2022 is the tenth year Stockspot has researched Australia’s largest super funds for our annual Fat Cat Funds Report.

We report on the top performing super funds by comparing over 500 multi-asset investment options offered by Australia’s largest 90 super funds to find the best super funds – and the worst. The funds were assessed on how they performed, after fees, compared to other super options of similar risk over five years.

Download the report now to see how your fund compares, or keep reading a summary of our research.

- Top performing super funds – Fit Cat Funds

- Worst performing super funds – Fat Cat Funds

- Best performing aggressive growth super funds

- Best performing growth super funds

- Best performing balanced super funds

- Best performing moderate super funds

- Industry vs retail super fund performance

- How does Stockspot compare?

- Lower fees – industry funds have almost 40% lower fees than the average retail fund. Not having a profit motive means they are not profit driven, but that doesn’t mean that they are all “low cost”.

- Asset allocation – industry funds tend to have a higher allocation to unlisted assets such as property, infrastructure and private equity which have enjoyed strong recent returns.

- You can switch your super fund because there are some super funds who offer indexed super options with low fees and consistent performance.

- If you’re ready to invest outside of your superannuation, low cost indexing is another way for Australians to get consistent returns.

Best super funds 2022

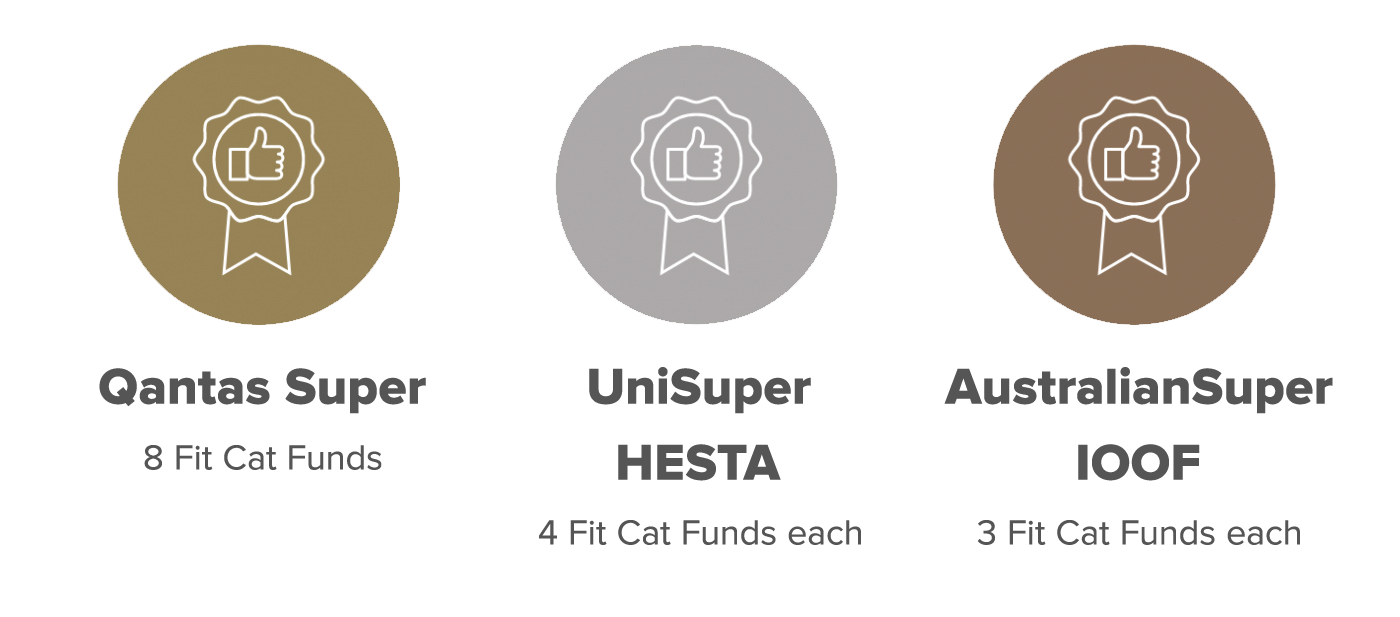

2022 Gold Fit Cat Fund Awards – Qantas Super

In 2022, Qantas Super took out the Gold Fit Cat Fund award for a second consecutive year for the most top performing funds over five years. Qantas Super is a corporate superannuation plan managing ~$9 billion for its staff, and had eight Fit Cat Funds.

| QANTAS SUPER FIT CAT FUND OPTIONS |

| Qantas Super – Aggressive |

| Qantas Super – Glidepath: Take-Off |

| Qantas Super – Growth |

| Qantas Super – Glidepath: Altitude |

| Qantas Super – Glidepath: Cruising |

| Qantas Super – Balanced |

| Qantas Super – Glidepath: Destination |

| Qantas Super – Conservative |

2022 Silver Fit Cat Fund Award – UniSuper and HESTA

The Silver award goes to both UniSuper and Health Employees Superannuation Trust Australia (HESTA). UniSuper is no stranger to the Stockspot Fit Cat Fund Awards having taken out the Gold award in 2021 and 2020, while HESTA (an industry super fund dedicated to people in health and community services) makes its first appearance in our list.

| UniSuper FIT CAT FUND OPTIONS |

| UniSuper – High Growth |

| UniSuper – Balanced |

| UniSuper – Conservative Balanced |

| UniSuper – Conservative |

| HESTA FIT CAT FUND OPTIONS |

| HESTA – High Growth |

| HESTA – Sustainable Growth |

| HESTA – Balanced Growth |

| HESTA – Conservative |

2022 Bronze Fit Cat Fund Awards – Australian Super and IOOF

The Bronze award gets shared between both AustralianSuper and IOOF. AustralianSuper is the largest superannuation provider in Australia managing $245 billion with one in ten working Australians using AustralianSuper as their preferred provider. IOOF has taken out the Bronze award for the second year in a row as their contemporary investment options have done much better than some of their inherited legacy investment options

| AustralianSuper FIT CAT FUND OPTIONS |

| AustralianSuper – High Growth |

| AustralianSuper – Conservative Balanced |

| AustralianSuper – Stable |

| IOOF SUPER FIT CAT FUND OPTIONS |

| IOOF – MultiMix Balanced Growth |

| IOOF – MultiSeries 50 |

| IOOF – MultiSeries 30 |

What did the top three super funds have in common? Low fees!

Despite having different investment strategies, the one factor these funds all had in common was investment fees of around 1% or under.

Congratulations to our Fit Cat Fund winners for 2022.

Worst super funds 2022

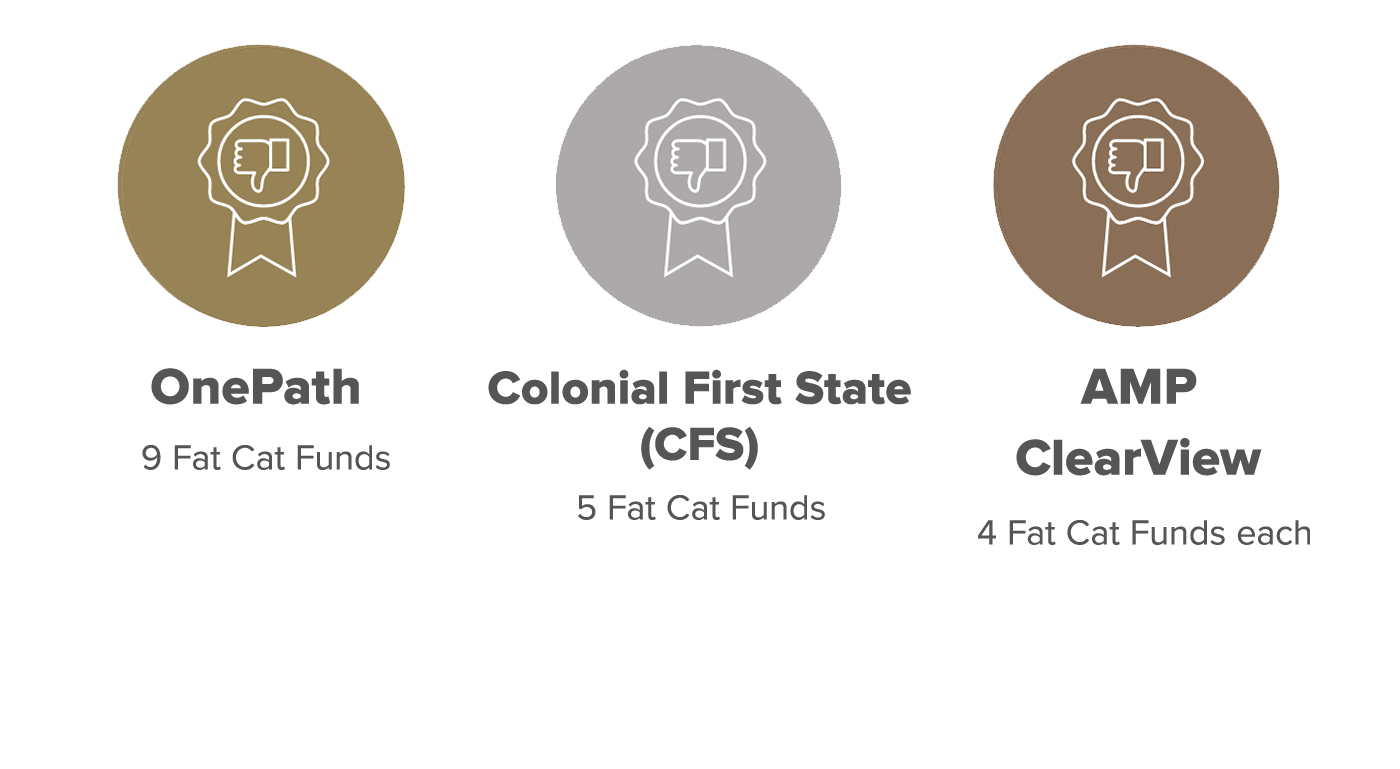

Last place: OnePath

Onepath has topped our list for the most Fat Cat Funds with a grand total of nine underperforming options and has been in the Fat Cat Fund category for ten years in a row. Last year, we once again called upon IOOF (OnePath’s parent owner and 2022 Fit Cat Bronze Award) to look to lower its fees and improve their performance, but it looks like they prefer to keep expensive fund options and members locked into underperforming funds for their own benefit.

| ONEPATH FAT CAT FUND OPTIONS |

| OnePath – OptiMix Balanced |

| OnePath – Managed Growth |

| OnePath – Active Growth |

| OnePath – OptiMix Growth |

| OnePath – OptiMix High Growth |

| OnePath – OptiMix Moderate |

| OnePath – Tax Effective Income |

| OnePath – OptiMix Conservative |

| OnePath – Balanced |

Second last place: Colonial First State (CFS)

CFS came in second last place with five Fat Cat Funds through both their FirstChoice Wholesale Personal Super product and their FirstChoice Employer Super product. CFS is one of the largest superannuation funds with $90 billion in assets and recently was partly sold by Commonwealth Bank to U.S. private equity giant KKR.

| Colonial First State (CFS) FAT CAT FUND OPTIONS |

| Colonial First State (CFS) – FirstChoice Employer Super – Lifestage 1965-69 |

| Colonial First State (CFS) – FirstChoice Moderate |

| Colonial First State (CFS) – FirstChoice Employer Super – Lifestage 1950-54 |

| Colonial First State (CFS) – FirstChoice Employer Super – Lifestage 1955-59 |

| Colonial First State (CFS) – FirstChoice Conservative |

Third last place: AMP and ClearView

The Bronze award for their last place is shared between two superfunds: AMP and ClearView. AMP is well accustomed to the Fat Cat Funds List and has had four funds in this year’s list. AMP’s share price has fallen by almost 80% since we published the first Fat Cat Funds Report in 2013, having been through five different CEOs, and billions have been withdrawn from underperforming AMP products. While they have improved from last year’s Silver Fat Cat Award, thanks to rationalising their old legacy suite of products, it has still not made up for some funds underperforming.

ClearView is a new entry to the Fat Cat list, and is a retail super fund with over $2b in assets but also specialised in life insurance. Both their active and passive super fund investment options failed to deliver over the last five years and had four funds in the Fat Cat Funds list this year

Watch our AMP Fat Cat Fund video produced in partnership with The Chaser back in 2016

| AMP FAT CAT FUND OPTIONS |

| AMP – Cautious Index |

| AMP – Future Directions Conservative |

| AMP – Conservative Index |

| AMP – Conservative |

| ClearView FAT CAT FUND OPTIONS |

| ClearView – IPS Active Dynamic 90ClearView – IPS Active Dynamic 50 |

| ClearView – IPS Active Dynamic 30 |

| ClearView – IPS Index Dynamic 30 |

Want to compare your super even further? Read the full 2022 Fat Cats Fund Report here.

Comparison of different super fund categories

Super funds that were analysed by Stockspot go by many names: balanced, diversified, moderately conservative, moderate and capital stable.

Investors need to be careful to understand the asset mix of their fund, not rely on how it has been named.

Find out more about how to choose the right super fund.

Best and worst performing aggressive growth super funds

Aggressive growth super funds are funds with at least 80% in growth assets like shares and property and generally targeted at investors with a very long investment horizon given that they can be very volatile over the short term.

The top performing aggressive growth super funds had very little in defensive assets such as bonds and cash. This helped them achieve returns of 8-9% p.a. over five years, as growth assets have enjoyed strong returns in recent years despite the COVID-19 and 2022 fall.

It should be noted that the equivalent Vanguard index fund still beat 70% of high growth funds over the past five years.

OnePath featured heavily in the Aggressive Fat Cat Fund list with five of the worst 10 performing funds. Meanwhile Qantas Super and some industry funds (e.g. UniSuper, Hostplus and AustralianSuper) took out most of the top 10 performing aggressive super funds, primarily due to their high exposure to illiquid and unlisted assets.

| TOP 10 AGGRESSIVE GROWTH FUNDS | 5 YEAR RETURN (P.A.) | |

| 1 | MLC – Horizon 7 Accelerated Growth Portfolio | 9.30% |

| 2 | Qantas Super – Aggressive | 8.60% |

| 3 | Qantas Super – Glidepath: Take-Off | 8.60% |

| 4 | Australian Retirement Trust – Growth | 8.40% |

| 5 | UniSuper – High Growth | 8.37% |

| 6 | HESTA – High Growth | 8.32% |

| 7 | Hostplus – Shares Plus | 8.18% |

| 8 | Public Sector Superannuation Accumulation Plan (PSSap) – Aggressive | 8.03% |

| 9 | AustralianSuper – High Growth | 7.99% |

| 10 | Military Super – Aggressive | 7.98% |

| BOTTOM 10 AGGRESSIVE GROWTH FUNDS | 5 YEAR RETURN (P.A.) | |

| 1 | OnePath – OptiMix Balanced | 2.88% |

| 2 | OnePath – Managed Growth | 3.13% |

| 3 | OnePath – Active Growth | 3.17% |

| 4 | Zurich – Managed Growth | 3.25% |

| 5 | OnePath – OptiMix Growth | 3.51% |

| 6 | Energy Industries Superannuation Scheme (EISS) – Balanced (MySuper) | 4.16% |

| 7 | Colonial First State (CFS) – FirstChoice Employer Super – Lifestage 1965-69 | 4.31% |

| 8 | Commonwealth Bank Group Super – Balanced (MySuper) | 4.46% |

| 9 | OnePath – High Growth | 4.46% |

| 10 | ClearView – IPS Active Dynamic 90 | 4.57% |

Aggressive growth super funds: average fee & returns

The bottom funds in this category typically had more cash and bonds, poor outperforming active managers, and higher fees. The average fee in this category was 2.1% which dragged performance down to 2.9-4.6% p.a.

Here the correlation between fees and returns can be clearly seen.

| AVERAGE FEE (P.A.) | AVERAGE 5 YEAR RETURN (P.A.) | |

| Top 10 | 1.30% | 8.38% |

| Bottom 10 | 2.10% | 3.79% |

Best and worst performing growth super funds

Growth super funds have 60-80% in growth assets like shares and property and, like aggressive growth funds, are generally targeted at younger investors with a long investment horizon given that they can be quite volatile over the short term.

Industry funds such as HESTA and UniSuper, as well as Qantas’ corporate super plan were in the top 10 growth super funds.

The top performing funds in this group had a relatively small (22.9%) allocation to bonds and cash. This allowed them to return 6.6-7.5% p.a. over five years, with the higher allocation to growth investments helping them to enjoy a strong few years of returns.

It should be noted that a simple index fund still beat 55% of all growth funds over the past five years.

| TOP 10 GROWTH SUPER FUNDS | 5 YEAR RETURN (P.A.) | |

| 1. | Qantas Super – Growth | 7.50% |

| 2. | Qantas Super – Glidepath: Altitude | 7.50% |

| 3. | HESTA – Sustainable Growth | 7.03% |

| 4. | IOOF – MultiMix Balanced Growth | 6.93% |

| 5. | Qantas Super – Glidepath: Cruising | 6.80% |

| 6. | HESTA – Balanced Growth | 6.75% |

| 7. | Energy Super – SRI Balanced | 6.72% |

| 8. | Brighter Super – Socially Responsible | 6.72% |

| 9. | UniSuper – Balanced | 6.65% |

| 10. | Lutheran Super – Balanced Growth – MySuper | 6.60% |

| BOTTOM 10 GROWTH SUPER FUNDS | 5 YEAR RETURN (P.A.) | |

| 1. | Zurich – Balanced | 1.89% |

| 2. | OnePath – OptiMix Moderate | 1.96% |

| 3. | Energy Industries Superannuation Scheme (EISS) – Conservative | 2.31% |

| 4. | OnePath – Tax Effective Income | 2.38% |

| 5. | TAL Personal Superannuation Plan – TAL Performance | 2.77% |

| 6. | Energy Industries Superannuation Scheme (EISS) – Conservative Balanced | 3.18% |

| 7. | SmartMonday – MySuper – Age 65 | 3.30% |

| 8. | Colonial First State (CFS) – FirstChoice Moderate | 3.84% |

| 9. | Suncorp – Lifestage Fund 1960 – 1964 | 3.91% |

| 10. | BT Super – 1940s Lifestage | 3.92% |

Growth super funds: average fee & returns

Retail super funds such as OnePath and Zurich performed the worst out of growth super funds, as well as the highly publicised Energy Industries Superannuation Scheme (EISS). The bottom funds in this group typically had a higher (33%) allocation to cash and bonds and high fees of 1.5% on average. This pulled down their performance to 1.9-3.9% p.a.

| AVERAGE FEE (P.A.) | AVERAGE 5 YEAR RETURN (P.A.) | |

| Top 10 growth super funds | 1.17% | 6.92% |

| Bottom 10 growth super funds | 1.47% | 2.95% |

Download the Fat Cat Funds Report to dive deeper into the best and worst performing super funds in Australia

Best and worst performing balanced super funds

Balanced super funds are funds with 40-60% in growth assets like shares and property and generally targeted at investors in their forties and fifties with a medium to long investment horizon.

The top performers in this group had a 45% allocation to fixed income and cash. This helped them achieve returns of 4.5-6.1% p.a. over five years.

However, a simple Vanguard index fund beat an extraordinary 66% of balanced funds over the past five years. Surprisingly one of our 2020 Fit Cats, QSuper, had a fund in the Fat Cat list for the balanced category for two years in a row.

| TOP 10 BALANCED SUPER FUNDS | 5 YEAR RETURN (P.A.) | |

| 1. | Qantas Super – Balanced | 6.10% |

| 2. | Qantas Super – Glidepath: Destination | 6.10% |

| 3. | AustralianSuper – Conservative Balanced | 5.51% |

| 4. | IOOF – MultiSeries 50 | 4.85% |

| 5. | Active Super – Conservative Balanced | 4.78% |

| 6. | Public Sector Superannuation Accumulation Plan (PSSap) – Income Focused | 4.69% |

| 7. | UniSuper – Conservative Balanced | 4.65% |

| 8. | Spirit Super – Moderate | 4.60% |

| 9. | Australian Catholic Superannuation – Conservative | 4.57% |

| 10. | HESTA – Conservative | 4.53% |

| BOTTOM 10 BALANCED SUPER FUNDS | 5 YEAR RETURN (P.A.) | |

| 1. | Zurich – Capital Stable | 0.59% |

| 2. | OnePath – OptiMix Conservative | 1.13% |

| 3. | ClearView – IPS Active Dynamic 50 | 2.05% |

| 4. | SmartMonday – MySuper – Age 75 and above | 2.10% |

| 5. | OnePath – Balanced | 2.10% |

| 6. | QSuper – Lifestime Sustain 2 | 2.16% |

| 7. | MLC – Inflation Plus – Conservative Portfolio | 2.20% |

| 8. | Colonial First State (CFS) – FirstChoice Employer Super – Lifestage 1950-54 | 2.24% |

| 9. | Colonial First State (CFS) – FirstChoice Employer Super – Lifestage 1955-59 | 2.25% |

| 10. | AMP – Cautious Index | 2.26% |

Balanced super funds: average fee & returns

Retail funds like Onepath, CFS and AMP performed the worst out of balanced super funds. The bottom funds in this group typically had a 52% allocation to defensive assets like bonds and cash. This combined with their poor performing assets pulled down their performance to 0.6-2.3% p.a.

| AVERAGE FEE (P.A.) | AVERAGE 5 YEAR RETURN (P.A.) | |

| Top 10 balanced super funds | 0.80% | 5.04% |

| Bottom 10 balanced super funds | 0.75% | 1.91% |

Best and worst performing moderate super funds

Moderate super funds are funds with 20-40% in growth assets like shares and property and generally targeted at older investors with a short to medium investment horizon given that they are relatively stable over the short term.

Industry funds made up nearly half of the Top 10 Fit Cat Funds.

The top performing funds in this group had a 64% allocation to bonds and cash. This helped them achieve returns of 3.1-4.56% p.a. over five years.

The bottom performing funds in this group typically had a slightly higher allocation to cash and bonds as well as higher fees. This reduced their performance to 0.9-2.2% p.a, mainly for the retail funds such as AMP and ClearView.

| TOP 10 MODERATE SUPER FUNDS (FAT CAT FUNDS) | 5 YEAR RETURN (P.A.) | |

| 1. | Qantas Super – Conservative | 4.50% |

| 2. | AustralianSuper – Stable | 3.99% |

| 3. | IOOF – MultiSeries 30 | 3.67% |

| 4. | UniSuper – Conservative | 3.59% |

| 5. | Spirit Super – Conservative | 3.50% |

| 6. | NESS Super – Stable | 3.44% |

| 7. | Fiducian Super – Capital Stable Fund | 3.43% |

| 8. | legalsuper – Conservative | 3.30% |

| 9. | ANZ Staff Super – Cautious | 3.30% |

| 10. | Perpetual WealthFocus – Diversified Real Return | 3.10% |

| BOTTOM 10 BALANCED SUPER FUNDS (FAT CAT FUNDS) | 5 YEAR RETURN (P.A.) | |

| 1. | TAL Personal Superannuation Plan – TAL Capital Protected | 0.87% |

| 2. | ClearView – IPS Active Dynamic 30 | 1.35% |

| 3. | ClearView – IPS Index Dynamic 30 | 1.78% |

| 4. | AMP – Future Directions Conservative | 1.79% |

| 5. | BT Super – 1940s Lifestage | 1.88% |

| 6. | Australian Ethical – Conservative | 1.90% |

| 7. | AMP – Conservative Index | 1.94% |

| 8. | SmartMonday – MySuper – Moderate – Index | 2.10% |

| 9. | AMP – Conservative | 2.14% |

| 10. | Colonial First State (CFS) – FirstChoice Conservative | 2.17% |

Moderate super funds: fees and performance

Due to the lower returns from moderate super funds, older Australians and pensioners in lower risk super strategies need to be even more sensitive to fees.

Compare the fees of the best performing moderate super funds with the worst performing:

| AVERAGE FEE (P.A.) | AVERAGE 5 YEAR RETURN (P.A.) | |

| Top 10 | 0.80% | 3.58% |

| Bottom 10 | 0.86% | 1.79% |

Industry vs retail super fund performance

Industry funds (and public sector funds) continue to do better than retail funds. The reason for this is due to:

Large retail funds from OnePath, CFS and AMP dominated the Fat Cat Funds with the majority of bottom 10 funds being a retail fund. The common theme is these funds charge higher than average fees.

The bottom performing funds in this group typically also had a larger allocation to cash and bonds and higher fees.

Read more about comparing industry super funds

Superannuation Comparison: Our Analysis

Many superannuation funds don’t index

Stockspot’s Model Portfolios have beaten ~95% of super funds over five years, while the Vanguard Index Fund options have beaten ~60%of funds in total after fees and taxes. This is largely due to the compounding effect of lower fees.

Additionally, superannuation managers can easily access low cost index funds, yet many choose not to. We believe this is because there are still huge conflicts of interest in the industry.

Super funds would rather pay themselves – their big teams of fund managers, analysts and asset consultants – despite the evidence that they do not add any value to super fund investment returns.

Bigger super funds don’t perform better

Super funds members don’t always enjoy benefits by joining larger funds. In many cases there are added costs as funds grow which lead to higher per-member fees. This is because of the cost of legacy administration systems and active investing.

There are more large funds who are Fat Cat Funds and they are usually between $20 billion and $50 billion in size. The best performing funds tend to either be between $5 billion and $20 billion or over $50 billion in size.

We expect more consolidation and merging in the industry, having already seen the likes of SunSuper and QSuper (into Australian Retirement Trust), Hostplus, Maritime and Statewide, and recent announcements of Mercy Super and HESTA. Find out how to choose the right super fund here.

Compare your superannuation fund to investing with Stockspot

The table below compares average super fund performance across growth, balanced and moderate strategies.

The more conservative the portfolio, the harder it is to beat an index fund portfolio.

| AVERAGE SUPER FUND 5 YEAR RETURN (P.A.) | STOCKSPOT 5 YEAR RETURN AFTER FEES AND TAXES (P.A) | STOCKSPOT OVERALL PERFORMANCE | |

| Growth | 5.1% | 6.6% (Topaz) 5.8% (Emerald) | Top 7% |

| Balanced | 3.5% | 5.1% (Turquoise) 4.7% (Sapphire) | Top 4% |

| Moderate | 2.7% | 4.0% (Amethyst) | Top 7% |

If you’re not happy with your superannuation, you have a few options: