investment funds that have been compared. Past performance is no indication of future performance.

- This is based on a 3% distribution yield, with the 15% tax on income that applies within accumulation super ↩︎