Ethical investing is about investing according to your morals, ethics and values, and allows you to invest in companies that demonstrate a positive environmental and social impact.

Ethical investing can also be called:

- socially responsible investing

- impact investing

- sustainable investing

- ESG (environmental, social and governance) investing.

Investing used to be about identifying companies based on financial returns alone, but over the last decade, there’s been a growing interest in a more socially focused investment approach. Nowadays, more investors are aiming to seek out companies that demonstrate both good financial performance and alignment with sustainable goals.

What does ethical investing involve?

There is no industry standard definition for ‘ethical investing’. This can create confusion as a lack of standardisation can lead to ‘greenwashing’, which is the practice of making a misleading claim about the sustainable benefits of a product. The good news is there are a number of regulatory initiatives (such as the United Nations and European Commission) aimed to create a more standardised approach to ethical investments.

What makes a company ethical?

With tens of thousands of publicly listed companies across the globe, it takes a bit of investigation to find out which ones have ethical and sustainable practices.

Ethical investing research uses a framework that filters out companies that don’t meet certain criteria and includes companies that demonstrate good ethical and sustainable practices. This is often referred to as “positive” and “negative” screening. For example, negative screening excludes companies involved in practices deemed to be unethical or unsustainable, such as fossil fuel mining, tobacco or weapons manufacturing.

Ethical investment frameworks are typically centered around environmental, social and governance (ESG) factors:

- Environmental: climate change, carbon emission and footprint, waste and toxic emission, clean technology and renewable energy.

- Social: employee wellbeing, supply chain standards, product safety, privacy/data, good stakeholder management, and community impact.

- Governance: board diversity (e.g. independence and gender diversity), executive pay remuneration, accounting and business practices, corruption, and transparency.

Companies who integrate ESG may benefit from the increased brand reputation and a more loyal and stable consumer following. Ethical investing allows you to invest in those companies that are less likely to face risks such as reputational damage and lawsuits for unsustainable practices.

Ethically focused exchange traded funds (ETFs) use extensive rules-based research to own the best ethical and sustainable companies.

Alignment with UN Sustainable Development Goals

In 2015, the United Nations agreed to unify 17 Sustainable Development Goals that are designed to drive government and business activity towards a sustainable future. The goals are a blueprint for developing a better planet. Companies are increasingly exploring ways to help address current sustainability issues, and the more we support these companies, the easier it will be for the UN goals to be realised.

Some of the ETFs in the Stockspot Sustainable Portfolios incorporate alignment with UN Sustainable Development Goals.

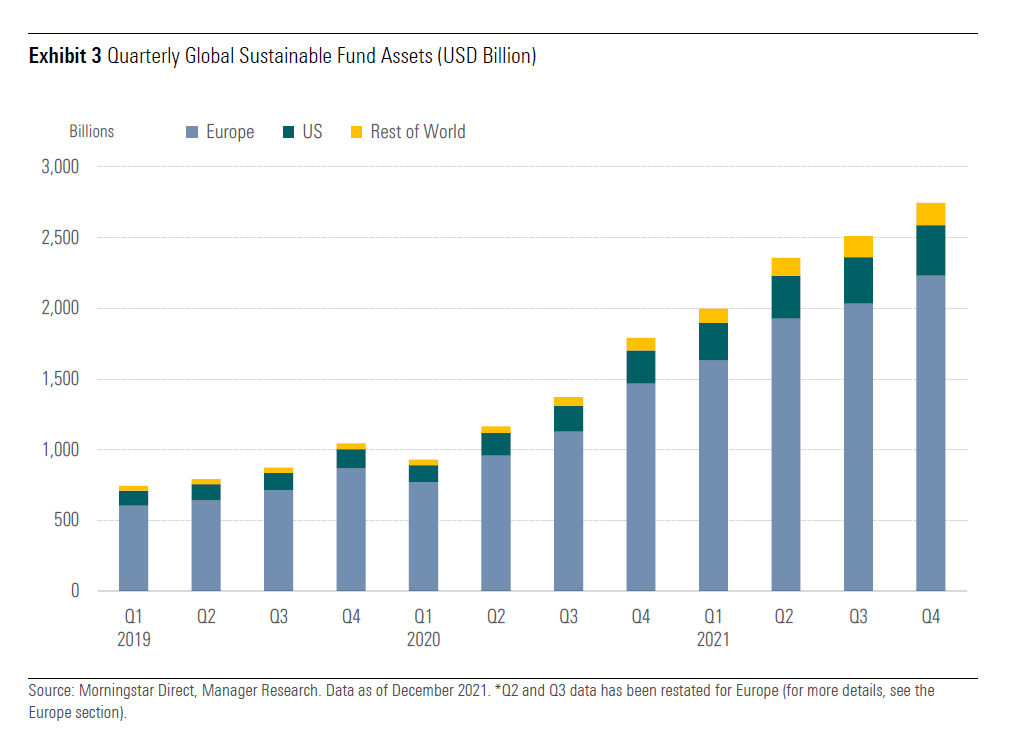

Growth of ethical investing

Ethical investing has been growing in popularity, particularly over the last few years. As a result of more money moving into ethically focused investment products and super funds such as Australian Ethical and Future Super, ethical frameworks are becoming a larger and larger consideration in investment and business decisions.

Australians are showing a strong desire for sustainable investment options, particularly following the Hayne Royal Commission, the Australian bushfire disasters, and the coronavirus pandemic.

These events have shed a spotlight on sustainable opportunities, and have made investors conscious of their role in supporting sustainable initiatives.