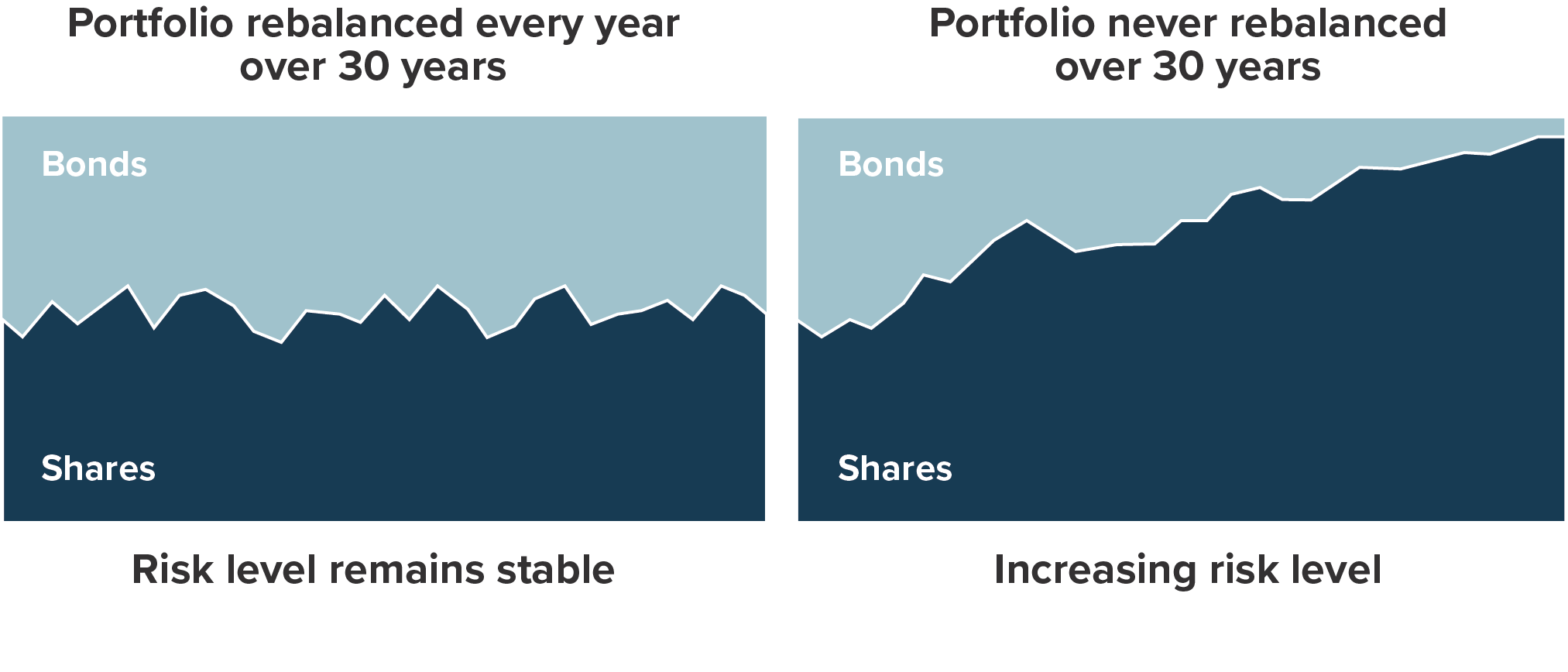

Rebalancing is one of those boring but important parts of investing.

It’s the quiet achiever in your portfolio. At its heart, rebalancing simply means selling the investments that have done well and buying more of the ones that haven’t. It helps keep your portfolio balanced and stops it from becoming too risky over time.

But rebalancing isn’t always easy. It can feel uncomfortable. And trying to manage it yourself can be time-consuming and stressful, especially when markets are volatile. That’s why rebalancing is one of the areas where DIY investors often go wrong.

Why rebalancing matters

Over time, different assets grow at different rates. Sometimes shares race ahead, while bonds or gold lag behind. Other times, it’s the safer assets like bonds or gold that hold up better when markets fall. If you don’t rebalance, your portfolio can drift away from its original mix, becoming either more risky or too conservative. If your goal is to keep a steady level of risk, you need to bring your portfolio back into balance every so often.

Real Life Example:

Let’s take the COVID market crash in early 2020 as an example of how rebalancing works in practice.

In February and March 2020, markets fell sharply as COVID spread and economies locked down. Shares dropped fast while safer assets like bonds and gold held up or even rose. Many investors panicked and sold their shares at the worst possible time.

At Stockspot, we did the opposite.

In March 2020 portfolio asset returns looked like this:

As shares fell, we sold some of our clients’ gold, which had risen 38% over the prior 12 months, and used that money to buy more Australian shares at lower prices.

It wasn’t easy. The news was grim. But this is exactly what rebalancing is all about… buying low and selling high.

Fast forward 6 months and shares had rebounded strongly and because we had rebalanced, our clients were able to take advantage of that rebound. Without rebalancing, they would have missed out on those gains or ended up with a riskier portfolio.

By November 2020 portfolio asset returns looked like this:

How Stockspot rebalances your portfolio

Our system automatically keeps an eye on every client’s portfolio every day and automatically rebalances when it’s needed. This could be because:

- You’ve updated your strategy due to a change in your life

- Our investment team has updated the ETF target weights

- Some parts of your portfolio have grown faster than others

We also use ETF distributions or deposits into your account as good times to rebalance. For example, if you add money to your account, we’ll use that cash to top up the parts of your portfolio that are underweight. It’s a smart way to keep things balanced without having to sell.

We don’t rebalance on a set schedule, like every quarter. Research shows it’s better to wait until an asset has moved a certain amount away from its target before making changes. Rebalancing too often can be costly and eat into your returns.

Why rebalancing is hard to do yourself

Rebalancing sounds simple, but in real life, it can be hard. It often means going against your gut.

Think back to March 2020. When markets were falling fast, most people wanted to sell shares, not buy them. It takes discipline to do the opposite!

At Stockspot, rebalancing is part of our automated service. You don’t need to worry about when or how to do it. We do all the work in the background to keep your portfolio aligned with your goals.

By letting us rebalance for you, you avoid:

- Emotional decision-making

- The hassle of doing complex calculations

- Paying brokerage fees every time you buy or sell

Rebalancing helps you make the most of market ups and downs. It’s about taking profits when markets are high and buying opportunities when they’re low. That’s how smart investors grow their wealth over time. Letting us handle rebalancing for you takes the stress out of the process and helps you stay focused on your long-term goals.