Investing for your kids is the best way to give them a financial head-start in life.

To help you get started, we’ve answered the most common questions we get asked.

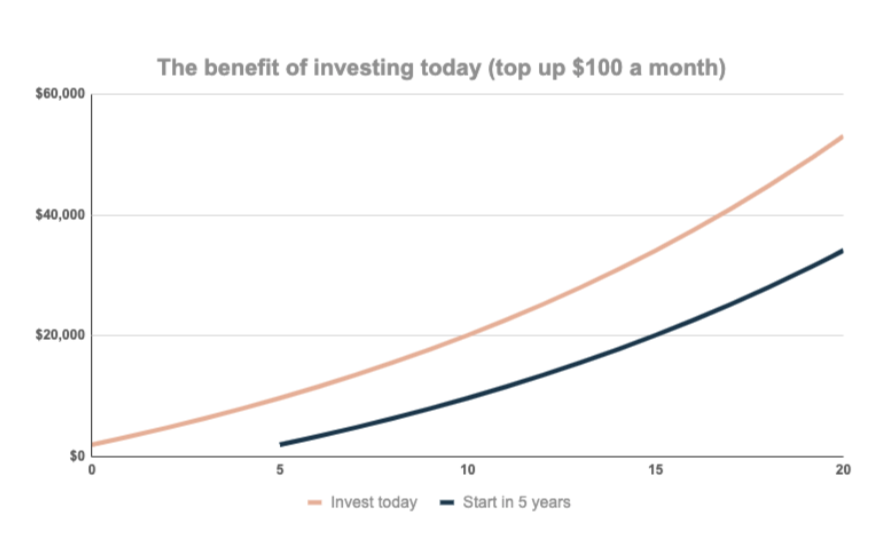

1. Is now the right time to invest?

It’s always the right time to invest. Getting started is actually the most important step because you need ‘time in the market’ for your money to grow.

The chart below shows the benefit of investing today compared to waiting 5 years. Starting early means you could be better off by $19,000.

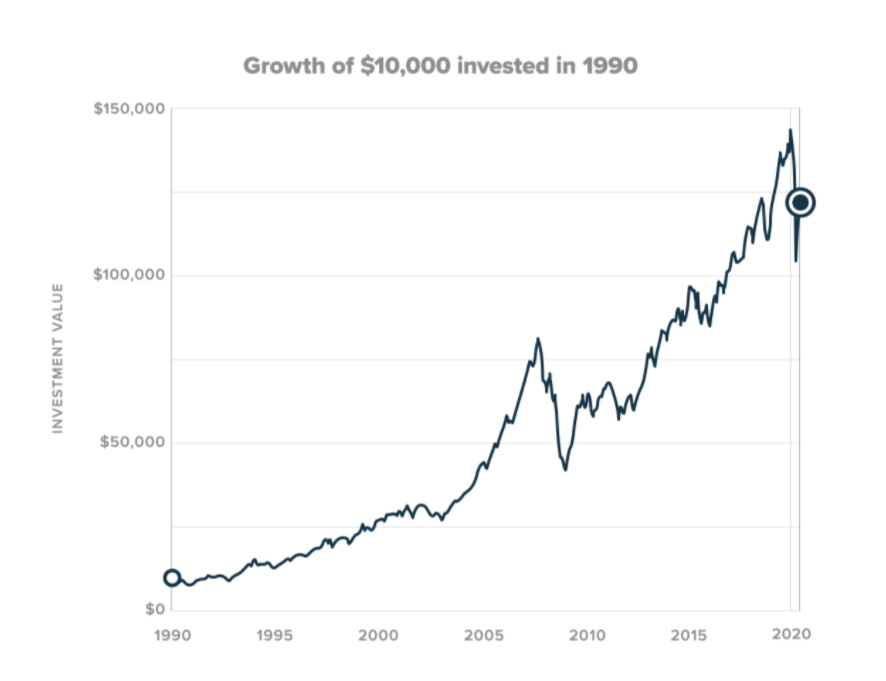

2. I’m afraid of losing money, what should I do?

1. Diversify: Spread your money across a mix of investments (shares, bonds and gold).

2. Dollar cost average: Invest small amounts regularly to ease your way into the market.

3. Keep a long term perspective: The share market has always recovered from short term dips.

Did you know: Stockspot’s portfolios have an allocation to government bonds and gold that helps reduce the impact of share market falls by 50%-80%.

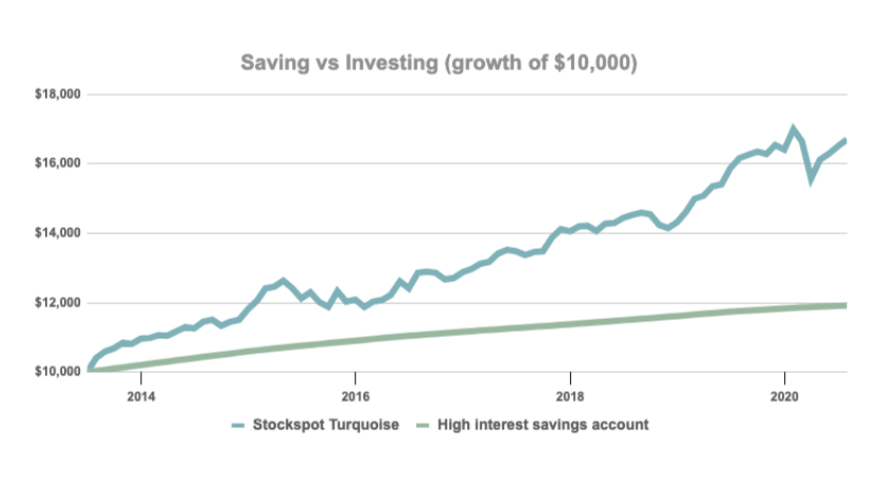

3. Why should I invest?

Money makes money. Then the money that makes money, makes you more money!

Investing in a diversified portfolio is the best way to help your money grow and reach your goals.

The below chart below compares saving your money vs investing your money.

4. Why Stockspot?

Stockspot is Australia’s largest and most experienced robo advisor. We help you to automate your investing so you can focus on enjoying other things in life.

Did you know: Stockspot has outperformed 99% of other similar funds in Australia over 1,3 and 5 years

Starting small

You can start investing with just $1,000 or build your way up to this amount gradually.

Then all you need is patience and discipline and time in the market for the money to grow!

Assumptions:

6% p.a return with dividends reinvested, monthly compounded.

Disclaimer: This is intended to demonstrate the impact of compound returns and is not intended to reflect future values of any particular portfolio. It does not take into consideration the effects of taxes, changing returns, or different investment decisions. Your actual return and final portfolio value may differ from this example. Past performance is no guarantee of future results.