Over the years our Client Care and Advice team has spoken with many investors who were told not to use Stockspot. Often by advisers worried about losing a client. From what we’ve heard, these chats tend to follow the same pattern… raise a myth, add a note of fear, then suggest you’re safer staying put.

So we wanted to call out a few of the common lines we hear and shine some light on them.

“There aren’t advisers at Stockspot, just robots”

Technology (the robots) definitely helps us automate rebalancing, reporting, tax optimisation and other tasks that should be automated. But algorithms don’t design our portfolios, sit behind our investment research or speak to our clients every day.

We have a team of talented advisers who speak with hundreds of clients each week and who run regular webinars like our investing for kids webinar and annual investor updates. They also support our charity clients with policy design, risk settings and good governance.

Human judgement matters when it should. Automation simply takes out human error where it should never happen, like with portfolio rebalancing.

Ironically, this myth often comes from advisers who use generic model portfolios built by someone else that sit on platforms like Netwealth or HUB24, and who charge full fees on top.

If you want access to people, we provide it. If you want transparency on how investment decisions are made, that’s here too.

“ETFs and indexing only work in up markets”

This one is usually raised after strong sharemarket years. The suggestion is that indexing is fragile.

The opposite is true. The strongest evidence in global finance shows that broad, low cost index investing gives you the best chance of success across full cycles. Markets move in unpredictable cycles. Growth leads for a while. Then value. Then emerging markets. No one picks these rotations perfectly. Not even the professionals.

SPIVA data, as well as our own analysis, regularly shows that most active strategies fail to beat their benchmark over long periods of 10, 15 and 20 years.

Indexing isn’t about guessing the next winning slice of the market. It’s about cost effectively owning the whole market and letting compounding do its work.

“Stockspot is just a brokerage platform”

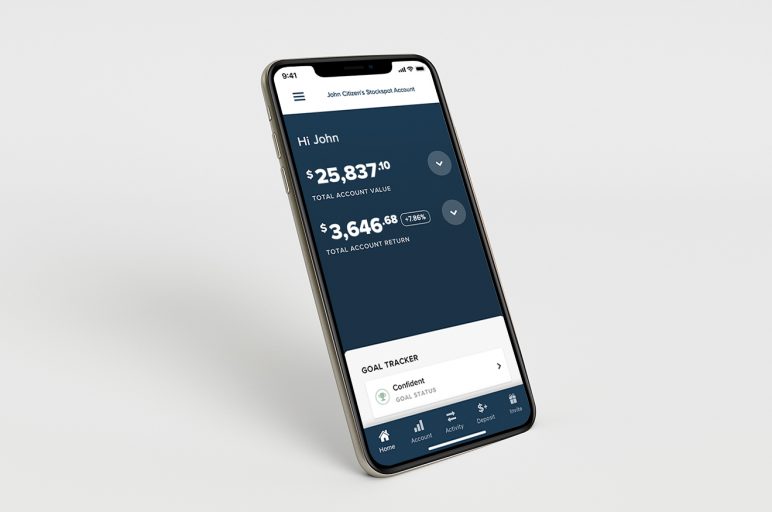

Brokerage platforms like CommSec or Stake simply execute trades and leave the decisions up to you. Stockspot is very different. We design the portfolios, select the ETFs, manage the asset allocation to match your personal goals and risk preferences, rebalance when needed, manage tax reporting and provide human advice and support.

We do the heavy lifting so you don’t need to research markets, pick products, or worry about portfolio drift. Calling Stockspot a brokerage is like calling a surgeon a scalpel. Tools matter, but what creates value is the expertise, discipline and evidence based process behind them

“Stockspot has only done well because of gold”

Gold is certainly part of our portfolios and has helped our performance over the last decade. We hold it because it diversifies shares and bonds. When shares fall, gold often rises. It smooths volatility.

But our long-term results can’t be reduced to one asset. Bonds helped when rates fell. Global shares helped when technology surged. Australian shares delivered when value returned. Emerging markets helped over longer periods.

Our approach is simple. Build a mix of investments that works across different environments. Don’t chase fads. Don’t tilt portfolios based on headlines. And don’t rely on a single factor.

If an adviser says “Stockspot only did well because of gold”, it usually means they missed out on owning it for their clients. The obvious question is why.

“Our [other advisers’] performance is strong. We beat the market.”

This one needs scrutiny. Performance is often presented in ways that tell only half the story. We see this all too often – advisers fudging past performance in all sorts of unscrupulous ways.

Common techniques include excluding terminated funds, showing returns before fees, using softer benchmarks or cherry picking timeframes that flatter results. I’ve even seen “track records” that stretch back before the fund existed!

Always ask to see long-term, after-fee returns of portfolios that actually existed and were invested into by real clients. And make sure the benchmark matches the risk of the portfolio. Comparing a high risk fund to a low risk benchmark and declaring victory is meaningless.

Index ETFs don’t allow these games. Their benchmarks are transparent. Their costs are visible. Their histories are clear.

“Our [other advisers’] tactical calls add value”

Some advisers promote tactical asset allocation as a form of risk management. The idea is that they shift portfolios based on their view of markets.

It sounds clever, but timing markets with consistency is near impossible. It also introduces extra trades, mistakes, tax and cost.

A better form of risk management is diversification with disciplined rebalancing. When assets move away from their target weight, you trim what has risen and add to what has lagged. It keeps risk stable and removes emotion.

This approach quietly reduces risk without heroic guesses. And it’s available to anyone.

“Alternative assets are where the real edge is”

If an adviser promotes private markets, hedge funds, venture capital or private credit as essential, ask for long-term, after-fee evidence. Not glossy projections. The gap between complex alternatives and simple index ETF mixes over the last fifteen years has been close to zero. The same pattern is emerging with private credit. It looks sophisticated and the yields look tempting but private credit carries liquidity locks, opaque pricing, higher default risks and no government protections. These risks often stay hidden until economic conditions turn.

If an asset or strategy is pitched as “exclusive access”, be extremely cautious. Exclusivity usually comes with more cost, less transparency and more risk than you need.

You can read more about private credit in this article and we’ve also written about some of the risks of private assets here.

“Stockspot doesn’t have a fancy office”

This one is true. We don’t run regular champagne evenings or greet clients in marble foyers with harbour views and canapés. We keep our costs lean so your fees stay low. Our energy goes into results after fees.

Fancy trimmings don’t compound your returns.

A final thought

If an adviser uses fear, mystery or prestige to push you away from transparent, low cost investing, it’s worth asking why. Are they worried you’ll learn that simple strategies outperform their expensive ones?

Evidence based investing shouldn’t be controversial. It’s just uncomfortable for business models built on layers of fees, complexity and the illusion of exclusivity.

At Stockspot we believe in after-fee returns, discipline through full market cycles, and quiet compounding backed by transparency that keeps everyone accountable.