We dropped by Sydney FC HQ last week to talk to the players about managing their personal finances and discuss some of the money traps young people fall into.

Sydney FC has a relatively young squad so many of the team are in the early stages of their playing careers. Being smart when it comes to managing their personal finances will enable the players to build a solid foundation for their careers after football.

Here are the 5 general tips we shared with the players. We think they are equally relevant to other Australians wanting to get ahead.

1. Spend less than you earn

It’s always important to spend less than you earn to avoid getting into expensive debt. If you’re having trouble keeping a budget, look to use a budgeting app like Pocketbook which can connect up to your bank accounts and credit cards to help you track your day-to-day spending.

2. Keep a cash buffer

Set aside a portion of your savings so that you can easily access it in case of an emergency, like illness, injury or loss of a job. We recommend that Stockspot clients have at least enough savings in cash and short term deposits to cover 6 months worth of expenses. This means they won’t need to sell long-term investments if something unexpected happens.

3. Start investing early and regularly

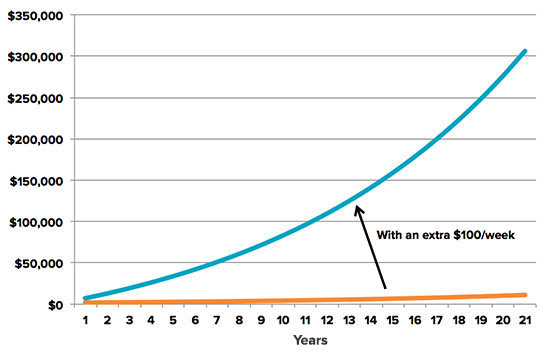

Investing early means you can take advantage of compounding, which helps you earn additional returns on profits that are re-invested. Setting aside a small amount on a regular basis (e.g. $100/week) can significantly boost your end balance thanks to compounding, as shown below.

The inverse is also true so we recommend avoiding debt where possible because the interest you pay compounds in a similar way! This can create a debt spiral which can be very difficult to get out of.

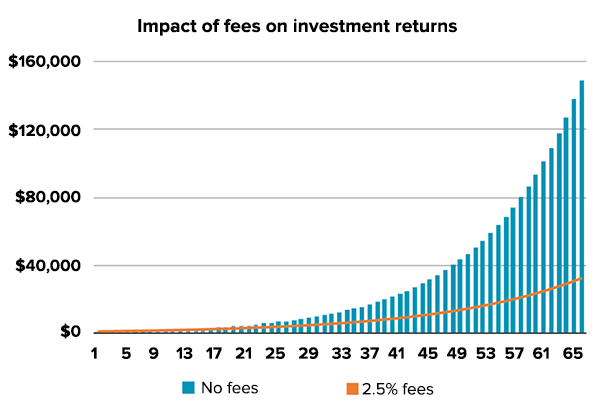

4. Focus on fees

High fees will eat into your wealth over the long term. For example if you invest $1,000 over 65 years in a portfolio returning 8% per year you will end up with $148,000. If that same investment charged just 2.5% per year in fees, your final balance would be reduced by 75%. That’s 3x your total savings paid to the financial industry in fees!

Don’t be afraid to ask your bank salesperson or financial adviser how they are paid. Seeing an adviser face-to-face can be a good option for some people but make sure they can explain how they are adding value to your financial situation and compare this to the fees they charge.

There are a growing number of low-fee services available that are technology driven and can significantly reduce the fees you pay over the long-term.

5. Don’t put all your eggs in one basket

Putting all of your savings in one asset class (e.g. shares in one company or a single property) increases your risk because one investment can easily go up and down due to factors outside your control. Diversification across different assets and regions can help reduce this risk because when one asset falls, others could be rising to offset it.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.