Meet Vivien Wong

Hi, I’m Vivien. I’m a mother and a digital field marketing specialist. In 2021 my family and I moved to regional Victoria, during the pandemic, into our first home.

We really love it here with its beautiful beaches, amazing community, well-hidden restaurant gems and, yes, even the weather!

I’ve been a Stockspot client for three years. Stockspot has enabled me to think about investing and how I would like to grow my financial independence. This is especially helpful given the way our world and how we work is changing and has changed so rapidly.

I want to start a business so I can have more time to live purposefully and realise my personal ambition to gain further financial freedom through solopreneurship.

A lot of it is motivated by my desire to spend more quality time with my 11-year-old who is growing up quickly and to carve out quality time to invest in my wellbeing, home, and relationships that matter to me.

Why I decided to trust Stockspot to manage my investment portfolio

I decided to trust Stockspot to manage my investment portfolio for a number of reasons.

My original intention in starting with Stockspot was to grow my savings by investing them in a higher yielding option, so over time I could secure my home deposit.

Having achieved the first milestone, I’m continuing with this strategy to build a nest egg to fund our lifestyle, retirement, and ensure a secured future.

We can live according to our goals despite the changes in the economy because I’ve learned that time in the market, as opposed to timing the market, works well for us.

Stockspot is simple without all the complicated jargon. Chris Brycki’s [Founder and CEO of Stockspot] regular column also educates me a lot about how to tune out the emotions and focus on what matters. You can say this is as much as investing in yourself and your financial future by acquiring the right knowledge.

“What I love about Stockspot is the Stockspot app interface and the amazing support crew. Stockspot is simple without all the complicated jargon.

The Stockspot sign up process was super easy

I found the Stockspot sign up process super easy. It was also straightforward and everything was clearly explained, and easy-to-find. When answers are not present the Stockspot support team always ensures that I have someone looking after me.

Stockspot is helping me achieve my financial goals

Stockspot is a firm investment strategy that has helped me to realise my dreams despite the ups and downs from life. In the last few years, we have seen unprecedented disruptions to how we live, work, travel, and battle natural disasters, and market changes. I was also working two jobs and balancing solo parenting.

I did consider putting my money in a savings account or acquiring a few shares. The lack of returns and diversification carried a risk level that I was not prepared to accept nor justify. Since discovering Stockspot it has given me a purpose and focus. Today, when I get a bonus payment or additional spare cash, guess where it goes to? I am a huge advocate for financial empowerment and recommend my friends to consider ETFs as part of their portfolio.

I have found my investing experience with Stockspot to be easy, transparent, and most importantly – it gives me full control on how I want to invest my money.

What I love about Stockspot

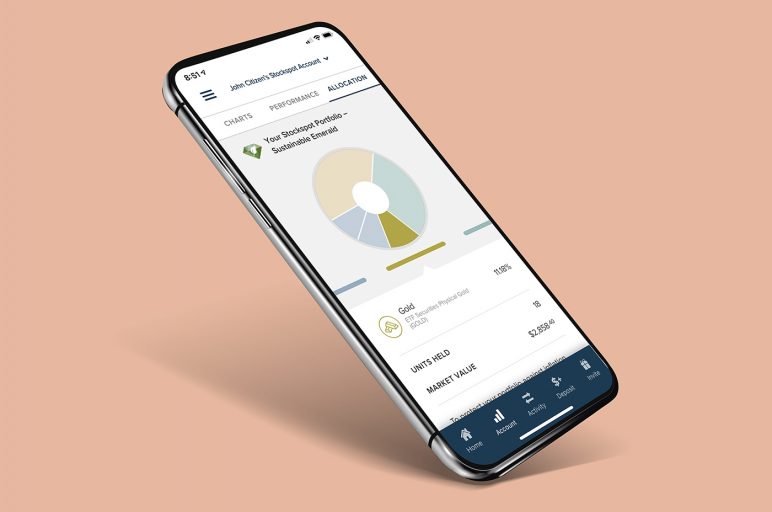

What I love about Stockspot is the Stockspot app interface and the amazing support crew.

The fees are structured in tiers that I have found to be very advantageous even when I was starting “small”. This is crucial in my long-term strategy. In the case that I need to access my funds, it is also very straightforward. Investing with Stockspot is akin to my ‘savings account with a booster’ approach. The only regret that I have is that I didn’t discover Stockspot sooner!

My portfolio is balanced accordingly when the market changes and all the thinking is done by Stockspot. The regular reviews also give peace of mind that my strategy is aligned with the changing phases in my life.

Investment should not be complicated to make sense. When I can see my investment growing positively over time, that’s the biggest proof that the decision to choose Stockspot has been the right move from day one.

My advice to people considering investing

What I would say to someone considering investing is that delayed gratification is a powerful thing.

Call Stockspot and have a chat. At the very least you will learn something useful. Start today because time is your biggest ally if it is used smartly.

Don’t underestimate the potential of starting “small” because over time, with the right strategy, you will see the results of your hard work and patience. If in doubt, always seek a second opinion. And I cannot emphasise this enough – start today!