- What is a Stockspot cash account?

- Why is Stockspot changing cash account providers?

- Do I need to do anything?

- Does the Monoova account pay interest?

- Are there any fees associated with the Manoova cash account?

- When will I receive my new Stockspot cash account details?

- Will I be able to access my funds during the cash account migration period?

- How can I transfer funds to my new cash account?

- What happens if I accidentally deposit money into my old cash account?

- Can I opt to keep my current cash account?

- Will I be able to set up online access to my new cash account?

- Where can I find my new cash account details?

- Is money with Monoova covered by the Government Guarantee?

- I have more questions, who can I contact?

1. What is a Stockspot cash account?

This is the cash hub for your Stockspot account. Whenever you wish to invest into your Portfolio or Stockspot Savings, your deposits flow into your Stockpot cash account before being invested. Similarly if you lodge a withdrawal, the proceeds flow into your Stockspot cash account before being paid across to your linked bank account. It’s also where your distributions are paid each quarter. If you have multiple accounts, you will have multiple cash accounts, one for each Stockspot account.

2. Why is Stockspot changing cash account providers?

We’re making this change to improve the speed of transfers into and out of Stockspot which has been a common request from clients. To achieve this we’re partnering with Monoova, one of Australia’s leading payments providers. Since 2017, Monoova has processed over AU$100 billion in transactions.

This change will provide Stockspot clients with faster deposit and withdrawal options, securely managed through Cuscal as the underlying Australian bank. In the future we’ll be rolling out additional features like PayID and PayTo to make it even easier to set up and manage regular deposits or withdrawals.

These features will be especially helpful for clients who use regular dollar-cost averaging or need to manage pension withdrawals, providing more flexibility and convenience.

3. Do I need to do anything?

Your funds will be automatically transferred by Stockspot to your new cash account with Monoova as part of the migration on Friday 8 November. You don’t need to do anything.

You will need to update any scheduled transfers or saved payee details in your online banking with your new Monoova account details which will be provided to you on Wednesday 13 November 2024.

4. Does the Monoova account pay interest?

No, the Monoova account won’t pay interest. We carefully weighed this decision but since only about 1% of your balance is held in cash we prioritised offering faster deposit and withdrawal options instead.

5. Are there any fees associated with the Monoova cash account?

No, there are no account management or transaction fees associated with your Monoova cash account. Your Stockspot fees will remain the same.

6. When will I receive my new Stockspot cash account details?

We will notify you by email that your new cash account details are available to view in your app and online dashboard on Wednesday 13 November. We strongly recommend cancelling any scheduled transfers to your Bank of Queensland (BOQ) cash account once we notify you of your new Monoova cash account details.

7. Will I be able to access my funds during the cash account migration period?

No, there will be a mandatory pause on investments and withdrawals over the migration period. Your cash balance will be automatically transferred by Stockspot to your new cash account with Monoova. Please make any deposits by 12pm Friday 1 November and withdrawals by 9am on Monday 4 November to ensure they are processed before the pause trading period. Investing will resume as normal on Wednesday 13 November.

8. How can I transfer funds to my new cash account?

You can deposit funds into your new cash account via bank transfer or BPAY using your new cash account details. These will be available to view in your Stockspot app and dashboard on Wednesday 13 November.

9. What happens if I accidentally deposit money into my old cash account?

Your funds will automatically bounce back to the sending account from 20 December 2024, when the accounts are closed. The funds may take 3 to 5 business days to appear back in the account, depending on your bank’s processing time.

10. Can I opt to keep my current cash account?

No. All cash accounts will be migrated to Monoova.

11. Will I be able to set-up online access to my new cash account?

No. The cash accounts won’t have online access. All of your cash account and transaction information is available in your Stockspot dashboard and mobile app and updates daily. You can generate a cash transaction report from your dashboard anytime which will include all of your cash transaction information.

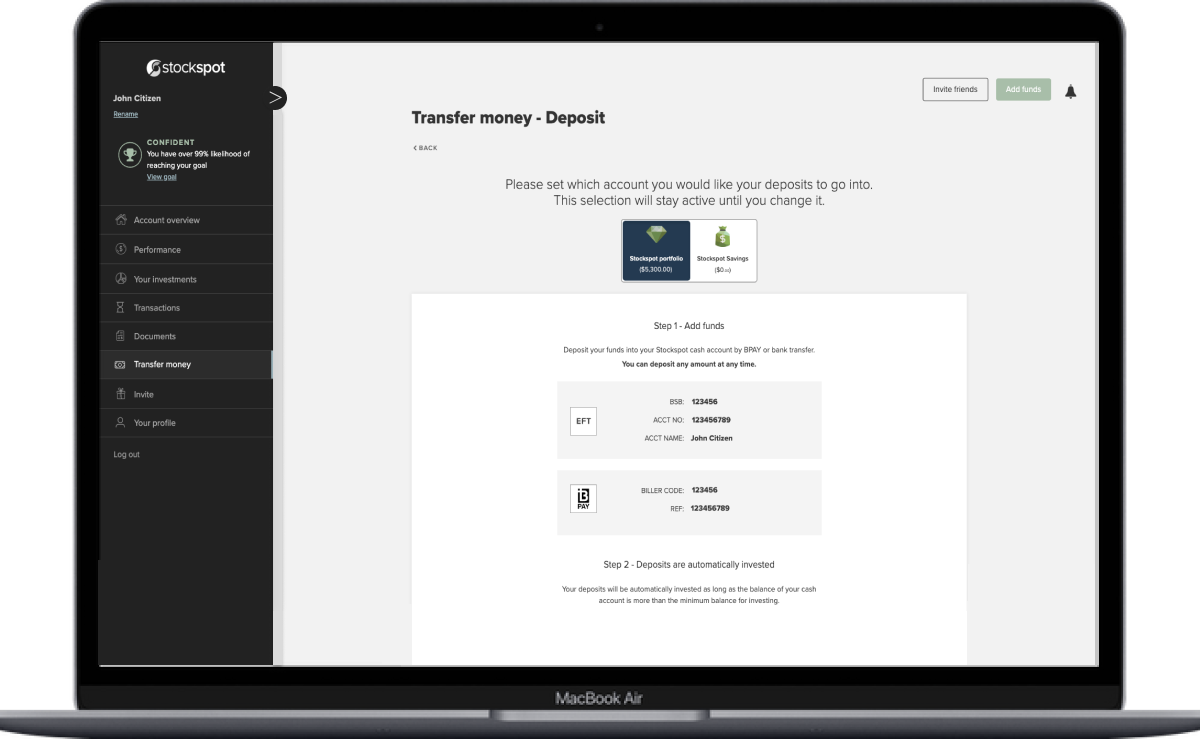

12. Where can I find my new cash account details?

Your new cash account details will be available in your Stockspot dashboard in the ‘Transfer Money > Deposit’ section and the ‘Deposit’ section of the mobile app. You can see how to find those details here.

13. Is money with Monoova covered by the government guarantee?

The Financial Claims Scheme (FCS), also known as the ‘government guarantee,’ is an Australian Government program that protects deposit holders with Australian banks, building societies, and credit unions (ADIs).

The underlying ADI used by Monoova, Cuscal, is covered by the scheme. However, Stockspot’s accounts are virtual and managed on a sub-ledger by Monoova, so are not covered individually.

To ensure the safety of client money, all funds are held in dedicated accounts that are separate from Monoova’s own corporate funds. Should Monoova become insolvent, funds would in effect be held on a resulting trust and would not be available for other creditors. Client moneys are also completely separate from Stockspot’s business bank accounts.

14. I have more questions, who can I contact?

We’re here to help answer all your questions. Please contact our Client Care & Advice team on

(02) 8091 8090 or at enquiries@stockspot.com.au.