Stockspot’s performance for the 12 months to 30 June 2024 was strong in both Stockspot Model Portfolios and Sustainable Portfolios.

Our five core options returned 11.1% to 15.4% after fees while our Sustainable options returned between 11.7% and 14.9%.

The Stockspot portfolios have also outperformed 98% of similar diversified funds in Australia over the last 5 years.^

Our Topaz Income and Topaz Inflation portfolios are still new, having been launched in October of last year, but have delivered returns of 10.0% and 11.9% respectively after fees.

US tech shares lead the way

The reporting period did not start off strongly with dips in Australian shares and bonds in April as interest rate cuts failed to materialise, which were mirrored by similar fears in the United States.

That didn’t hold back the booming technology sector.

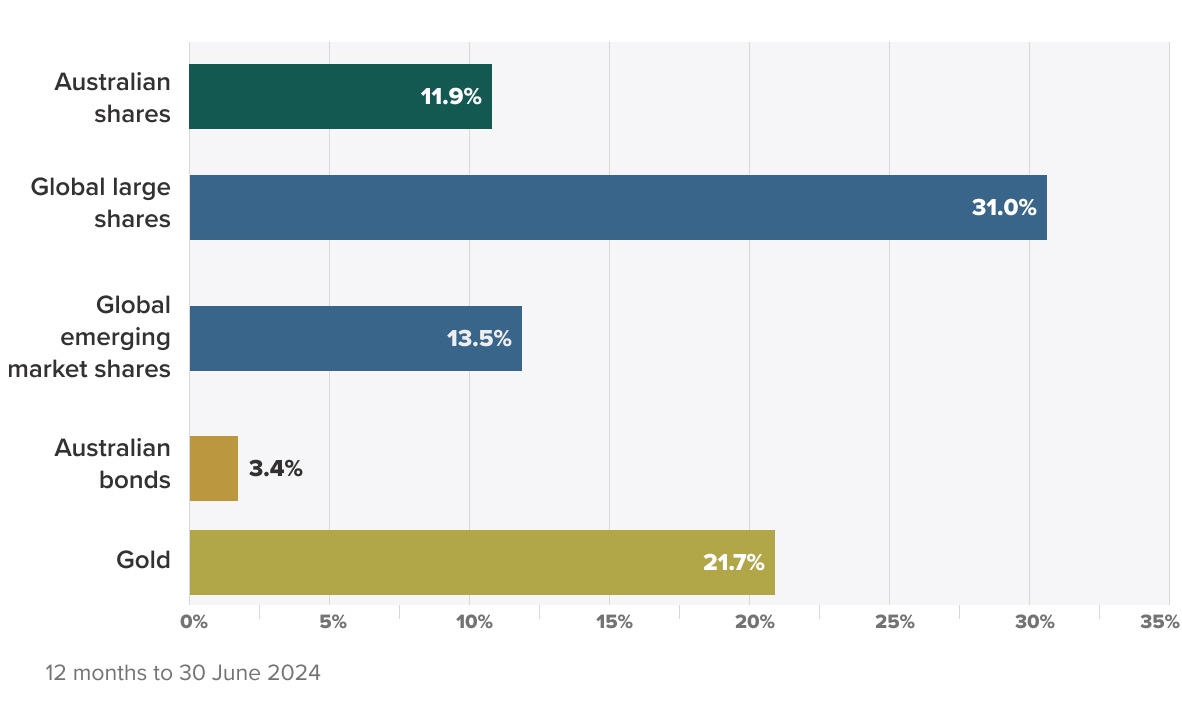

Semiconductor producer Nvidia rode the AI wave to overtake Apple at the top of the list in terms of the world’s largest companies amid a general strong showing from US tech stocks that flowed into our global shares ETF, IOO, which was up a huge 31% over 12 months.

America took the lead and Asia followed, with Taiwanese and South Korean semiconductor producers catching Nvidia’s wave to end June strongly for our emerging markets ETF, IEM, which was up 13.5% year-on-year at the end of the reporting period.

What the news doesn’t tell you about the ASX

Our own S&P ASX/200 smashed through the 8,000 point barrier for the first time in early July on the back of slow but solid gains across March-June.

Even more importantly for Stockspot customers, the ASX Accumulation Index, which includes dividends paid to customers, topped 103,000 points on the same day.

That shows the value of time in the market and reinvesting dividends: the ASX has grown by 33% since 2007, but the Accumulation Index has grown a massive 182% in the same time.

Our domestic market pays an above average amount in dividends, partly as a result of our culture of dividend paying but also because of the make up of our market, which has an over-representation of financial and mining companies compared to other global peers.

That, combined with our unique tax rules around franking credits, makes the income dividends aspect of our portfolios very attractive and continually benefit those who stay in the market for longer.

At Stockspot, we re-invested around $5 million of customer dividends in July.

Going for gold

Gold jumped 5.9% in April, but then fell slightly as inflation fears ebbed away. It ended the financial year up 21.7%.

The global gold price remains near historic highs as inflation data released at the end of June suggests that stagflation is still a potential problem.

Gold has historically done well in times of stagflation – when the economy is stagnant but inflation remains elevated – and while governments both in Australia and abroad are doing their best to avoid that, persistent inflation continues to be a structural challenge and other economic data suggests that we are not out of the woods yet.

The last golden age was in the 1970s when stagflation was a big problem for the global economy, and in many ways, we may be seeing a repeat of that now.

As long as it remains on the agenda, investors will find a place for gold, which in turn benefits those who hold it as a vital piece of a diversified portfolio.

It has long been our view that it is underrepresented in most portfolios, and our allocation of 14.8% to gold in every Stockspot portfolio shows our commitment to gold as a defensive asset.