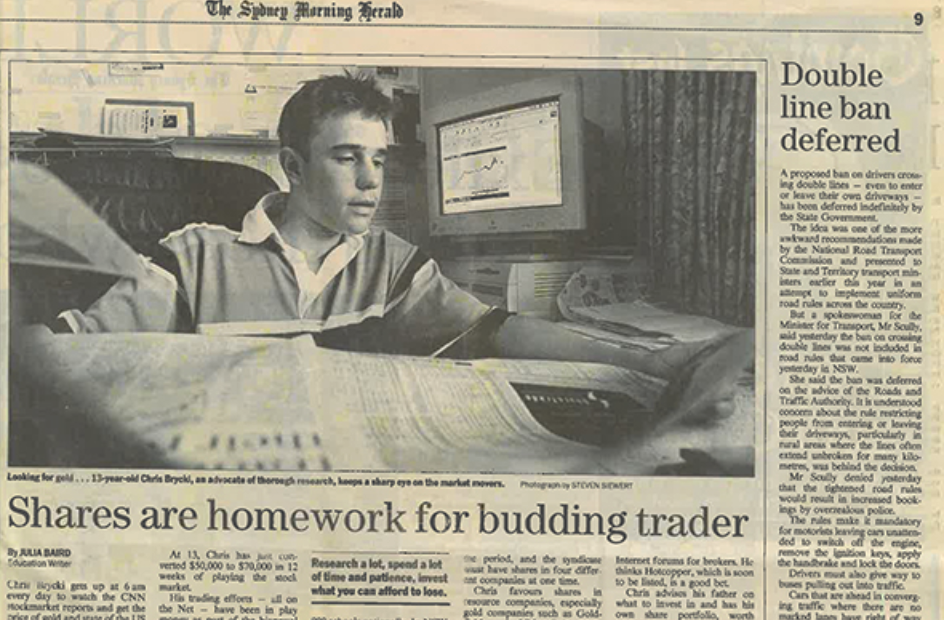

It’s been almost 30 years since I made my first investment. It was January 1996 and I was just 10 years old. Not exactly a typical hobby for a kid in primary school. But I was hooked. I kept a diary of every investment I made between 1996 and 1999, and I still have it today.

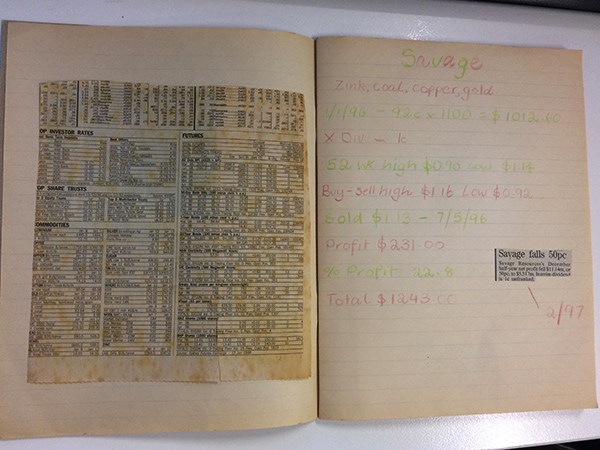

The diary looks more like a colouring book than a trading journal. Each stock I owned had its own colour scheme. Inside, I tracked my running profit or loss, dividends, and even stuck in news cutouts about the companies I followed.

My first-ever share was Savage Resources. I bought it in 1996, held it for five months and sold for a 22.8% profit. A nice little win for a 10-year-old.

That win gave me a taste for trading. I went on to enter the ASX Schools Share Game every year from 1999 to 2003, winning it three times. There were around 40,000 students in it from all over Australia. The game only ran for eight weeks, so to win you had to buy the most volatile stocks you could find and trade like crazy. It wasn’t really investing. It was speculation.

What I realised later was that most of my early wins came down to luck. As a 10-year-old, I didn’t have any special insight into which stocks would rise or fall. Many first-time investors fall into the same trap. They believe their early wins are skill, but more often than not, it’s luck.

Even today, with professionals all over the world constantly watching markets, predicting which individual shares will go up or down is more guesswork than science. If you’re buying individual shares, ask yourself… what advantage do I really have over the thousands of people analysing these companies full-time?

If the answer is none (and for most people it is), then picking individual shares is unlikely to help you build wealth over the long run. It usually just means more stress, more risk, higher costs and taxes, and worse results.

You don’t need to pick shares to be a successful investor. In fact, you’re better off not trying. By investing in a broad market ETF, you can capture the returns of all the companies in the market, without trying to guess which ones will do well. It’s how you harness the power of the market, rather than trying to beat it.

That’s been our philosophy at Stockspot from the start. Help people grow their wealth by keeping investing simple, diversified, low-cost, and consistent.

I may have started my investing journey with a colourful diary and a lucky stock pick, but the real lesson came later. Long-term investing success doesn’t come from lucky guesses…. it’s about consistently following the right strategy.

This article was first published on the ASX website: https://www.asx.com.au/blog/investor-update/2025/my-first-share-investment