Australian cities are still amongst the most expensive in the world according to the latest Worldwide Cost of Living Survey. Both Sydney and Melbourne ranked 5th and 6th respectively behind Singapore, Paris, Oslo and Zurich.

Brisbane and Perth came equal 21st while Adelaide came in at 37th. This is a major change from 15 years ago when no Australian cities made the top 50.

10 year change in cost of living

| Sydney | Melbourne | |

| 2015 | 5th (↑ from 25th in 2005) |

6th (↑ from 28th in 2005) |

| 2014 | 5th (↑ from 14th in 2004) |

6th (↑ from 28th in 2004) |

| 2013 | 3rd (↑ from 40th in 2003) |

4th (↑ from 43rd in 2003) |

| 2012 | 7th (↑ from 64th in 2002) |

8th (↑ from 74th in 2002) |

| 2011 | 6th (↑ from 60th in 2001) |

7th (↑ from 73rd in 2001) |

Source: Economist Intelligence Unit – Worldwide Cost of Living Survey

The survey looks at many elements to make this assessment including transport, utility bills, healthcare, education and recreational costs. Luxury items like iPhones, cosmetics and clothing are also significantly more expensive in Australia than overseas and the gap has not been closing. Many global retailers employ price discrimination which means that Australians pay more for the exact same products versus buying them overseas.

This explains why online shopping has been booming as Australians jump on better prices from online overseas-based shops. Australia’s online retail spending increased to $16.6 billion for the year to January 2015, or by 9% compared to the year before. It now represents 7% of all retail sales.

As well as everyday cost of living, some of the bigger items like buying a home or a car or even travelling overseas is more expensive in Australia when compared to other parts of the world. With rising costs across the board, Australians are looking at an expensive future.

Buying property

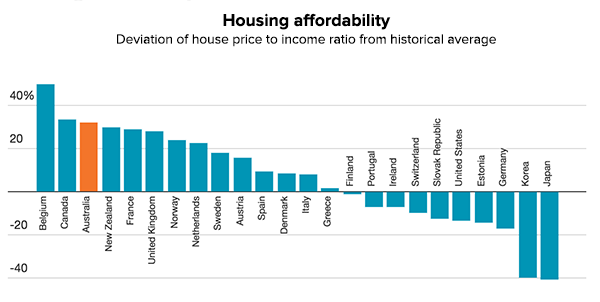

Not surprisingly, the International Monetary Fund (IMF) has Australia ranked 3rd when it comes to the least affordable places in the world to buy a house versus long term averages. The IMF data compares the ratio of property prices in each country to its average income to work out the affordability level. Australia sits at 31.6% above the historical average.

Source: IMF via The Guardian – June 2014

Last year alone we saw housing prices rise by 6.8% in Australia according to the ABS, with Sydney rising by an extraordinary 12.2%, Brisbane 5.3%, Melbourne 4.5% and Perth 1.2%. Sydney property has now risen 26% over 2 years compared to a national average of 16.1%. The average house price in Australia has risen to $571,000 vs $539,000 in 2013.

Australian house prices

| 2013 change | 2014 change | |

| Sydney | +13.8% | +12.2% |

| Melbourne | +7.9% | +4.5% |

| Brisbane | +5.7% | +5.5% |

| Perth | +8.7% | +1.2% |

| Adelaide | +3.4% | +2.5% |

| Hobart | +4.9% | +2.2% |

| Average | +9.3% | +6.8% |

Source: Australian Bureau of Statistics

Planning a holiday

Even taking a holiday is generally more expensive for Australians than for people living overseas.

When we compared the same travel period with the same airline on the equivalent flights between Sydney and a selection of major cities around the world, we found that a person booking return flights in Australia for all but one city ended up paying more than if they booked the same trip from overseas.

Even the Kiwis pay less to travel to Australia than Aussies going to New Zealand. And flying to Japan as an Australian is more than double the cost for Japanese to visit Australia.

Difference in ticket prices for Australians

| Ticketed in Australia | Ticketed overseas in AUD | % difference in price | |

| Sydney <> Auckland | $493 | $457 | +7.9% |

| Sydney <> Singapore | $899 | $687 | +30.9% |

| Sydney <> Hong Kong | $973 | $870 | +11.8% |

| Sydney <> Tokyo | $1,449 | $653 | +121.9% |

| Sydney <> London | $2,898 | $2,288 | +26.7% |

| Sydney <> New York | $2,327 | $2,450 | -5% |

Prices as at 23rd March 2015, travelling on 1st July and returning 31st July 2015 flying the same airline on the equivalent flights.

The fall in the Australian dollar from $1.10 USD in 2010 to $0.78 USD in early 2015 is also contributing to an increase in the cost of overseas holidays. Figures from Tourism Research Australia show that domestic trips rose by 5% to 79.7 million trips in the 12 months to September 2014 as more Aussies decided to holiday locally versus travelling overseas.

What it all means

With the rising cost of living and expensive big-ticket items, Australians need a smart financial game plan to build wealth for the future.

It’s important to maximise the returns on the money you’re setting aside and saving for big-ticket purchases to ensure you’re staying ahead. If you’re working towards a longer-term goal, investing a portion of your savings rather than leaving all of it in the bank can provide a higher return so that you can reach your goals sooner.

Investing does have risks but this can be reduced through having a medium to long-term timeframe (3 to 10 years) and diversification (not keeping all your eggs in one basket). Diversifying your investment portfolio across companies, industries, geographical regions and assets (like shares and bonds) can help reduce the risk and maximise returns in the long run.

Another factor to carefully consider when it comes to saving or investing is fees. Fees can eat into a significant portfolio your investment returns so keeping them low means you have a much better chance of achieving higher returns over the long-term.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.