What is sustainable investing?

Sustainable, or sustainability-related, investing is when an investment product or strategy considers factors relating to sustainability, such as environmental, social or governance (ESG) matters.

Ethical or sustainable investing research uses a framework that filters out companies that don’t meet certain criteria and includes companies that demonstrate good ethical and sustainable practices.

Stockspot launched our Sustainable Portfolios in July 2020 to enable investors to invest in a way that aligns with their values, while still maintaining the unique asset balance and risk alignment of our model portfolios.

The best sustainable ETFs on the ASX

Australian Share Sustainable ETFs

Sustainable investing in Australia had a mixed year in 2025 with overall growth of $252 million to $3,388 million.

The big story was money flowing to lower cost ETFs while higher fee options lost ground. Cheaper index based products like E200 and IESG saw solid inflows as investors focused on keeping costs down. Vanguard’s VETH also attracted new money on the back of a competitive fee and strong recent returns. In contrast higher fee funds such as FAIR INES and IMPQ saw net outflows despite sustainability remaining a popular theme. This suggests investors still care about ethical outcomes but are becoming far more price sensitive. Cost matters more when markets are uncertain and returns are harder to come by.

| ETF CODE | ETF NAME | Management fee % | FUM ($m) | FUM growth (Q4 ’24 to Q4 ’25) $m | 1-YEAR RETURN | 3-YEAR RETURN (P.A.) | 5-YEAR RETURN (P.A.) |

| E200 | SPDR S&P/ASX 200 ESG ETF Fund | 0.05% | $255.5 | $199.2 | 10.3% | 12.0% | 11.3% |

| FAIR | Betashares Australian Sustainability Leaders ETF | 0.49% | $1,224.0 | ($28.9) | 0.3% | 10.0% | 5.8% |

| GRNV | VanEck MSCI Australian Sustainable Equity ETF | 0.35% | $271.0 | $17.6 | 8.9% | 13.2% | 9.0% |

| IESG | iShares Core MSCI Australia ESG ETF | 0.09% | $426.3 | $11.4 | 7.5% | 12.8% | N/A |

| IMPQ | Perennial Better Future Active ETF | 0.99% | $38.8 | ($0.4) | 0.9% | 3.4% | 0.5% |

| INES | Intelligent Investor Ethical Share Fund (Managed Fund) | 0.97% | $76.7 | ($1.4) | 13.1% | 11.1% | 7.8% |

| RARI | Russell Investments Australian Responsible Investment ETF | 0.45% | $461.0 | ($5.0) | 12.0% | 13.6% | 10.8% |

| VETH | Vanguard Ethically Conscious Australian Shares ETF | 0.16% | $635.0 | $59.4 | 12.7% | 14.1% | 10.7% |

Global Share Sustainable ETFs

There are at a minimum 8 broad-based index global share sustainable ETFs available in Australia.

Global sustainable ETFs told a similar story over 2025 with growth of $83 million to $8,715 million. Investors continued to favour broad diversified exposure with low fees. The biggest inflows went to the cheapest global options like IWLD WXOZ WXHG and VESG. These ETFs combine ESG screens with very low costs and strong recent returns. In contrast higher fee products struggled to attract new money. ESGI saw outflows despite solid long term performance. Even large established funds like ETHI and HETH only recorded modest inflows relative to their size given fees close to 0.60%. The message is clear. Investors want sustainable exposure but they are no longer willing to overpay for it. Cost efficiency and scale are becoming just as important as ethical labels when allocating globally.

| ETF CODE | ETF NAME | Management fee % | FUM ($m) | FUM growth (Q4 ’24 to Q4 ’25) $m | 1-YEAR RETURN | 3-YEAR RETURN (P.A.) | 5-YEAR RETURN (P.A.) |

| ESGI | Vaneck MSCI International Sustainable Equity ETF | 0.55% | $238.4 | ($3.3) | 6.30% | 15.21% | 12.09% |

| ETHI | Betashares Global Sustainability Leaders ETF | 0.59% | $3,819.1 | $24.6 | 4.8% | 18.0% | 12.7% |

| HETH | Betashares Global Sustainability Leaders ETF – Currency Hedged | 0.62% | $704.0 | $12.0 | 10.7% | 16.7% | 9.5% |

| IWLD | iShares Core MSCI World ex Australia ESG Leaders ETF* | 0.09% | $1,523.9 | $25.8 | 12.2% | 23.4% | 16.8% |

| VESG | Vanguard Ethically Conscious International Shares Index ETF | 0.18% | $1,383.2 | $5.0 | 12.4% | 23.1% | 14.8% |

| WXOZ | SPDR S&P World ex Australia Carbon Control Fund* | 0.07% | $657.2 | $9.4 | 13.1% | 22.7% | 14.9% |

| WXHG | SPDR World ex Australia Carbon Control (Hedged) Fund* | 0.10% | $359.8 | $10.0 | 18.9% | 20.7% | 11.8% |

| WEMG | SPDR S&P Emerging Markets Carbon Control Fund* | 0.35% | $30.2 | ($0.1) | 17.1% | 15.7% | 6.9% |

Global Bond ETFs

Green bonds are issued for projects that provide clear environmental impacts such as renewable energy, pollution prevention, clean transportation and sustainable water.

Global green bond ETFs saw modest growth over the last year of $6.2 million to $694 million as investors remained cautious on fixed income. Inflows were small and returns were steady rather than spectacular. Lower fee index based options again held up better. AESG and VEFI attracted net inflows as investors favoured simple diversified exposure at a lower cost. Higher fee and more complex products struggled to gain traction. GBND saw slight outflows despite its sustainability focus and long track record. Newer and smaller funds like AEBD and GOOD picked up some early inflows but from a low base. The broader trend is clear. Investors want ethical fixed income but expectations are realistic. Stability and cost matter more than strong headline returns in this part of the market.

| ETF CODE | ETF NAME | Management fee % | FUM ($m) | FUM growth (Q4 ’24 to Q4 ’25) $m | 1-YEAR RETURN | 3-YEAR RETURN (P.A.) | 5-YEAR RETURN (P.A.) |

| GBND | Betashares Sustainability Leaders Diversified Bond ETF – Currency Hedged | 0.39% | $217.8 | ($0.5) | 2.2% | 3.3% | -2.0% |

| VEFI | Vanguard Ethically Conscious Global Aggregate Bond Index (Hedged) ETF | 0.26% | $79.8 | $0.7 | 4.6% | 3.3% | -1.3% |

| AESG | iShares Global Aggregate Bond ESG (AUD Hedged) ETF | 0.19% | $329.0 | $2.0 | 4.0% | 3.3% | N/A |

| GOOD | Janus Henderson Sustainable Credit Active ETF (Managed Fund) | 0.50% | $3.0 | $0.8 | 5.3% | N/A | N/A |

| AEBD | BetaShares Ethical Australian Composite Bond ETF (AEBD) – launched 4 November 2024. | 0.34% | $64.7 | $3.2 | 3.7% | N/A | N/A |

Global sustainable ETF size

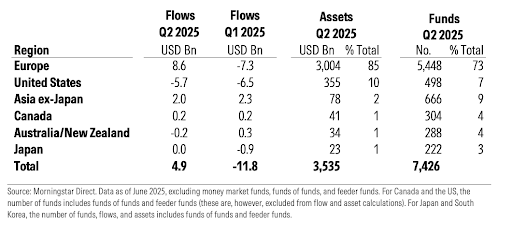

The popularity of sustainable ETFs worldwide has experienced a decline in momentum in recent years. Despite this, the global sustainable ETF market had record estimated net inflows of USD$4.9 Billion in Q2 2025, a marked recovery from Q1 2025, a period in which a record-breaking USD$11.8 billion was withdrawn from funds*.

This recovery was driven by Europe, which added USD $8.6 billion after net outflows the prior quarter, while the US continued its outflow streak of 11 consecutive quarters, with USD $5.7 billion in redemptions.

Total global sustainable fund assets rose 10% to USD $3.5 trillion, supported by market gains. Product activity also increased, with 72 new sustainable funds launched globally, helped by new incentives in Thailand. Meanwhile, Europe saw record renaming activity as asset managers aligned with new EU ESG naming rules, with nearly 600 fund names changed in Q2 alone according to Morningstar data.

Sustainable ETFs at home in Australia and New Zealand faced a slightly more challenging environment from investors posting only slight inflows in calendar year 2025, and funds such as Betashares Global Sustainability Leaders ETF ASX: ETHI only adding $24m over 12 months and Betashares Sustainability Leaders Diversified Bond ETF – Currency Hedged ASX: GBND shrinking by over $140 million.

What is greenwashing?

Unfortunately, as people become more environmentally and socially conscious many funds use the ESG framework as a marketing tool, rather than there being any real sustainable benefit in their ETF.

This practice of making misleading claims about the sustainable character of a product is known as ‘greenwashing’.

Many investors choose to invest in sustainable ETFs because they care about climate change and want to reduce their overall carbon footprint. However, a deeper dive shows that only some of the ETFs available in Australia achieve this objective.

That’s why, even if a sustainable ETF performs well, it’s important that investors do their own research and review exactly how sustainable the underlying investments of their chosen ETFs are.

To avoid greenwashing, investors should review how sustainable investment products filter and define their screening (both positive inclusions and negative exclusions) of companies, and should consistently urge their fund to be transparent with their investment process and portfolio holdings.