With Australia aiming to achieve net zero emissions by 2050, investors can play their part in contributing to a more climate-friendly world by investing in sustainable investments.

Switching to exchange traded funds (ETFs) that focus on prioritising environmental, social, and governance (ESG) characteristics can be an effective way to reduce your carbon emissions. Often this has a greater impact on reducing emissions than many non-investing activities and is a great way to align your personal values when investing.

- What ESG ETFs are available for investors to reduce their carbon footprint?

- Is the best way to reduce carbon emissions through divestment or engagement?

- What are the risks of sustainable investing?

- Why investing in sustainable ETFs can make a difference to climate change

What ESG ETFs are available for investors to reduce their carbon footprint?

The ESG and sustainable investing market in Australia is now worth $40 billion according to Morningstar, of which sustainable ETFs are growing in market share with a size of around $9 billion.

There are three types of sustainable and ESG ETFs available to choose from:

- Broad-based ESG ETFs – covering broad regions/countries and investments with environmental, social, and governance criteria for selecting sustainable companies.

- Thematic ESG ETFs – covering niche sustainability issues and themes that are not constrained by region/country.

- Active ESG ETFs – rather than follow a rules-based sustainable index, active ETFs choose companies with the aim of outperforming an index and generating positive sustainable outcomes.

We prefer to avoid thematic ETFs and active fund managers, and instead favour the best ESG ETFs for our Sustainable Portfolios.

Click here to scroll down to see the types of ESG ETFs available.

Is the best way to reduce carbon emissions through divestment or engagement?

When it comes to sustainable investing, there are two main approaches: divestment or engagement.

Divestment involves not investing in a company if it does not meet strict criteria or rules. For example, our chosen sustainable Australian shares ETF does not invest in any companies involved in the fossil fuel industry.

Engagement involves investing in a company with the aim to have a greater impact through voting and encouraging them to act in a socially responsible manner. Investors can take positions in unsustainable or transitioning companies and vote on shareholder proposals with a specific focus on efforts surrounding sustainability. Engagement is a more active role than simply divesting, as investors can direct company management to make decisions that align with their social and environmental values.

So which is the best approach? We believe that a hybrid approach combining both strategies of divestment and engagement can achieve good sustainable outcomes for investors.

ETFs adopt this approach through their strict negative screening processes where they avoid companies that don’t meet strict ESG criteria. ETF issuers can also use their investment stewardship to vote on your behalf. For example, BlackRock, the largest asset manager in the world, is normally in the top 10 shareholders of most companies. They, as well as other ETF issuers, have a corporate governance and investment stewardship team that can vote on investors’ behalf in favour of company proposals that incorporate ESG considerations in order to deliver the best value for shareholders.

What are the risks of sustainable investing?

While sustainable investing can achieve a positive outcome for the planet without sacrificing returns, there are some risks to consider.

Investing in sustainable ETFs that have strict ESG screens can lead to sector concentration risk. This could mean your portfolio has a lower allocation to sectors like materials, energy and financials. Meanwhile, your weighting towards sectors like healthcare and technology could be elevated. Sectors go through periods of outperformance and underperformance. Not having an allocation to oil and mining companies has seen ESG ETFs underperform in 2022.

Sustainable ETFs are also more expensive than traditional index ETFs, charging a higher management fee. Every dollar you pay in fees means less money in your pocket, so paying high management fees could eat into your returns.

Why investing in sustainable ETFs can make a difference to climate change

To contribute to a more carbon-neutral society investors can consider buying sustainable ETFs.

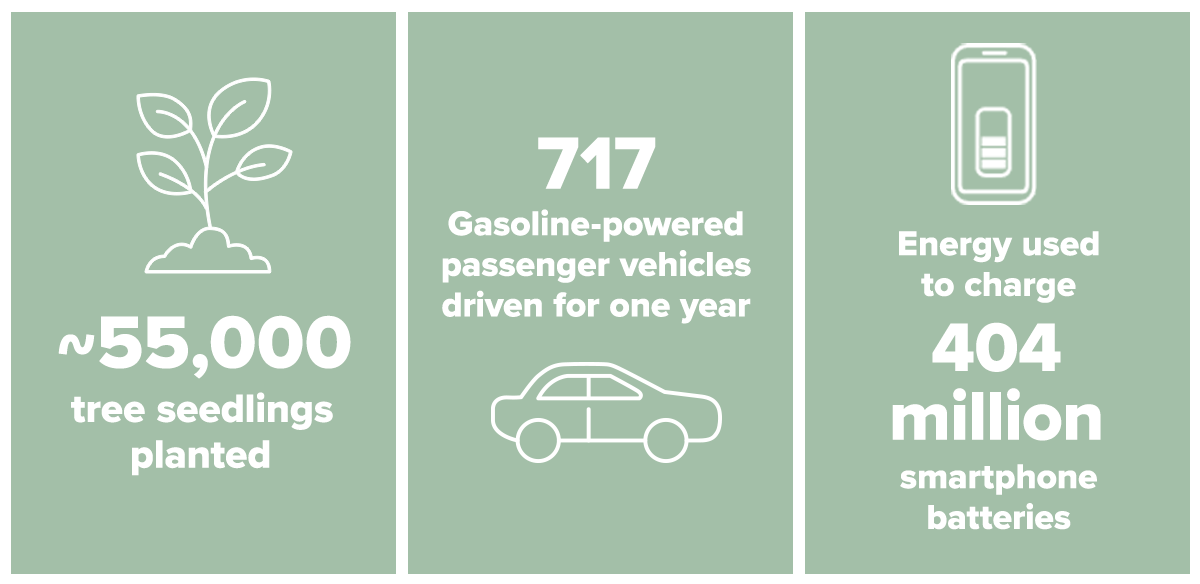

The holdings within the Stockspot Sustainable Portfolios contributed 3,665 fewer tonnes of carbon emissions than holdings within a normal index portfolio. This means you can reduce your carbon emissions by up to 90% by simply switching from a normal investment portfolio to a sustainable portfolio.

Switching to a sustainable portfolio can also reduce your carbon footprint more than most non-investing activities such as switching to an electric car or recycling.

This means that you can achieve your investment goals, while also contributing to a greener planet.

Nearly 15% of Stockspot clients have chosen to invest their money in a sustainable way. If the trends in overseas markets are anything to go by, sustainable ETFs will continue to become more popular in Australia as more investors incorporate environmental and ethical values into their financial goal-setting.

ESG ETFs available on the Australian market

Broad-based ESG ETFs

| ETF Ticker Code | ETF Name | Category | Cost |

| FAIR | BetaShares Australian Sustainability Leaders ETF | Australian shares | 0.49% |

| RARI | Russell Australian Responsible Investment ETF | Australian shares | 0.45% |

| VETH | Vanguard Ethically Conscious Australian Shares ETF | Australian shares | 0.17% |

| GRNV | VanEck Vectors MSCI Australian Sustainable Equity ETF | Australian shares | 0.35% |

| E200 | SPDR S&P/ASX 200 ESG Fund | Australian shares | 0.13% |

| IESG | iShares Core MSCI Australia ESG Leaders ETF | Australian shares | 0.09% |

| ETHI | BetaShares Global Sustainability Leaders ETF | Global shares | 0.59% |

| HETH | BetaShares Global Sustainability Leaders ETF – Currency Hedged | Global shares | 0.62% |

| ESGI | Vaneck Vectors MSCI International Sustainable Equity ETF | Global shares | 0.55% |

| VESG | Vanguard Ethically Conscious International Shares Index ETF | Global shares | 0.18% |

| IWLD | iShares Core MSCI World All Cap ETF | Global shares | 0.10% |

| IHWL | iShares Core MSCI World All Cap AUD Hedged ETF | Global shares | 0.13% |

| WXOZ | SPDR S&P World ex Australian Fund | Global shares | 0.18% |

| WXHG | SPDR S&P World ex Australian (Hedged) Fund | Global shares | 0.21% |

| DJRE | SPDR Dow Jones Global Select Real Estate Fund | Global shares | 0.50% |

| WEMG | SPDR S&P Emerging Markets Fund | Global shares | 0.65% |

| GBND | BetaShares Sustainability leaders Diversified Bond ETF – Currency Hedged | Fixed income | 0.49% |

| VEFI | Vanguard Ethically Conscious Global Aggregate Bond Index (Hedged) ETF | Fixed income | 0.26% |

| AESG | iShares Global Aggregate Bond ESG (AUD Hedged) ETF | Fixed income | 0.19% |

| DBBF | BetaShares Ethical Diversified Balanced ETF | Diversified | 0.39% |

| DZZF | BetaShares Ethical High Growth ETF | Diversified | 0.39% |

| DGGF | BetaShares Ethical Diversified Growth ETF | Diversified | 0.39% |

| IBAL | iShares Balanced ESG ETF | Diversified | 0.22% |

| IGRO | iShares Growth ESG ETF | Diversified | 0.22% |

Thematic ESG ETFs

| ETF Ticker Code | ETF Name | Category | Cost |

| CLNE | VanEck Vectors Global Clean Energy ETF | Clean Energy | 0.65% |

| HGEN | ETFS Hydrogen ETF | Clean Energy | 0.69% |

| TANN | BetaShares Solar ETF | Clean Energy | 0.69% |

| URNM | BetaShares Global Uranium ETF | Clean Energy | 0.69% |

| ERTH | BetaShares Climate Change Innovation ETF | Climate Aligned | 0.65% |

| XCO2* | VanEck Global Carbon Credits ETF (Synthetic) | Climate Aligned | N/A |

| EDOC | BetaShares Digital Health and Telemedicine ETF | Health | 0.67% |

| IEAT | BetaShares Future of Food ETF | Food | 0.67% |

Active ESG ETFs

| ETF Ticker Code | ETF Name | Category | Cost |

| INES | InvestSMART Ethical Share Fund (Managed Fund) | Australian Shares | 0.97% |

| IMPQ | eInvest Better Future Fund (Managed Fund) | Australian Shares | 0.99% |

| AEAE | Australian Ethical High Conviction Fund (Managed Fund) | Australian Shares | 0.80% |

| FUTR | Janus Henderson Global Sustainable Active ETF (Managed Fund) | Global Shares | 0.80% |

| MCSE | MFG Core ESG Fund (Managed Fund) | Global Shares | 0.50% |

| GIVE | Perpetual Ethical SRI Fund (Managed Fund) | Global Shares | 0.65% |

| JZRO | Janus Henderson Net Zero Active ETF (Managed Fund) | Global Shares | 0.85% |

| MCCL | Munro Climate Change Leaders Fund (Managed Fund) | Global Shares | 0.90% |

| NNUK | Nanuk New World Fund (Managed Fund) | Global Shares | 1.10% |