At the 2023 New South Wales State election, the then-state government proposed a new scheme called the NSW Kids Future Fund. The aim of the fund was to provide a nest egg for children in the state (aged 10 and under) via a Kids Future Fund account from 2024. As the government failed to win reelection, the proposed scheme was never implemented by the new government.

Regardless of the election outcome, Stockspot has provided a breakdown of this scheme and how you can create your very own ‘kids future fund’ to help you start investing for your children today.

How would have the NSW Kids Future Fund worked?

The government would have contributed an opening balance of $400, and parents could have contributed up to $1,000 per year, with the government matching annual contributions of up to $400.

According to the government’s estimates at the time, if parents made the matched contribution of $400 per year, the fund could have grown to around $28,000 over 18 years, and potentially reached $49,000 if they contributed the maximum of $1,000 annually.

Importantly, the money in the fund could not have been withdrawn until the child turned 18, ensuring that it could have only been used to provide long-term benefits for their future.

At the time of announcing the scheme, tax implications of the proposed NSW Kids Future Fund had not been released.

“Investing at a young age can be a powerful tool for children to secure their financial future.” Chris Brycki

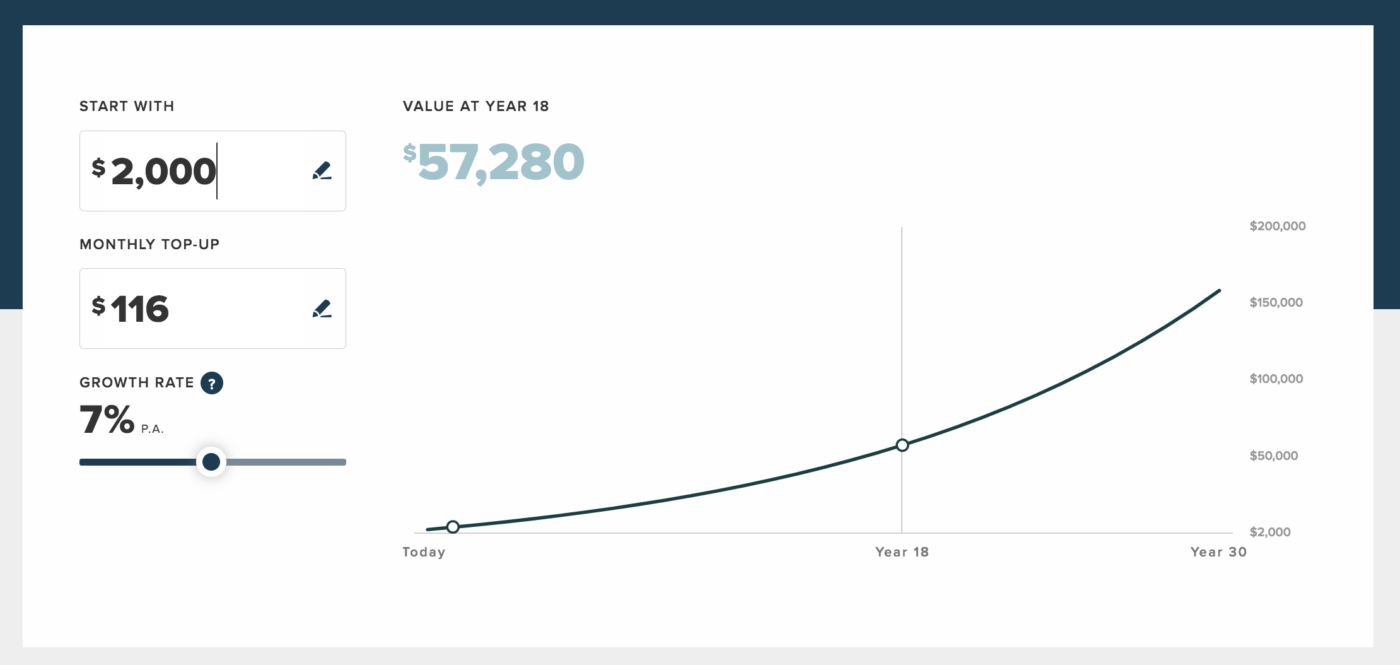

According to the Stockspot investment calculator, an initial investment of $2,000 plus annual contribution of $1,400 ($116 per month) would lead to a balance of $57,280 by the time a child is 18. This is based on an annual growth rate of 7%.

How much was the NSW Kids Future Fund expected to cost taxpayers?

The government estimated that the program would have cost $850 million over four years, with 947,000 NSW children under 10 signed up in the first year and then 100,000 newborns a year from 2024 onwards.

Who was eligible to participate in the NSW Kids Future Fund?

In year one of the scheme, children aged up to 10 would have been eligible to enter the scheme. Children over the age of 10 would not have been eligible to participate in the scheme.

Was the Kids Future Fund a good policy?

Teaching kids about investing early is important for many reasons. It helps children develop a strong understanding of how to make smart financial decisions. It also instils in them the importance of saving, budgeting and managing money.

The program seemed to encourage parents to save up for their children’s future which is important in the current climate where the cost of moving out of home including housing, food and education is rising. This can help ensure they have greater financial security as they grow and enter adulthood.

It also had the potential to reduce income inequality by providing children from low-income families with access to the same financial opportunities as those from wealthier backgrounds.

Some of the disadvantages of the program included the possibility that the government money may be better spent elsewhere (like directly in schools), that there’s the potential for poor investment returns since the government only guarantees 4% per year (which is below the current inflation rate of 7.8%) and there’s a lack of control over investments (where the money will be invested), when the money can be taken out and what it can be used for. The scheme was also only available for children under the age of 10 so older children would have missed out.

What are alternatives to the NSW Kids Future Fund?

One alternative to Kids Future Fund is Stockspot investing for kids.

Stockpsot developed investing for kids in 2018 to help parents and grandparents invest for their children and grandchildren to get ahead. We currently have thousands of parents (and grandparents) investing with us, many of whom make regular contributions to help their children and offspring benefit from compound growth.

We believe that saving and investing are incredibly important topics that children miss out on learning at school. If more children get first-hand experience seeing the benefits of regular saving and compound returns, it will be one of the most valuable financial lessons they’ll get in life.

Some of the advantages of Stockspot investing for kids over the NSW Kids Future Fund are:

- The Stockspot portfolios have a track record of performance whereas the NSW Kids Future fund was new with no performance history.

- There are several Stockspot portfolios to chose from whereas the NSW Kids Future fund was expected to be a single investment option.

- The Stockspot investments are held in legally and beneficially by you whereas the NSW Kids Future Fund investments were to be pooled with others.

- Stockspot investing for kids is open to kids of all ages whereas the NSW Kids Future Fund would only have been open for kids under the age of 10.

- You can contribute as much or as little as you like to Stockspot whereas the NSW Kids Future fund was to be capped at $1,000 per year.

- You can withdraw whenever you like whereas you would have had to wait until the child turns 18 with the NSW Kids Future Fund.

- You can use the money for whatever you like with Stockspot whereas the NSW Kids Future Fund could only have been used for a limited number of purposes (like housing or education).

- Stockspot doesn’t charge any fees until the child turns 18 or the account reaches $10,000.

- You get access to a dashboard and app where you can track the investments (and discuss them with your kids). It was not clear whether the NSW Kids Future fund would have had an app.

- Stockspot publishes regular educational content to help parents talk to their kids about investing. Our YouTube channel has a kids investing series of videos with some more tips and ideas: https://www.youtube.com/playlist?list=PLG_2uoxbwYhLPOeZN1KRh4n1XkkXzOxtY

- There’s a Sustainable investing option for parents who want to invest in that way whereas the NSW Kids Future fund would have been a single investment option.

- The NSW Kids Future Fund, ultimately, was subject to whoever was in power at the time and subsequently was never implemented to a change in government.

Some of the advantages of the NSW Kids Future Fund would have had over Stockspot investing for kids:

- The government would have guaranteed a return of at least 4% per year whereas Stockspot returns are not guaranteed.

- The government would have co-contribued up to $400 per year to the investment whereas Stockspot only waves fees.

How to invest in ETFs for kids

The Stockspot investing for kids portfolios contain low-cost index exchange traded funds or ETFs. ETFs are listed on the stock exchange and provide direct access to a wide range of investments such as Australian shares, international shares, bonds or metals. They are perfect for growing and preserving long term wealth.

If you’re thinking about investing in ETFs for your child, you can set up a minor’s account where the investment is held in your name as trustee, with your child listed as the account designation. This means you’ll be in charge of the investments until your child turns 18, when they can be transferred across to them as an adult. To ensure you choose the right investment structure, it may be a good idea to seek advice about the tax implications, such as ongoing tax on income and future capital gains tax.

You can learn more about Stockspot’s investing for kids accounts here