Artificial intelligence has dominated markets over the past few years, driving one of the strongest rallies in history. The biggest companies in the world are now the ones building chips, data centres and software for AI.

Nvidia, Microsoft, Meta, Apple and the rest of the “Magnificent Seven” have powered global share markets to new highs.

Some investors are calling this the next industrial revolution. Others believe it’s a bubble waiting to burst.

The truth is no one knows.

Markets move in cycles, and periods of overexcitement are usually followed by periods of disappointment. The challenge is knowing when that shift happens.

Why trying to time the AI bubble doesn’t work

Every cycle looks obvious in hindsight. During the dot-com boom, many people thought “this time is different”. It wasn’t. But it also wasn’t clear when the party would end. Some tech stocks went up tenfold before they crashed. I saw it first-hand when several of the tech shares I owned fell by more than 90%. It was a tough but valuable lesson that I wrote more about in this article.

Fast forward to the 2020s. Many investors thought Nvidia looked expensive when it reached US$40 a share and a US$1 trillion valuation in 2023.

Since then, it’s risen fivefold to over US$200 and US$5 trillion.

Getting out too early can be just as costly as hanging on too long!

Markets can stay irrational much longer than most people expect.

This is why at Stockspot we don’t try to predict or time these cycles. The evidence is clear that even professional fund managers struggle to do it consistently. Instead of betting on which sector or theme will outperform next, we focus on building diversified portfolios that can weather many market conditions.

Why owning the whole market still wins

Will the same AI and tech giants still be leading the market in 25 years?

Almost certainly not.

That’s the nature of markets. Today’s winners eventually make way for new leaders. It’s not a flaw in the system, it’s how economic progress works.

If you look back at the S&P/ASX 300 from twenty-five years ago, only a small number of those companies are still around today. Even fewer (around 7% of companies), have beaten the market .

The companies changed, but investors who owned the index – the whole process of market renewal – came out ahead.

Index investing captures this transition automatically. When a company grows, its weight in the index increases. When it stumbles, it gradually fades and new leaders take its place. You don’t need to guess who the next winner will be, the market adjusts for you.

When you own the whole market via an index ETF, you’re not betting that nothing will change, your investing in a process that’s designed to evolve.

How diversification and rebalancing protects investors

Each Stockspot portfolio holds a mix of Australian shares, global shares, bonds and gold. These assets don’t all move in the same direction at the same time, which helps smooth returns and reduce risk.

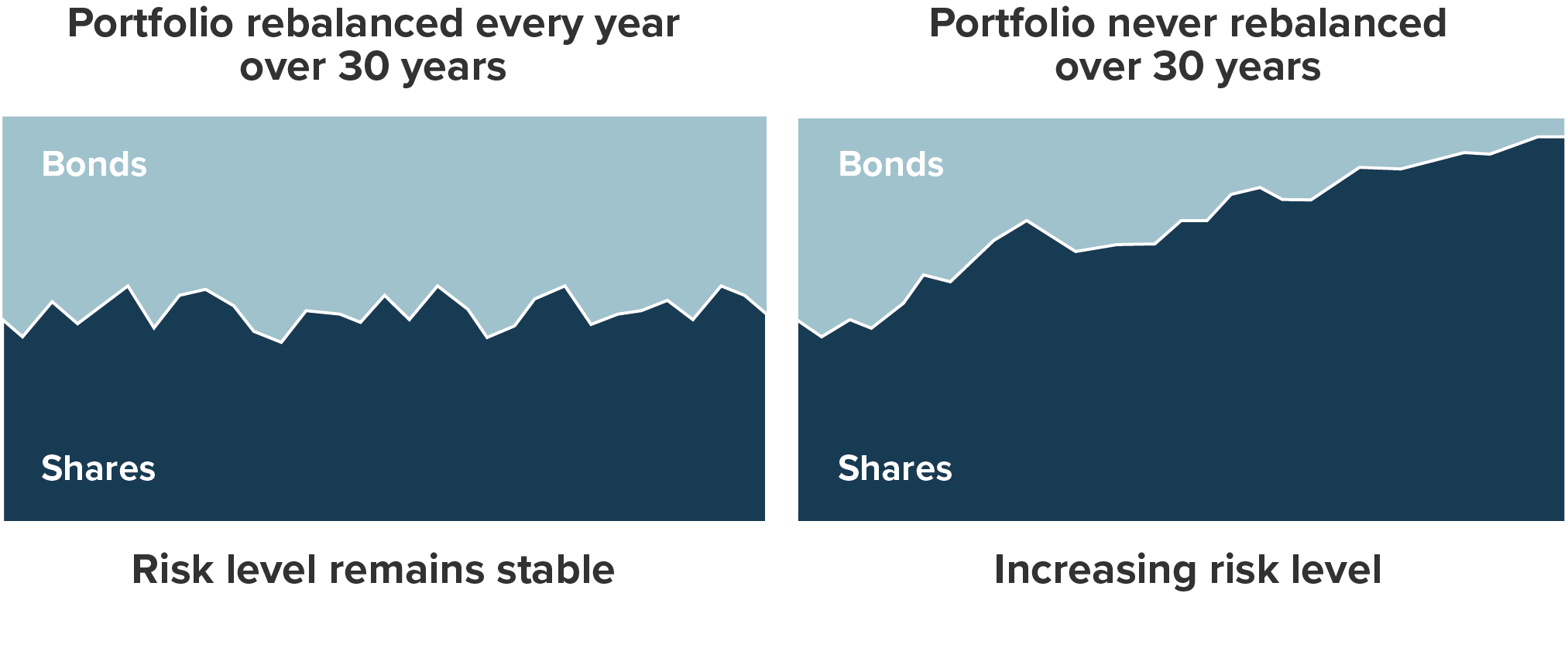

Rebalancing also plays an important role in keeping portfolios on track. When one part of the portfolio performs very well, like gold did recently, we automatically trim it back and reinvest into areas that haven’t grown as much. This disciplined process sells high and buys low automatically, without the need to predict what’s next.

It’s a simple concept, but it’s incredibly powerful. Over time, rebalancing takes profits from assets that have run hard and adds to those that are out of favour. It means we’re never overexposed to one theme, even if it’s dominating headlines.

How Stockspot portfolios would perform in an AI sell-off

If the AI trade does unwind, Stockspot portfolios are well positioned to handle it. Our defensive assets (bonds and gold) tend to perform well when shares fall. That’s because investors usually seek safety when uncertainty rises.

Historically, this mix of growth and defensive assets has helped our portfolios hold up much better than the share market during sell-offs. For example, during sharp downturns like early 2020, our portfolios fell significantly less than the S&P/ASX 300 because of this diversification.

Why an AI slowdown isn’t all bad news

While an AI bubble burst sounds scary, it wouldn’t necessarily be bad for all markets. If the AI boom slows, the capital that leaves large U.S. tech companies could flow into undervalued regions. Emerging markets, which we already hold in our portfolios, could be among the beneficiaries.

We’ve seen this pattern before. When the tech boom collapsed in 2000, it set the stage for the resources boom that powered Australia and emerging markets for much of the following decade. Market leadership changes over time. That’s why diversification across different markets and sectors matters.

The long-term advantage of staying invested

Market cycles come and go, but the real driver of wealth is staying invested. Diversification, rebalancing and patience have proven far more effective than trying to pick winners or jump in and out of sectors of the market based on headlines.

No one knows whether AI stocks will keep rising or whether they’re due for a major correction. What we do know is that owning a broad mix of assets and rebalancing regularly gives investors the best chance of steady long-term growth without taking unnecessary risks.