Stockspot Super’s investment options

When it comes to planning for retirement, choosing the right investment options for your superannuation can make a significant difference. But with so many funds and strategies available, it can be hard to know where to begin. With Stockspot Super, we make the process simple by offering a range of investment options that are tailored to your age. In this article we dive into Stockspot Super’s unique investment options and why they may be the right fit for different types of investors.

1. Stockspot model portfolios: A foundation for all investors

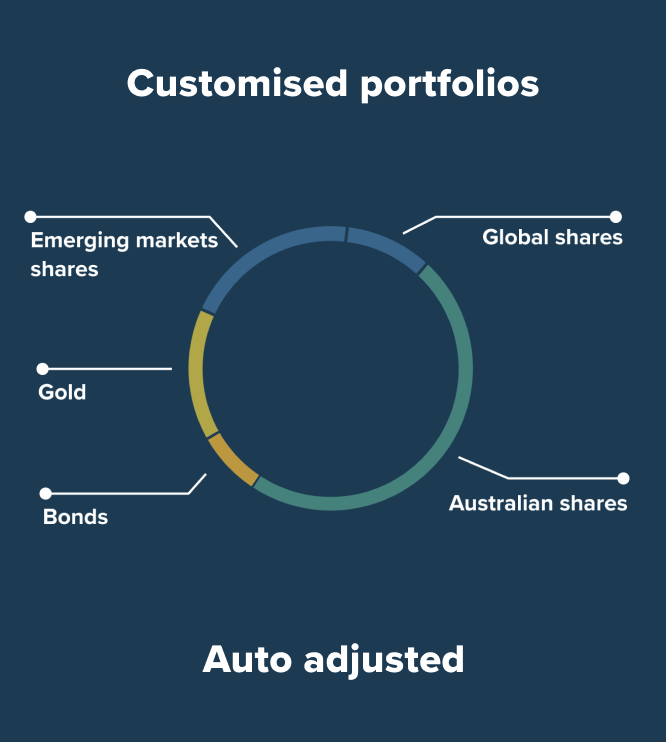

At the heart of Stockspot Super are our model portfolios. These portfolios are built using Exchange Traded Funds (ETFs), which spread your money across various assets, such as shares, bonds, property, and commodities such as gold. Each portfolio is aligned with a specific risk level—from Aggressive Growth to Conservative—to suit where you are in your financial journey.

For younger investors in their 20s to 40s, the Aggressive Growth or Growth portfolios offer a higher allocation to growth assets like shares and property, which can provide greater returns over time. These portfolios work well for those who have a long time before retirement and can afford to take on more short-term risk.

As you approach your 50s and early 60s, Stockspot’s Balanced or Moderately Conservative portfolios might be a better fit. These options mix growth and defensive assets, such as bonds, to protect the savings you’ve accumulated while still allowing for growth. For retirees or pre-retirees, the Conservative portfolio leans more toward defensive assets like bonds and cash, designed to safeguard your nest egg from market volatility.

Why gold matters: One unique aspect of Stockspot Super’s portfolios is our inclusion of gold. Gold is an excellent diversifier because its value often rises when other asset classes, like shares, are underperforming. It also acts as a hedge against inflation and currency fluctuations – particularly important for the Australian economy, where a falling Australian dollar tends to be good for gold prices. Including gold in your portfolio can help stabilise returns during periods of market volatility, ensuring your investments remain resilient over time.

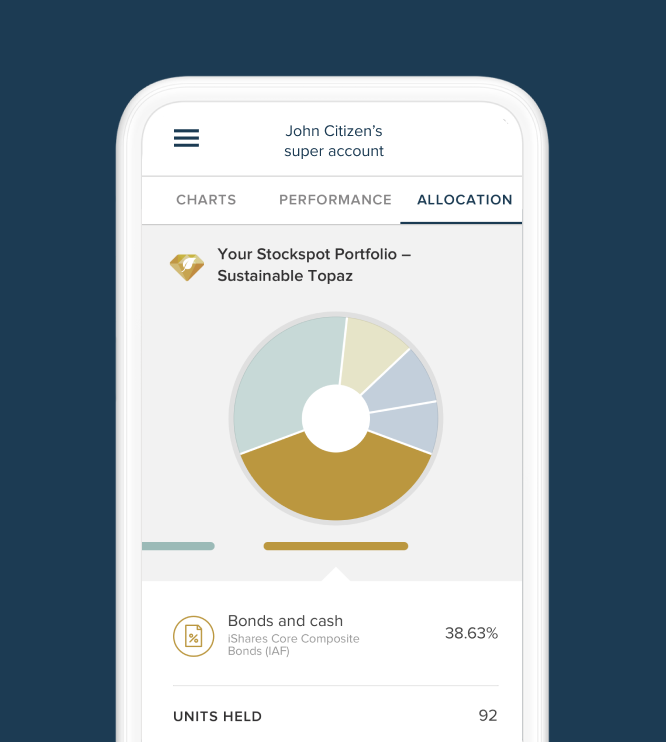

2. Sustainable portfolios: Align your values with your investments

For investors looking to invest in line with their values, Stockspot offers Sustainable Portfolios. These portfolios focus on companies that meet Environmental, Social, and Governance (ESG) standards, allowing you to invest in businesses committed to sustainability.

Sustainable portfolios are ideal for those who want their super to support positive social and environmental change while still aiming for strong financial returns. These portfolios offer a responsible way to grow your retirement savings while reflecting your personal values.

3. Stockspot Themes: Customise your portfolio to match your interests

If you have a specific interest in certain sectors or markets, Stockspot Themes allow you to personalise your portfolio further. Once your portfolio reaches $50,000, you can choose up to three themes to add exposure to specific areas like Tech shares, U.S. Shares or High Dividend Shares.

For example, if you believe technology is the future, you can use the Tech Shares Theme to invest more heavily in tech-related companies. Or, if you’re interested in boosting the income component within your super, the High Dividend Shares Theme can give you access to higher dividend paying companies in Australia and abroad. This flexibility allows you to reflect your market outlook without straying too far from a diversified strategy.

4. Income portfolio and Inflation portfolio: Specialised options for specific needs

Stockspot also offers specialised portfolios for investors with specific needs, such as generating income or protecting against inflation.

The Income Portfolio is designed for those who want to receive regular income from their investments. This is particularly suited for retirees or individuals who rely on their super for living expenses. The portfolio focuses on generating steady income through dividends and interest, offering a more stable return profile while still allowing for moderate growth.

For investors worried about rising prices eroding their purchasing power, the Inflation Portfolio is tailored to provide protection during inflationary periods. It includes assets like commodities and inflation-linked bonds, which tend to perform well when inflation is high. This portfolio helps safeguard your retirement savings from the effects of inflation, ensuring your money maintains its value over time.

Why diversification matters

All of Stockspot’s investment options are designed with diversification in mind. Diversifying your portfolio by spreading your investments across various asset classes reduces the risk of any single investment dragging down your overall performance. When shares are underperforming, bonds or gold may perform better, helping to balance returns and reduce risk.

Diversification is a core strategy for long-term investing, as it helps smooth out market fluctuations and ensures your super is always positioned to capture growth opportunities in different sectors.

Why choose Stockspot Super?

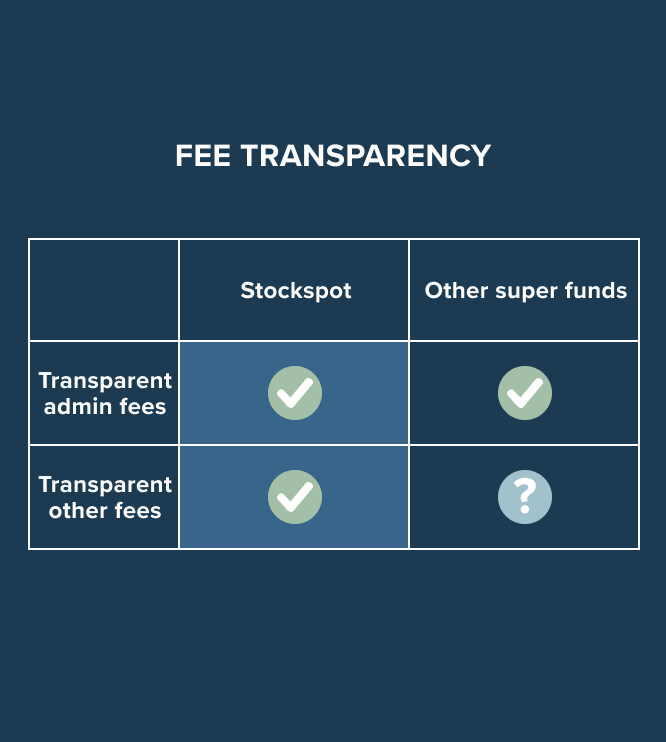

Stockspot Super can offer investment options that are simple, transparent, and flexible enough to meet your individual needs. Whether you’re just starting your career, approaching retirement, or already retired, there’s a portfolio designed for you.

Our model portfolios provide a solid foundation for any investor, while Sustainable Portfolios allow you to align your investments with your values. Stockspot Themes offer customisation for those with specific market views, and our Income and Inflation Portfolios are specialised options for retirees or those seeking stability.

By focusing on diversification, low fees, and the long-term benefits of compounding, Stockspot Super helps you build a retirement plan that lasts.

Ready to take control of your super?

How to join Stockspot Super

Learn more about Stockspot Super here.

Before opening an account please read the Stockspot FSG, Stockspot Super MDA Guide, and the Super Simplifier PDS and Supplementary PDS, along with other relevant disclosure documents including your personalised Statement of Advice (SOA) and Investment Agreement.