This quarter again showed that long-term investing is about discipline, not prediction. Gold, once overlooked and now in record demand, helped lift our portfolios to new highs and proved the value of holding an allocation to this asset through every market cycle.

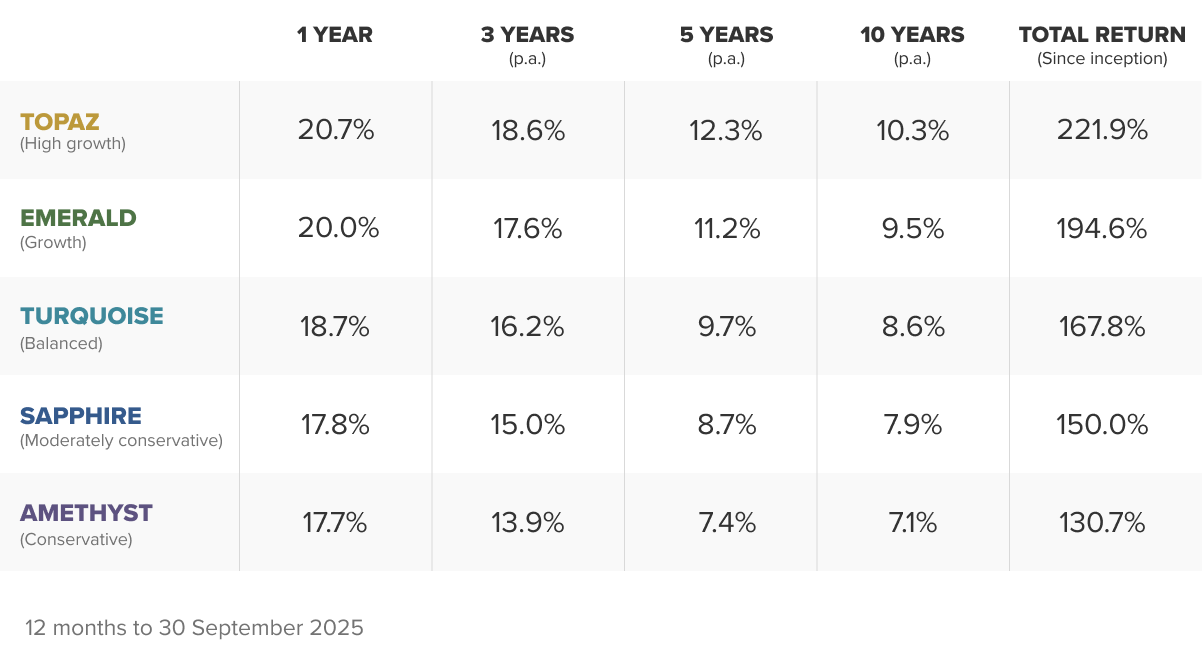

Our five Model Portfolios returned 17.7% to 20.7% after fees, while our Sustainable Portfolios gained 14.0% to 14.9%.

Our most popular Topaz portfolio has now returned 10.3% p.a. over 10 years.

The Topaz Income Portfolio returned 18.8%, and the Topaz Inflation Portfolio – buoyed by gold, silver and gold miners – jumped 37.4% over the year.

A golden year for the Stockspot portfolios

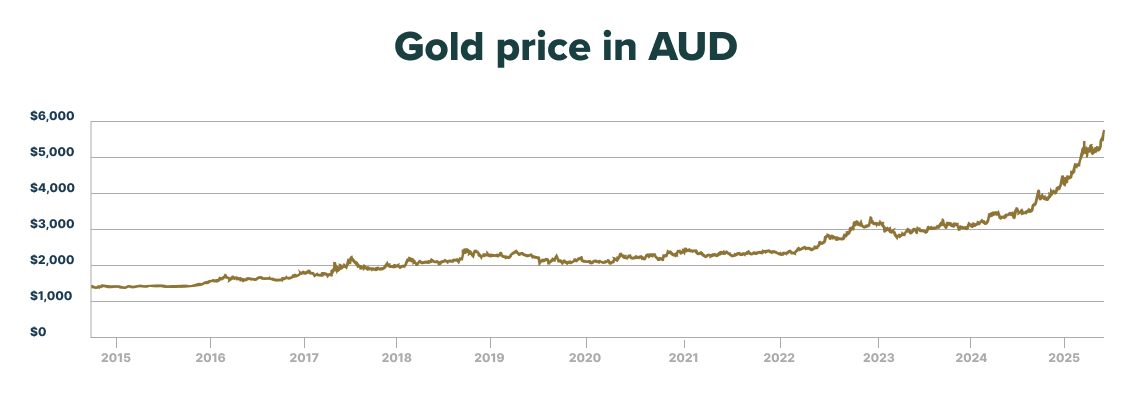

Gold has been one of the biggest contributors to portfolio returns in recent years – and 2025 has been its strongest run since 1979.

Over the twelve months to September, gold climbed 52.2%, adding around 7.7% to portfolio returns thanks to our 14.8% allocation across all portfolios.

In October we reduced our target allocation to 12.3%, not because we’ve lost conviction, but to keep portfolios optimised for the current environment. Gold remains a core holding in every Stockspot portfolio, but its diversification benefits have moderated as it’s begun to move more closely with shares.

Meanwhile, bonds now offer better defensive qualities than they did several years ago. By trimming gold and slightly increasing bonds, we’re locking in some of the gains and strengthening portfolio balance for the next phase.

This small adjustment ensures portfolios stay resilient across a wide range of market conditions, without letting any single defensive asset dominate outcomes.

More improvements for clients

September also marked a major milestone for Stockspot and our clients. We introduced our most significant update since launching twelve years ago:

- $1 per month fees on balances up to $20,000, making Stockspot the most affordable way to access professional investment advice in Australia.

- New investment Themes for Bitcoin and Ethereum ETFs, available as optional add-ons for clients who want small, sensible exposure to digital assets.

- A lower entry point for portfolio customisation, now $20,000 (previously $50,000).

Our crypto Themes give investors a regulated, diversified way to access this emerging asset class (capped at around 6% each) rather than through high-risk trading or unregulated exchanges.

While headlines recently focused on a US$10 billion crypto liquidation and price crashes in some tokens, our approach remains deliberately conservative. We believe crypto can play a role in a diversified portfolio, but only in moderation and through transparent, exchange-traded structures.

It’s a simple, long-term way to benefit from innovation without taking unnecessary risks.

Looking ahead

The past year has reinforced why discipline and diversification matter. Gold’s extraordinary performance has rewarded those who stayed invested through the cycle, and our recent allocation update ensures portfolios remain balanced for the next phase.

It’s also a reminder of what being contrarian really means.

When we first added gold to client portfolios in 2014, it traded around AU$1,400 an ounce and most investors wanted nothing to do with it. Super funds and advisers were convinced bonds and cash were the only safe havens. We took the opposite view.

Eleven years later, as gold passes AU$6,000, we’re trimming our allocation for the first time – not because we’ve lost faith in gold, but because discipline matters just as much as conviction.

Markets reward patience, not prediction. That’s why Stockspot will keep doing what we’ve always done: quietly balancing risk, trimming excess, and helping investors stay the course while everyone else chases the next big thing.

Disclaimer: Past performance of financial products is no guarantee of future performance. Stockspot ABN 87 163 214 319 is a licensed Australian Financial Services provider (AFSL 536082). This is general information only and is not intended to provide you with financial advice, and has been prepared without taking into account your objectives, financial situation or needs. Before making any investment decision, you should review our MDA Guide as well as the TMD and fact sheet for the relevant investment portfolio. We recommend you seek appropriate financial, taxation, and legal advice if necessary. You should also read our Financial Services Guide before deciding whether to obtain financial services from us.