Chris Brycki, Stockspot CEO, answers some of the most common client questions relating to the emerging market share ETF (IEM) and its place in the Stockspot model portfolios.

What are emerging markets shares in my Stockspot investment portfolio?

Emerging markets shares in your investment portfolio are investments in companies from developing countries. These countries are still growing and expanding economically. While investing in emerging markets can be a bit riskier than more established markets, they offer the potential for higher returns and protection from inflation, due to the high commodity exposure of emerging markets. Examples of emerging markets include Brazil, India, China, and South Africa. Having some of these shares in your portfolio, in the form of the IEM ETF, adds diversity and the chance to benefit from the growth in these economies.

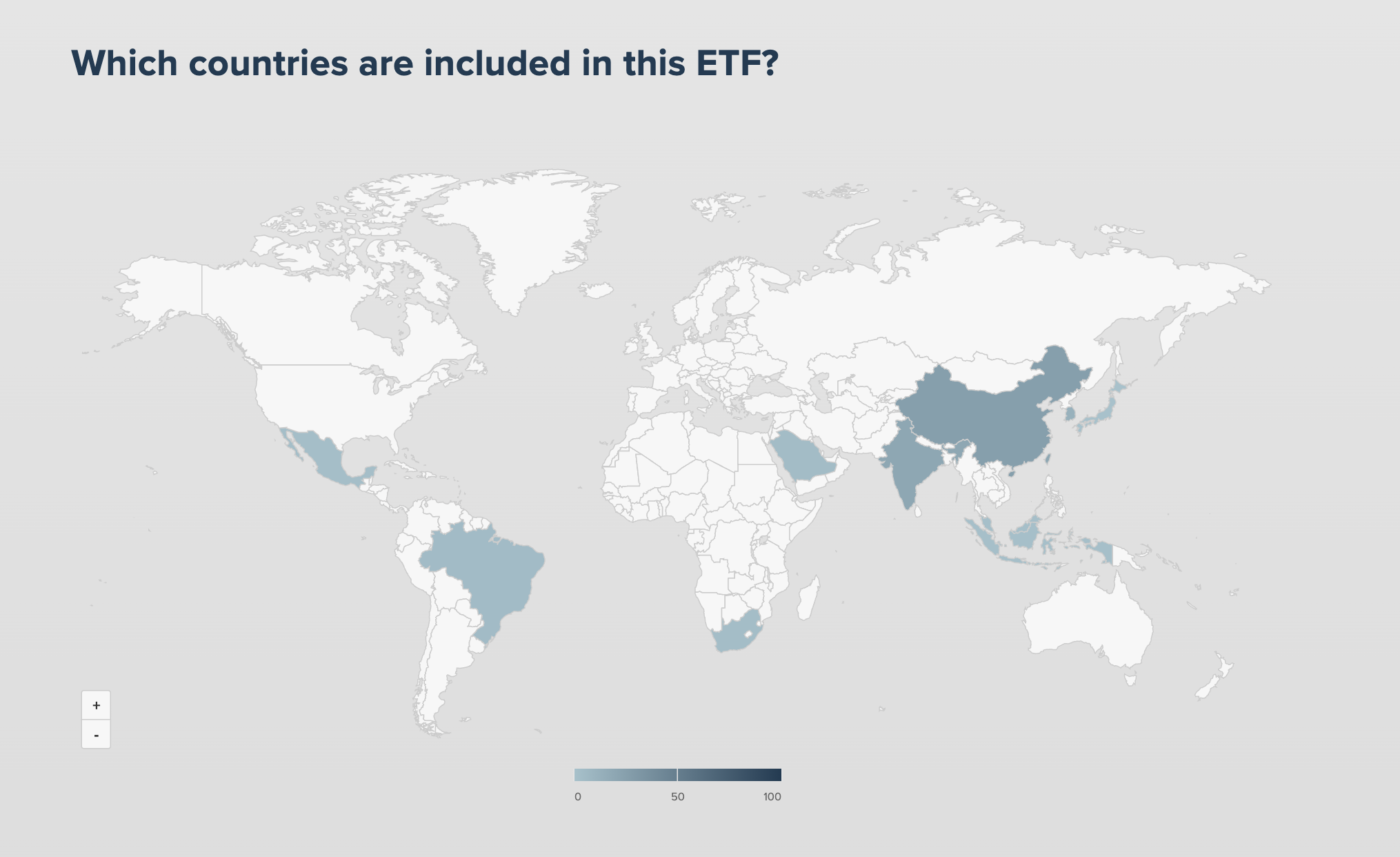

What countries do I have exposure to through the emerging markets ETF (IEM)?

The iShares MSCI Emerging Markets ETF (IEM) provides exposure to a variety of emerging market countries. Some of the major countries included in the ETF may be Brazil, India, China, South Africa, Mexico, amongst others. The IEM ETF is designed to track the performance of the MSCI Emerging Markets Index, which represents a broad range of companies in developing economies. Keep in mind that the specific countries and their weighting in the ETF can change over time due to market fluctuations and adjustments made in the index. For example, over the last few years Indian companies have become a larger part of the ETF while Chinese companies have shrunk.

What companies do I have exposure to through the emerging markets ETF (IEM)?

The iShares MSCI Emerging Markets ETF (IEM) gives you access to over 1,000 companies listed on share markets around the world. Some that you may have heard of include Samsung, Tencent, Alibaba, Baidu, Tata Motors and Hyundai.

Why do I own emerging markets? Do they have a role in my portfolio?

Owning emerging markets in your portfolio can serve several purposes:

- Growth Potential: Emerging markets often have higher growth rates, compared to developed ones. By investing in these markets, you have the potential for higher returns as these economies expand.

- Diversification: Adding emerging markets to your portfolio helps spread risk. Since emerging economies can behave differently to developed markets, they may not always move in sync. Historically emerging markets have done well during periods of higher inflation due to many emerging economies being commodity exporters. Diversification can reduce the overall risk in your investment portfolio.

- Global Exposure: Investing in emerging markets allows you to participate in the growth of economies around the world outside of Australia. It broadens your investment horizon and can capture opportunities in regions with increasing consumer demand and industrialisation.

The percentage of IEM in your Stockspot portfolio is dictated by your risk capacity and investment horizon as well as the strategy you’ve chosen.

Why is there a bigger allocation to emerging markets vs global developed shares?

Stockspot uses Modern Portfolio Theory (MPT) to build our portfolios. MPT considers the trade-off between risk and return to identify the combination of assets that offer the highest expected return for a given level of risk in your portfolio.

Emerging markets may have a larger allocation in a portfolio under MPT due to its combination of higher expected returns, lower volatility, low correlations with other assets, and its contribution to achieving an optimal risk-return trade-off for your risk level.

Why have developed markets performed better than Emerging markets for some time?

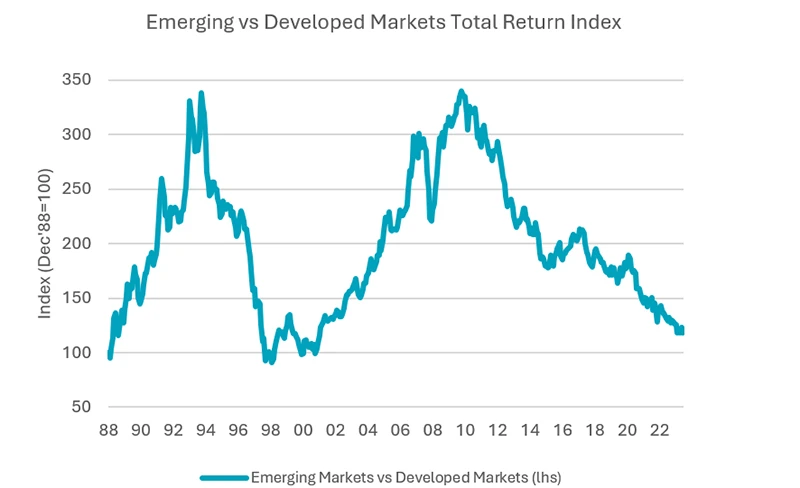

It’s true that developed markets, like the U.S. have performed better comparative to emerging markets, over the past decade. This is evident in the historic performance of our ETFs, since Our Global ETF IOO has outperformed IEM recently. As shown in the chart below, developed market shares have outperformed emerging market shares since around 2010. However between 2000 to 2010 emerging market shares beat developed market shares by 3x.

This trend can be attributed to several factors:

Economic growth: Developed markets, especially in regions like the United States and parts of Europe, have experienced more stable and robust economic growth compared to many emerging markets. Emerging markets often face structural challenges, political instability, and economic volatility, which can hinder their growth prospects.

Technology and innovation Leadership: Developed markets are home to many leading technology and innovation companies like Amazon, Meta, Telsa and Netflix. These companies have driven significant growth and have outperformed traditional industries, contributing to the overall performance of developed market indices.

Monetary Policy and Interest Rates: Central banks in developed markets, such as the Federal Reserve in the United States and the European Central Bank, have pursued accommodative monetary policies over the past decade, including low-interest rates and quantitative easing. These policies have supported asset prices and economic growth in developed markets.

Trade Tensions and Global Uncertainty: Trade tensions between major economies, such as the United States and China, along with geopolitical uncertainty and protectionist measures, have negatively impacted emerging markets more than developed markets. Emerging markets are often more reliant on global trade and are sensitive to changes in trade policies and global economic conditions.

In what market environments do emerging markets perform well?

Predicting the exact timing for which emerging markets will start to perform well is challenging, it depends on a multitude of factors including global economic conditions, geopolitical events, and market sentiment. Many emerging markets are commodity exporters, and their economies are highly sensitive to changes in commodity prices. Rising commodity prices, particularly for key exports such as oil, metals, and agricultural products, can significantly benefit emerging market economies and lead to strong performance.

It’s worth noting that just because an asset has underperformed recently doesn’t mean it will continue to do so indefinitely. Assets like emerging markets, that have underperformed in the short term, may have the potential to revert to their long-term average performance. Removing an asset after a period of underperformance may mean missing out on potential future gains when the asset’s performance improves.

Overall, while investing in emerging markets involves risks, including higher volatility and geopolitical uncertainties, the potential long-term returns justifies continued investment, especially for investors with a diversified portfolio and a long-term investment horizon.

Can I reduce or remove emerging markets from my portfolio?

The allocations between different investments in the portfolio are designed to optimise returns at each level of risk. At Stockspot we use Modern Portfolio Theory to determine the optimal allocation to each asset class, including emerging markets, based on expectations on returns, volatility and correlation. You can read more about how Stockspot build robust investment portfolios in my blog, how to build an awesome investment portfolio. The allocation in each investor’s portfolio takes into account these factors and has been selected to give, what we believe to be, the best risk versus return.

Stockspot’s Sustainable portfolios allocate less weighting to emerging markets. If, however, you’re already invested in emerging markets through our model portfolios, our advice is to stick with your allocation. Despite recent underperformance, our portfolios have consistently outperformed most diversified funds. This success is mainly because of our robust diversification across various assets.

Remember, different assets perform differently at different times. Instead of feeling the urge to switch out underperforming assets, recognize that our portfolios are well diversified. Every asset has its moment, including emerging markets. So, remain patient and trust in diversification. Eventually, emerging markets will shine, while others may lag behind. Just stay the course, and diversification will work its magic over time.