- What is a Stockspot cash account?

- Why is Stockspot changing cash account providers?

- Do I need to do anything?

- Will I earn interest?

- Are there any fees associated with the Bank of Queensland cash accounts?

- When will I receive my new Stockspot cash account details?

- Will I be able to access my funds during the cash account migration period?

- How can I transfer funds to my new cash account?

- What happens if I accidentally deposit money to my old cash account?

- Can I opt to keep my current cash account?

- Will I be able to set up online access to my new cash account?

- Where can I find my new cash account details?

- Who is DDH Graham?

- I have more questions, who can I contact?

1. What is a Stockspot cash account?

This is the cash hub for your Stockspot account. Whenever you wish to invest into your Portfolio or Stockspot Savings, your deposits flow into your Stockpot cash account before being invested. Similarly if you lodge a withdrawal, the proceeds flow into your Stockspot cash account before being paid across to your linked bank account. It’s also where your distributions are paid each quarter. If you have multiple accounts, you will have multiple cash accounts, one for each Stocksopot account.

2. Why is Stockspot changing cash account providers?

We’re moving cash account providers to the Bank of Queensland (BOQ), one of Australia’s largest banks. The cash account product they offer is better suited to our service and will allow us to offer new products and features in the future.

In addition, the account will be paying interest that is in line with the official cash rate. The current rate is 3.85% p.a. (rates are subject to change).

3. Do I need to do anything?

Your funds will be automatically transferred by us to your new cash account as part of the migration. However, you will need to update any scheduled transfers or saved payee details in your online banking with your new Bank of Queensland account details which will be provided to you on 1 June 2023.

4. Will I earn interest?

Yes. Interest on the accounts is inline with the official cash rate, accruing daily and paid on the last day of each calendar month. The current rate is 3.85% p.a. (rates are subject to change).

5. Are there any fees associated with the Bank of Queensland cash accounts?

No. There are no account management or transaction fees associated with your cash account. Your Stockspot fees will remain the same.

6. When will I receive my new Stockspot cash account details?

We will notify you by email of your new separate cash account details on 1 June (including BSB number, account number and BPAY details). You will be able to access your new cash account details in your Stockspot dashboard and app. Any cash in your current Stockspot cash account will be transferred by us into your new cash account.

7. Will I be able to access my funds during the cash account migration period?

No. There will be a mandatory pause on investments and withdrawals over the migration period. Your cash balance will be automatically transferred by us to your new cash account. Please make any deposits by midday 19 May and withdrawals by 21 May to ensure they are processed this month. Investing will resume as normal on 1 June.

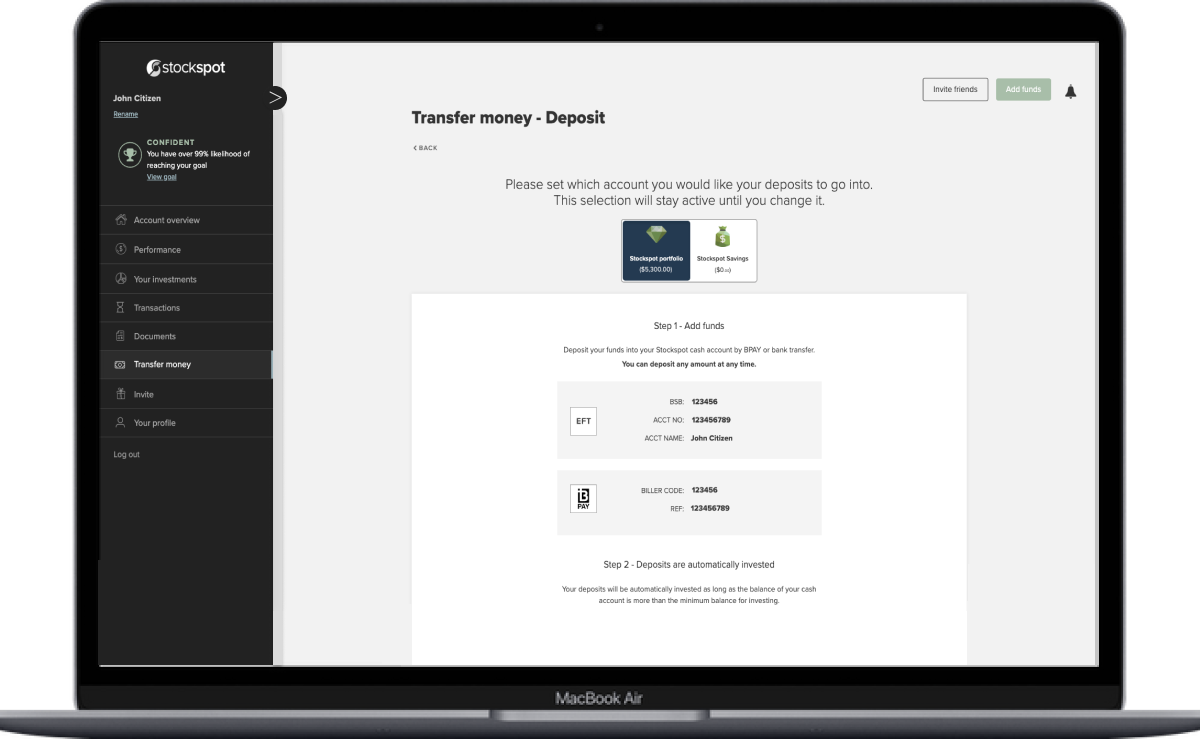

8. How can I transfer funds to my new cash account?

You can deposit funds into your new cash account via bank transfer, or BPAY using your new cash account details. These will be available to view in your Stockspot app and dashboard by 1 June.

9. What happens if I accidentally deposit money to my old cash account?

As the cash account will be closed after the migration, your funds will automatically bounce back to the sending account.

10. Can I opt to keep my current cash account?

No. All cash accounts will be migrated to Bank of Queensland. If you have a Macquarie cash account and wish to explore options for maintaining this account outside of Stockpot, we recommend contacting our Client Care & Advice team on (02) 8091 8090 or at enquiries@stockspot.com.au.

11. Will I be able to set-up online access to my new cash account?

No. The cash accounts will not have online access. All of your cash account and transaction information is available in your dashboard and mobile app and updates daily. You can generate a cash transaction report from your dashboard anytime which will include all of your cash transaction information.

12. Where can I find my new cash account details?

Your new cash account details will be available in your Stockspot dashboard and the Stockspot mobile app. You can see how to find those details here.

13. Who is DDH Graham?

DDH Graham Limited (DDH) is the agent, administrator, and distributor of the Bank of Queensland Cash Account.

14. I have more questions, who can I contact?

We’re here to help answer all your questions. Please contact our Client Care & Advice team on (02) 8091 8090 or at enquiries@stockspot.com.au.