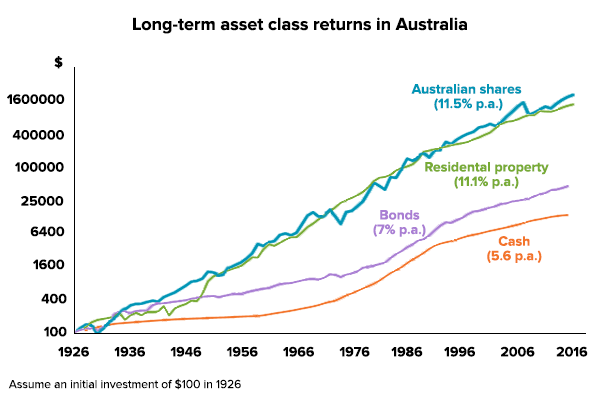

Over long periods of time, markets have always risen and generated wealth for investors. That’s much harder to see if you’re focused on market movements over a few days, weeks or even months.

In the 4 years since Stockspot launched, all 5 of our portfolios and all 5 of the the core ETF investments within our portfolios have risen in value.

Stockspot 4 year portfolio performance

| Topaz | |

|---|---|

| Emerald | |

| Turquoise | |

| Sapphire | |

| Amethyst |

Total return after ETF and management fees as at 30 April 2018. How we calculate returns.

Stockspot 4 year core investment performance

| Gold | |

|---|---|

| Emerging markets | |

| Australian shares | |

| Global shares | |

| Bonds |

However this upward trend is much harder to observe over shorter periods of time. Over days, weeks or even months market movements appear to be much more random. Paying too much attention to short term performance can be a distraction to achieving your investment goals.

The best way to remain sane while investing is to ignore short term moves altogether. This allows you to separate the signal (upward trend) from the noise (random moves around that trend). Only when you block out short term moves and zoom out to longer timeframes does the upward trend become obvious.

Sources: ABS, REIA, Global Financial Data, AMP Capital

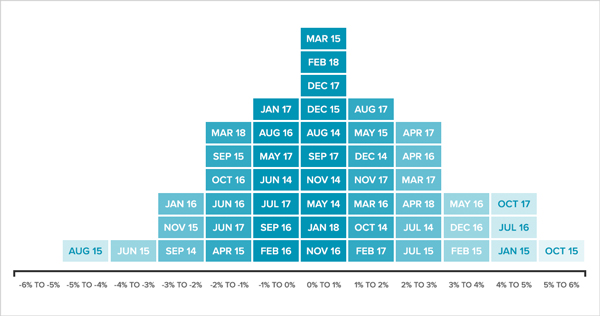

Why monthly returns are meaningless

Take our aggressive growth portfolio (Topaz). Since we launched it has had an average return of 0.66% per month which is about 3x more than you’d get in the bank.

However the range of monthly returns has been much wider at +5.1% to -4.8%. This chart shows the returns in different months over the past 4 years. They’ve been stacked to show what’s most common.

Stockspot Topaz monthly portfolio returns

What’s interesting is that out of 48 months:

- Monthly returns fit a typical ‘bell curve’ around the average return of 0.66%.

- In a typical year, 8 months were up and 4 months were down.

- The most common return of -1% to 1% happened 35% of the time (4 months a year).

- Three quarters of the time the portfolio return was -2% to +2% (9 months a year).

- There have been 4 months with a return greater than +4% and 1 month of worse than -4%.

So if you had been invested in this portfolio over the whole period your total return would have been around 35.4% after fees. But over a single month you could be up 5% or you could be down 5%.

Nobody really knows when markets are about to rise or fall in the short term so if you were investing for the first time you could get lucky or unlucky in your first month.

But the point is that if you’re investing for a few years it doesn’t really matter what returns are over a month or two. The only way you would have done badly is if you panicked and sold during a market dip.

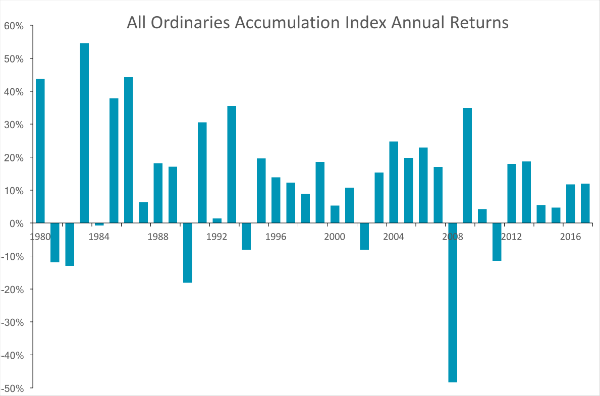

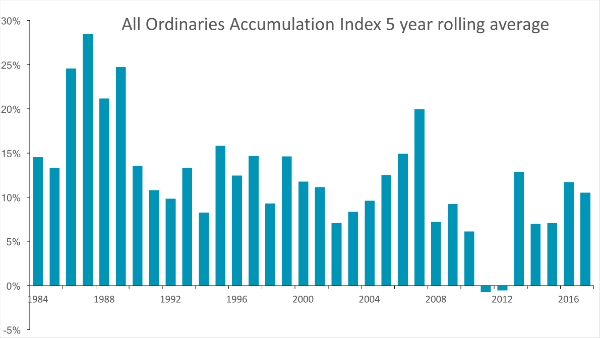

Australian shares over 1, 5 and 10 year periods

It’s not only monthly returns that are random and worth ignoring, here’s the 1 year returns for the Australian share market. Since 1980 there have been 29 up years and 8 down years with returns ranging from around +66.8% in 1983 to -40.4% in 2008.

Over rolling 5 year periods (i.e. prior 5 year blocks) a lot of that uncertaintly disappears. Since 1980 there were only 2 times when the rolling 5 year returns were negative. That was 2011 and 2012 after the Global Financial Crisis (GFC), and in any case they were only slightly negative.

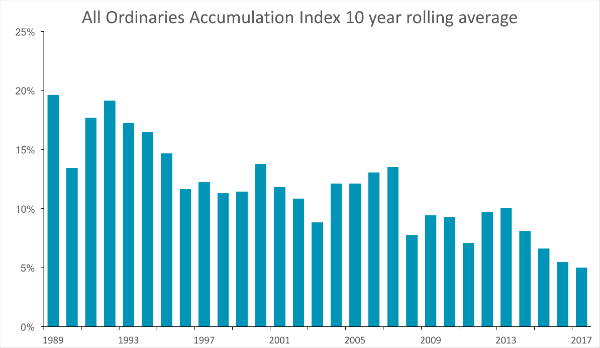

Zoom out further still to look at 10 year rolling returns and there hasn’t been a single instance of negative performance since records began in 1875! So if you chose any 10 year window to invest over the last 140+ years, you would have made money every time.

How can this help your investing?

The reason you earn a higher return when you invest is because you accept more variability in short term results compared to leaving cash in the bank. Investing rewards your patience with better long term returns.

Stockspot’s Topaz portfolio has returned 35.4% total (7.88% p.a.) over the last 4 years, but to have achieved this return you would have needed to have stayed invested even when your portfolio fell 4.8% in August 2015.

That would have taken nerves of steel! However if you had instead left your cash in the bank during the same 4 year period you would have earned only around 10.4% total (2.5% p.a).

That’s why your risk profile and investment time frame are so important; they allow you to become an investor rather than a speculator. The longer you invest, the more that time will iron out any bumps along the way and give you a decent return.

The benefit of investing outside of just Australian shares is that you can skew the odds even further in your favour and shorten how long you need to invest in order to benefit.

It’s why we also own global shares, emerging markets, bonds and gold and we combine them in a way which reduces your risk. Rather than investing for 7-10 years which is what you need with only Australian shares, we suggest the following timeframes for our diversified portfolios:

| Topaz | |

|---|---|

| Emerald | |

| Turquoise | |

| Sapphire | |

| Amethyst |

Find out how Stockspot makes it easy to grow your wealth and invest in your future.