Managing investments for a charity or not-for-profit doesn’t need to be complex. In fact, simplicity is often the smartest strategy.

At Stockspot, we help Australian charities cut through confusion and regain control of their finances, using low-cost, evidence-based investing that supports your mission, not someone else’s commission.

Here’s how we do it:

Low fees, high transparency

We don’t charge performance fees. No hidden platform costs. No brokerage surprises. Just one simple, transparent fee, and no kickbacks from any fund managers. Keeping fees low is one of the simplest ways to maximise investment returns.

Diversified portfolios built for stability

All our portfolios include Australian and global shares, bonds, and gold, designed to weather all market conditions with their inverse relationships. We also offer sustainable investment options for ethically-minded organisations.

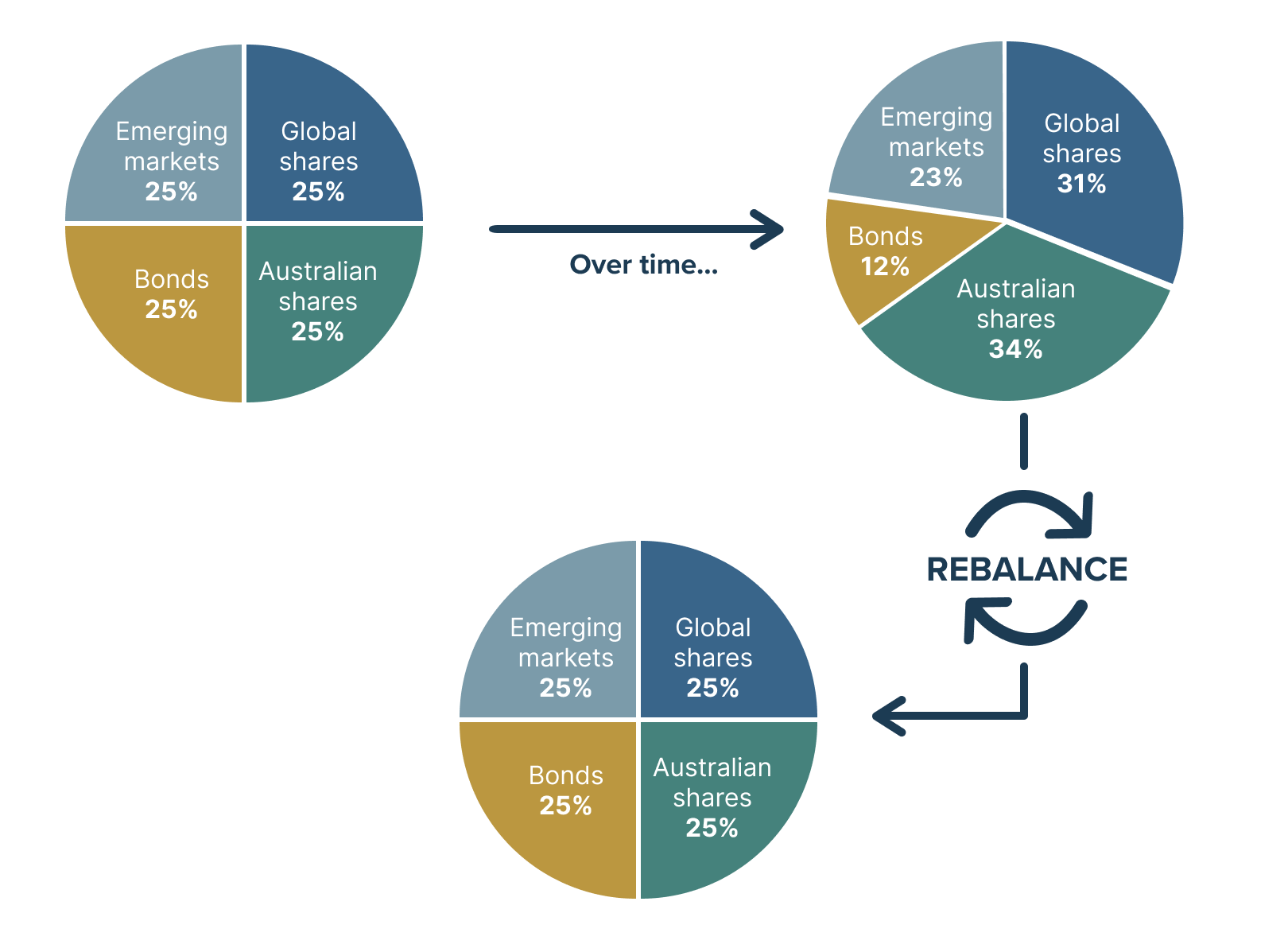

Automated, strategic rebalancing

Forget the next ‘hot sector’ or trying to outguess the market. We rebalance based on thresholds, not hunches, keeping your portfolio aligned.

Always accessible, always supported

You’ll have 24/7 access to your portfolio via our dashboard and app for complete visibility. You can also access our expert advice team when needed by phone, email or live chat.

We can even help you draft or review your Investment Policy Statement or attend investment committee meetings.

The outcome?

By reducing your fees and avoiding investment red flags, using an advisor like Stockspot can see more money going to your mission and less wasted on unnecessary fees, products, or complexity.

Ready to take the next step?

Book a complimentary strategy chat with our charity investment advisors.

Want to learn more? Download the comprehensive guide to investing as a charity or not-for-profit below.