Meet Erik Kasearu

Hello there, my name is Erik Kasearu. I am a widowed father of two adult sons, and a retiree living in the leafy Adelaide Hills.

I enjoy outdoor sports like hiking and cycling. I’ve walked the Camino de Santiago (Way of St James) and bicycled coast to coast across Canada.

My other passions are art, current affairs, and the economic world, finance world and political world.

Why I trust Stockspot with my investment portfolio

I decided to trust Stockspot after making some losses on my regular trading account.

I like share trading and like to research equities, it’s like a hobby. Over the years I had made some good gains.

But I also hadn’t put regular stop losses on my accounts and ended up losing more than 10% on some of these shares.

After researching shares further, I realised I should instead stick to ETFs and being a passive trader rather than trying to be an active share trader.

My experience had shown that I had the wrong balance. I should have had 75% of my money with Stockspot and 25% on my regular share trading account.

What occurred to me was I could significantly de-risk my portfolio by rebalancing my investments to predominantly hold ETFs. At the same time, I could still retain a significant minority of funds in my regular share trading account.

I googled who I should go with and realised that Stockspot had very good ratings. The Stockspot website was also very good and very informative.

“I decided to trust Stockspot after making some losses on my regular trading account. I realised I should instead stick to ETFs and being a passive trader rather than trying to be an active share trader.

The Stockspot sign up process was good

Signing up to Stockspot was easy and the process was particularly good.

The sign up process itself actually gave me confidence in investing with Stockspot.

It was reassuring that I retained ownership of the funds and ETFs that Stockspot invests on my behalf.

I was pleasantly surprised that I was able to speak to someone quickly and someone answered the phone. They gave clear and direct information.

Achieving my investment goals

I’m on my way to achieving my investment goals with Stockspot by limiting my downturns and moving more of my money to a passively managed ETF account.

I anticipate receiving some more funds soon and I will be moving those to Stockspot too.

My experience with Stockspot

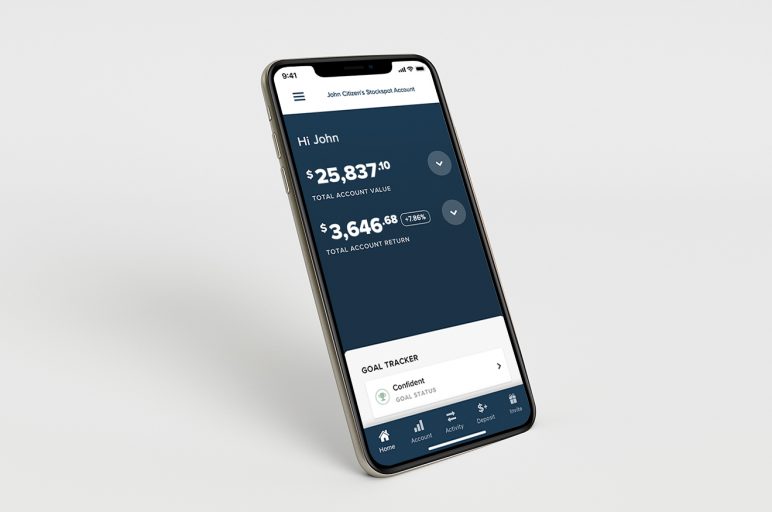

It’s good on so many aspects. Stockspot provides interesting research plus plenty of attractively presented data, diagrams, and performance information on my portfolio.

The company seems really well run and a competent outfit.

My advice someone who is not investing

My advice for those leaving their money in a savings account is wake up! Don’t get minimal return when ETFs in a Stockspot account still are great for the risk averse investors but make your money work for you as well!

I think ETFs in a company like Stockspot are a way for people who are scared of risk to invest.

Yes, there might be short-term shocks, but markets eventually recover.

What I like about Stockspot

What I love about Stockspot is everything! The quality of the product, the information, the fact that it’s all above board, the people are competent and available to help you if needed. There are so many positives.

A final word about life

I am not just an investor, but a human being. My lifestyle and spending habits stem from my investments.

My final bit of advice is to enjoy your money. Don’t be just saving for the proverbial rainy day in retirement. Be comfortable with drawing down from your funds to do wonderful things like travel. You worked hard for it.

Just start investing and enjoying life.