2025 was a strong first year for Stockspot Super members. Returns were driven by global shares and gold. The year reinforced why discipline and diversification matter most when markets are shaped by politics, inflation and concentration risk.

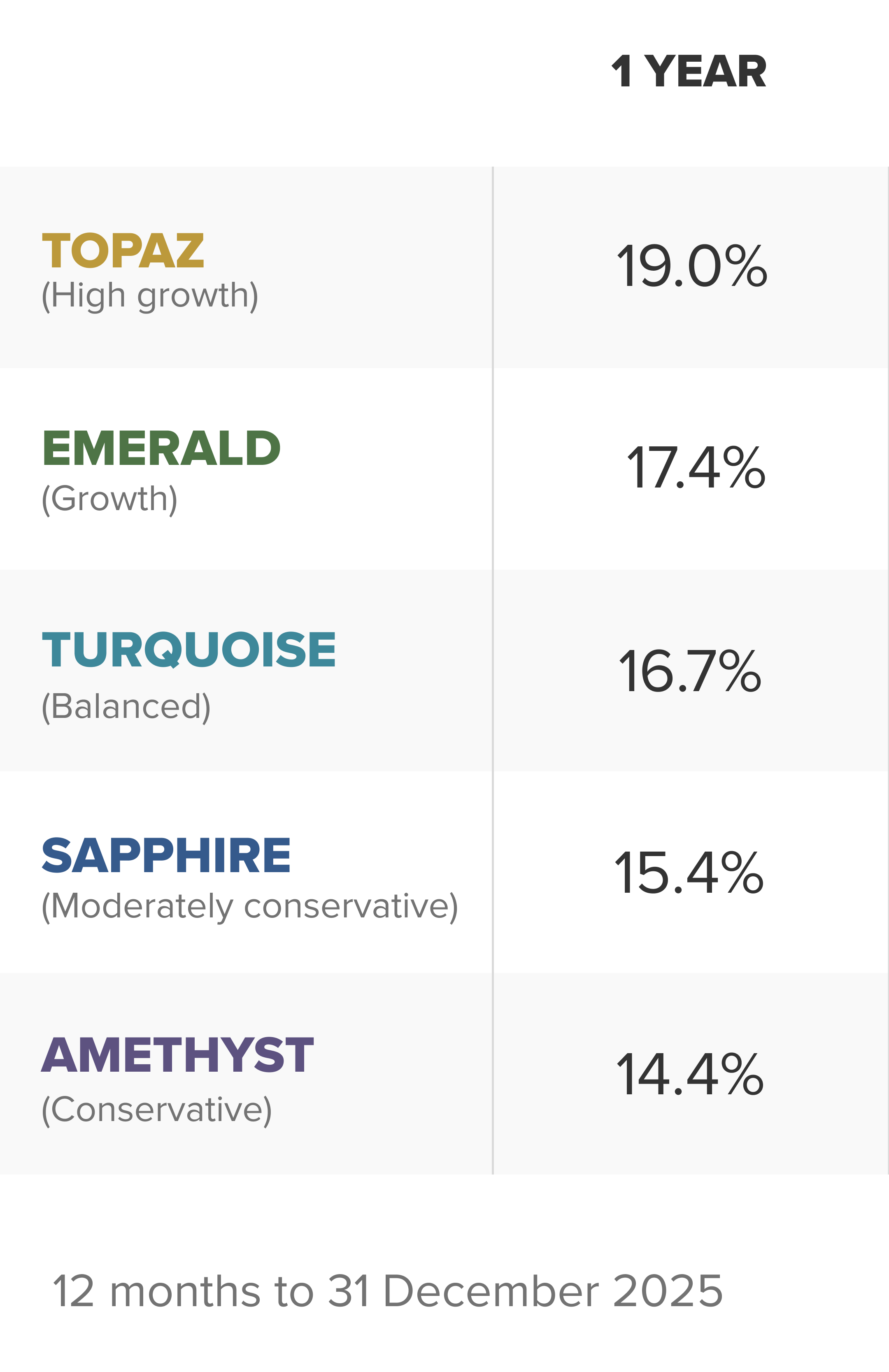

Stockspot Super portfolio performance

Over the 12 months to December 2025, Stockspot Super delivered strong outcomes across its core portfolios. The High Growth (Topaz) portfolio returned 19.0% after fees, while the Balanced (Turquoise) portfolio returned 16.7% after fees, with returns driven by global shares and gold.

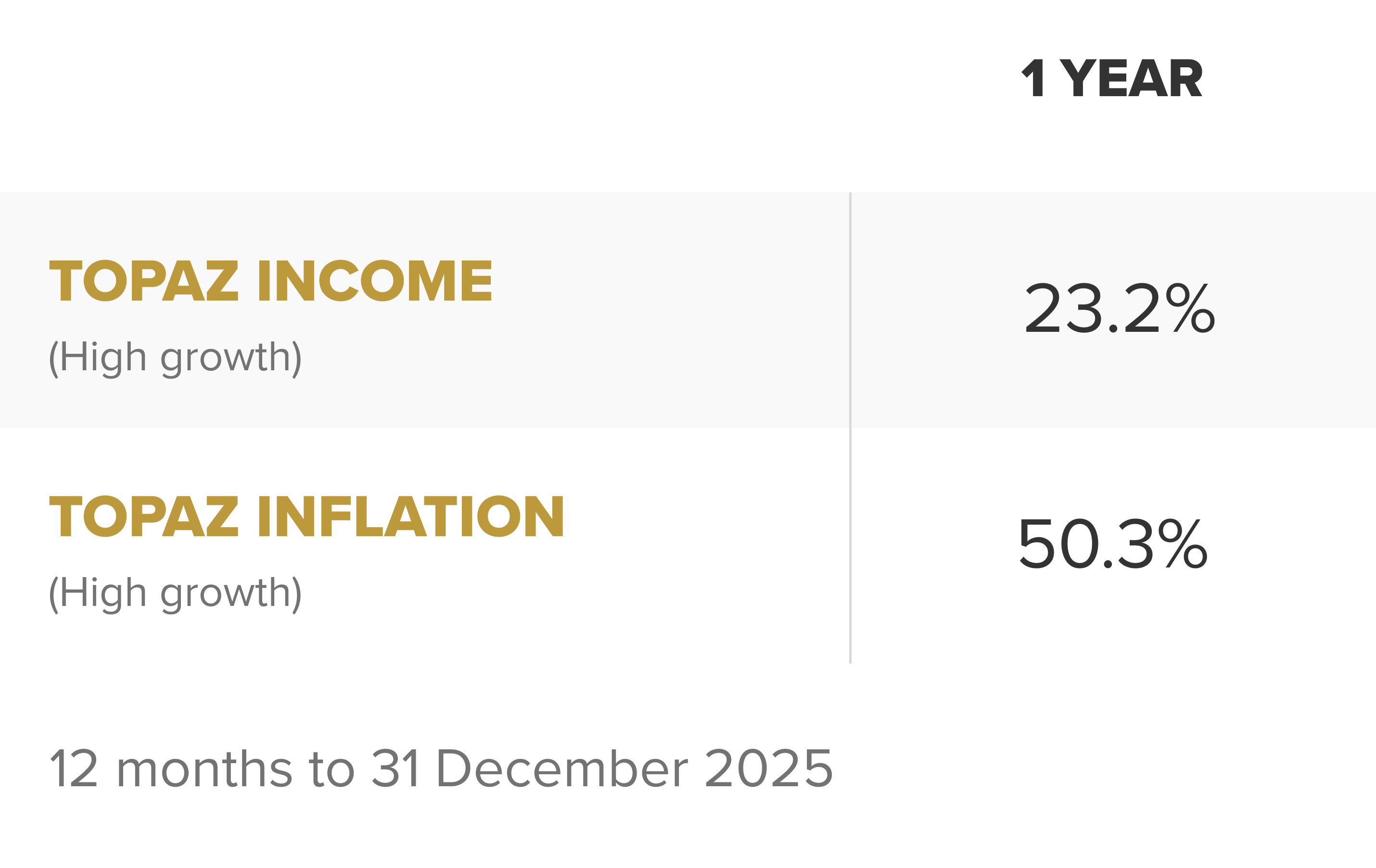

Specialist options also performed strongly, with High Growth Income returning 23.2% and High Growth Inflation returning 50.3%, reflecting higher exposure to hard assets. See our latest super returns here.

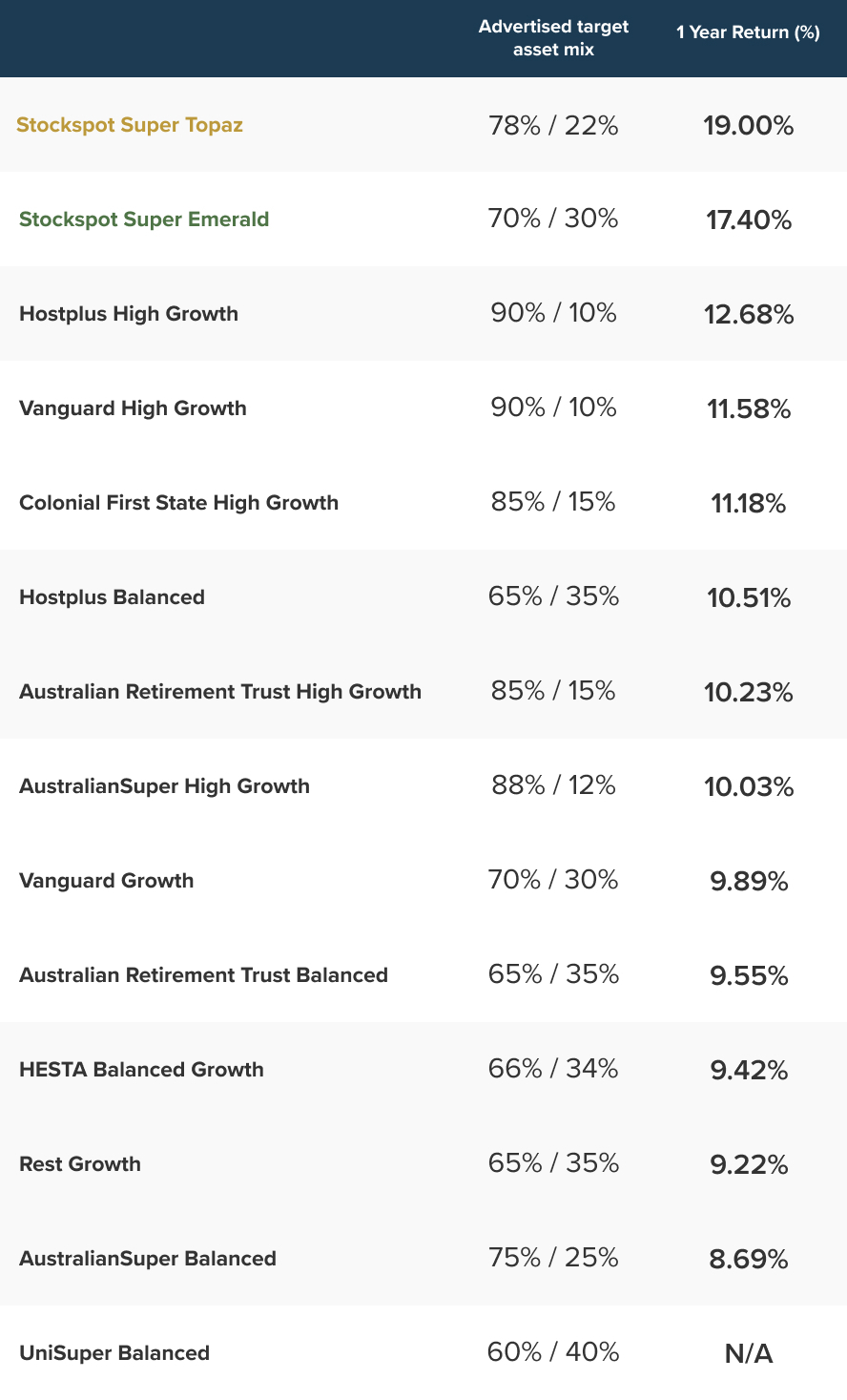

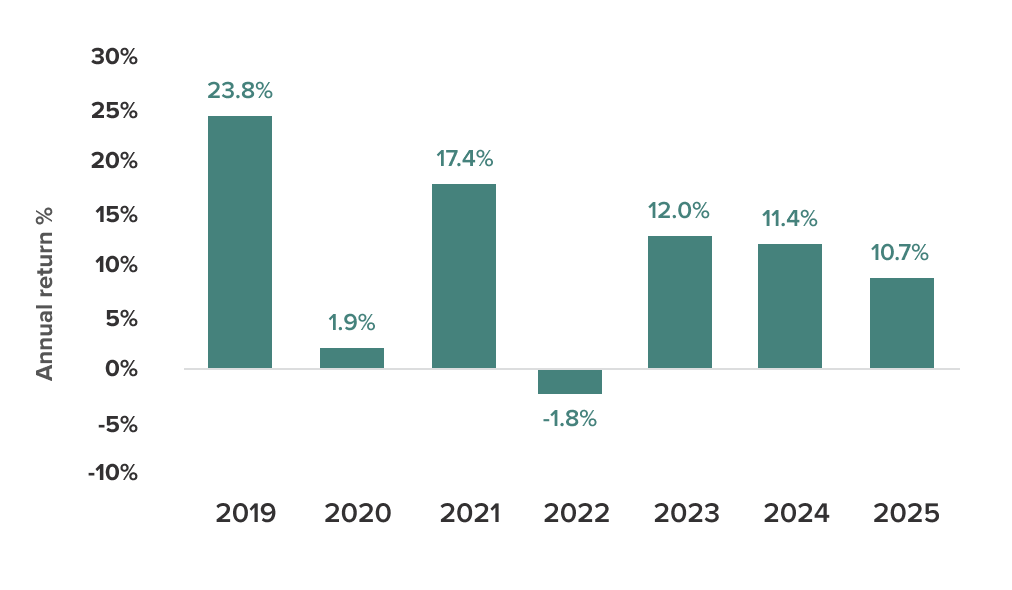

Stockspot’s high growth (Topaz) portfolio with a 78/22 allocation to growth and defensive assets, returned 19.0% after fees. Comparable options at major funds delivered returns of around 10% to 12% over the same period.

Stockspot’s growth portfolio (Emerald), with a 70/30 allocation to growth and defensive assets, returned 17.4% after fees. Equivalent balanced options at large super funds delivered returns of approximately 8% to 10%.

These portfolios are taking similar levels of risk. The difference in outcomes reflects how portfolios are built, how costs are managed, and how asset allocation decisions are made.

Gold has been a key point of differentiation for Stockspot Super. While most super funds hold little or no allocation to gold, we have maintained a meaningful allocation. Gold has more than doubled since we first wrote about this in 2024.

In 2025, that decision played a major role in lifting member returns. Holding gold through every market cycle reinforced the value of true diversification, particularly at a time when traditional defensive assets have been less reliable.

We believe the lack of gold exposure across much of the super industry is a structural weakness. Gold has no credit risk, cannot be printed, and has historically behaved differently to shares and bonds. In an environment of elevated debt, inflation risk and geopolitical uncertainty, we see it as an essential component of a resilient long term portfolio.

Why simplicity and costs matter in super

All Stockspot Super portfolios are built exclusively using broad market, low cost ETFs.

The long term evidence continues to support index investing. Despite this, most super funds actively manage the majority of member money using complex strategies that add cost without reliably adding value.

One of the defining features of 2025 was market concentration. A small group of technology and semiconductor companies drove a very large share of global equity returns as confidence in AI commercialisation accelerated. This environment proved difficult for active managers. Missing a handful of stocks meant missing much of the market’s return.

Similar periods have occurred before including the Nifty 50 era of the 1960s and early 1970s. History shows concentration can persist longer than expected.

Indexed investors captured the full benefit of these trends. Many active and tactical strategies did not.

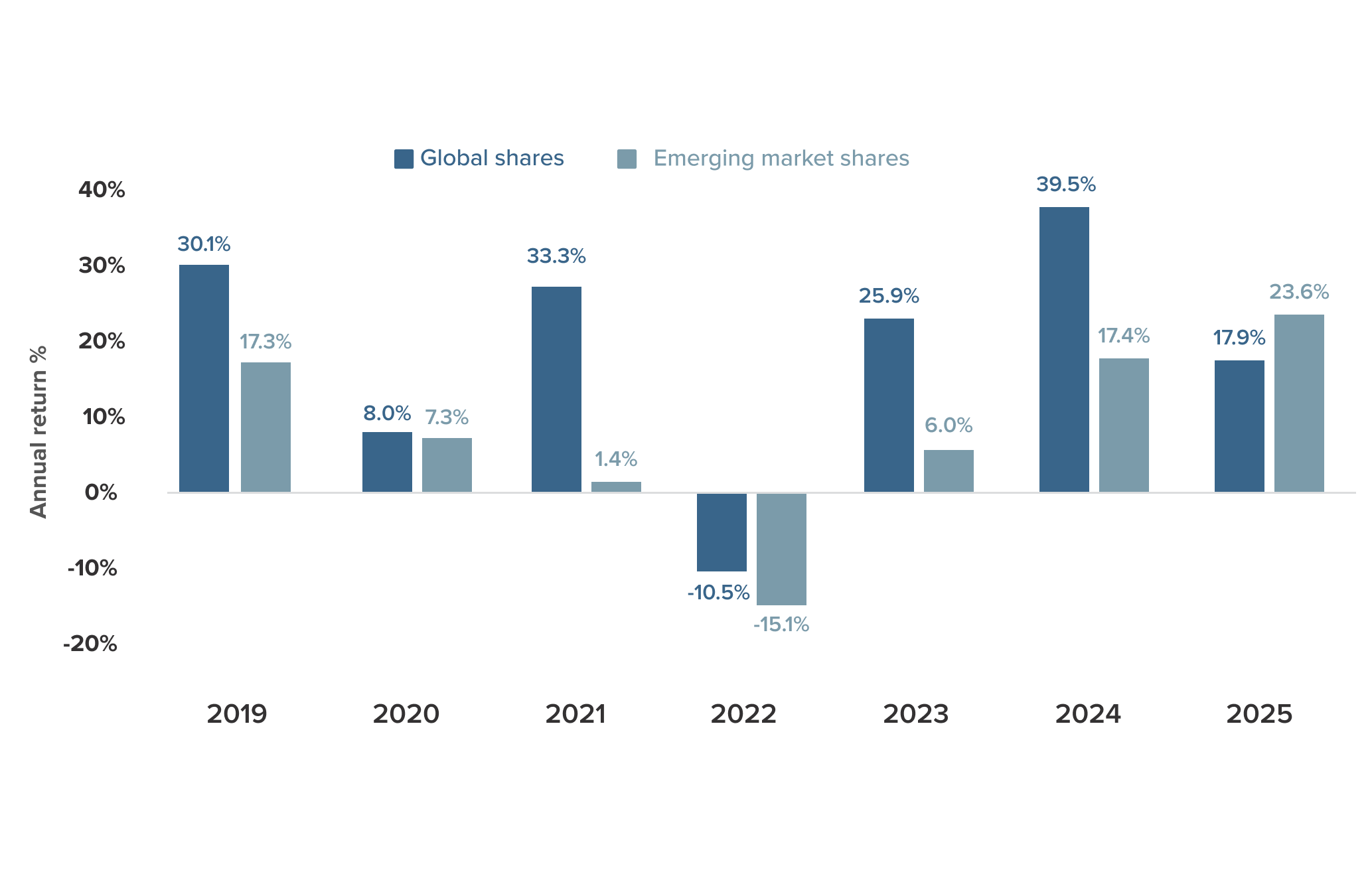

Global sharemarkets

Global sharemarkets delivered solid returns over the year.

U.S. equities again led the way. Performance was driven largely by large technology companies, supported by strong earnings and growing confidence in long term AI adoption. Despite periods of volatility early in the year around tariffs, global large cap equities delivered strong returns.

Smaller companies materially underperformed large caps, highlighting the widening gap between large and small companies.

Emerging markets strengthened in the second half of the year and returned 23.6% over the 12 months. South Korea and China led the recovery. This marked the first sustained period of outperformance versus developed markets since 2017.

One of the dominant drivers across global portfolios was the continued rally in AI and semiconductor related companies. The Magnificent 7 moved back to the front of the market after lagging earlier in the year. Strong earnings delivery and increasing confidence in AI commercialisation drove a re acceleration in returns.

These companies now account for a large share of global equity performance. This concentration also helps explain why many active managers underperformed over the period.

While market concentration has increased, this is not new. Similar periods have occurred before, including the Nifty 50 era of the 1960s and early 1970s. History shows concentration can persist longer than expected, which makes diversification and disciplined rebalancing even more important in super.

Australian shares

The Australian sharemarket delivered an average return of around 10.7% over the year.

Returns were supported by a resilient domestic economy. The labour market remained strong and company earnings held up better than expected, even as interest rate cuts were pushed further out.

Australian shares played a steady role in Stockspot Super portfolios. They provided diversification and income and helped dampen volatility during periods of global market uncertainty.

Bonds

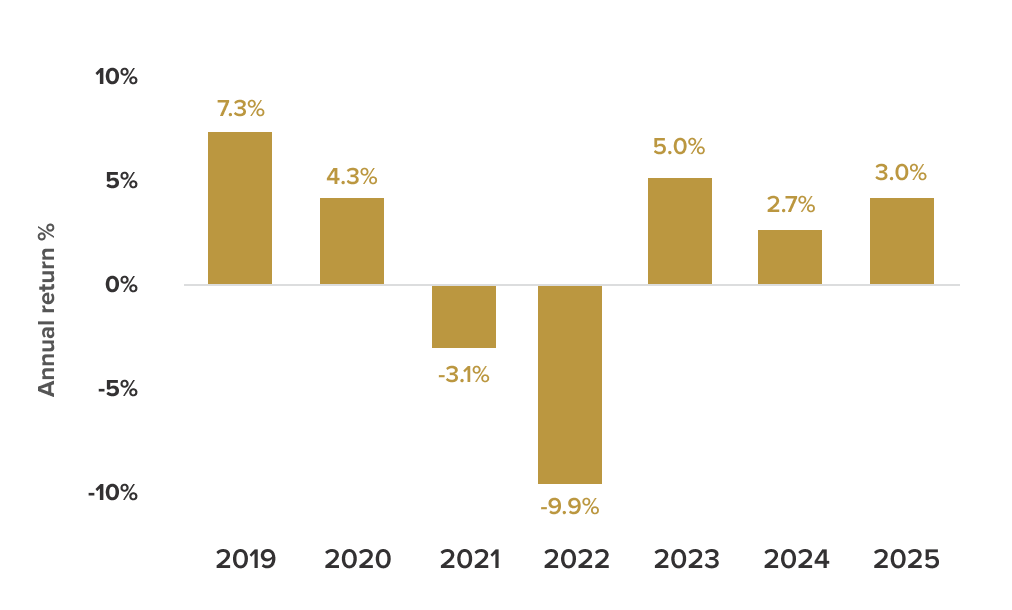

Bonds delivered a positive return of around 3% over the year, despite elevated volatility.

Yields rose early as markets repriced expectations for fewer rate cuts. As economic data softened in the second half of the year, yields declined and bond prices recovered.

Bonds continued to play an important role in super portfolios. During periods of equity market weakness, bond allocations helped cushion volatility and provided balance against sharemarket risk.

Gold and portfolio impact

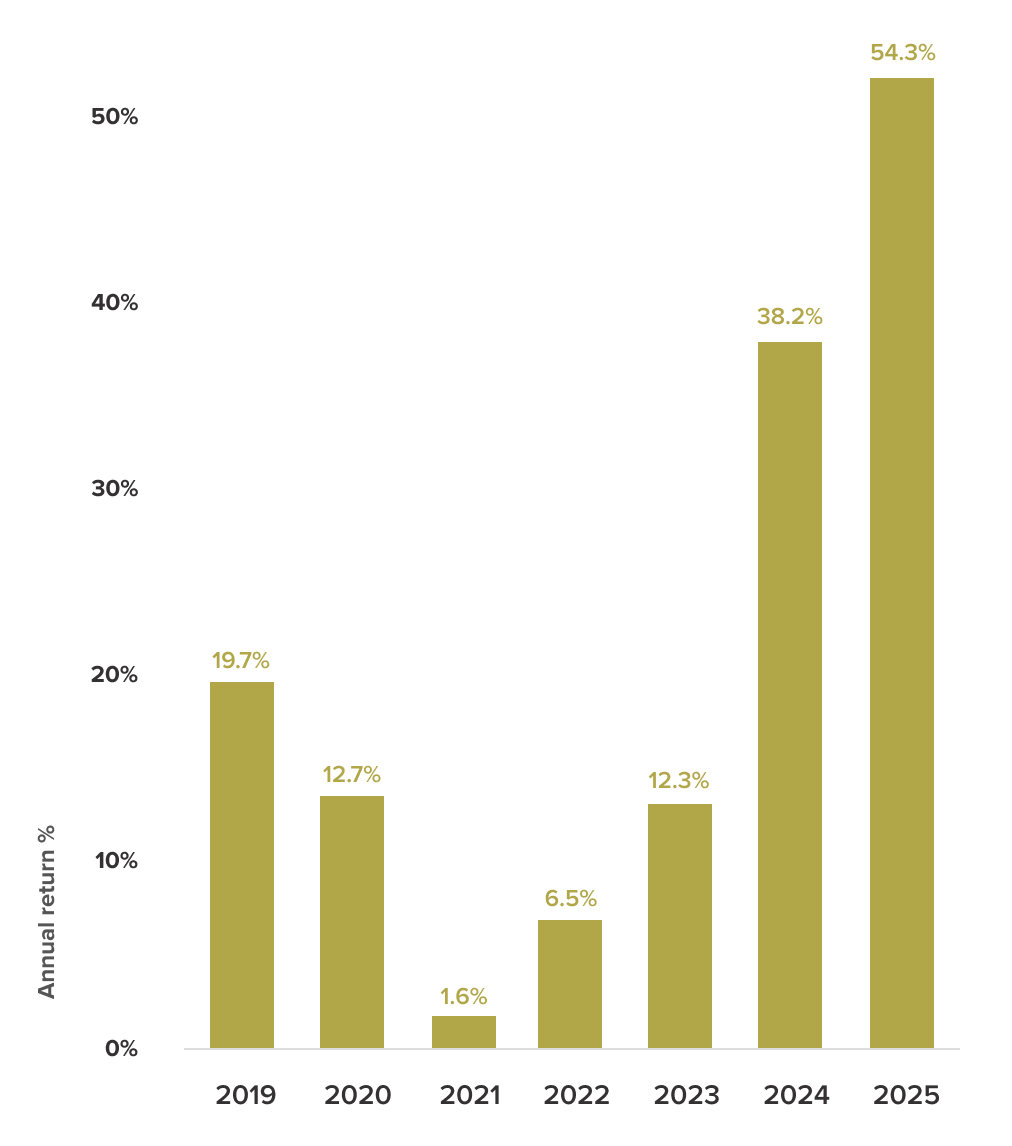

Gold was the standout performer in 2025.

The gold price rose by 54.3% and reached multiple all time highs, peaking near US$4,550 per ounce in December. Performance was driven by persistent geopolitical tensions, renewed trade and tariff risks, a weaker U.S. dollar, record central bank buying and a sharp lift in investor demand.

Stockspot has held a meaningful allocation to gold across our investment portfolios for many years. This positioning flowed through to strong outcomes, particularly in portfolios with higher exposure to defensive and inflation sensitive assets.

Why gold continues to matter in super

Several structural forces continue to support gold’s role in long term retirement portfolios.

Central banks are buying gold at the fastest pace in decades as they diversify away from government bonds and the U.S. dollar. This appears to be a structural shift rather than a short term trade.

Global debt and fiscal deficits remain elevated. High debt levels limit how far interest rates can rise without destabilising economies. This increases the risk that inflation runs above target over time.

Currency debasement has also played a role. 2025 is on track to be the weakest year for the U.S. dollar since 1973. Gold cannot be printed and carries no credit risk, which reinforces its appeal as a long term diversifier.

Traditional asset correlations remain fragile. Shares and bonds have been more correlated than in the past, reducing the effectiveness of a simple 60/40 portfolio. Gold has continued to act as one of the few reliable diversifiers.

These forces suggest gold is likely to remain a strategic asset for super portfolios for many years.

Gold is volatile and returns will not be smooth. Disciplined rebalancing remains critical to capturing its benefits while managing risk.

As 2025 showed once again, retirement outcomes are built through patience, not prediction. Simple, diversified portfolios tend to work best when markets and geopolitics are anything but boring.