While the recent debate about super has centred on tax concessions and fairness, an overlooked story is quietly unfolding.

Thousands of everyday self managed super fund (SMSF) investors have outperformed the country’s largest super funds. And they didn’t need billion-dollar budgets, star stock-pickers or exotic investments to do it.

They simply stuck to low-cost exchange traded funds (ETFs).

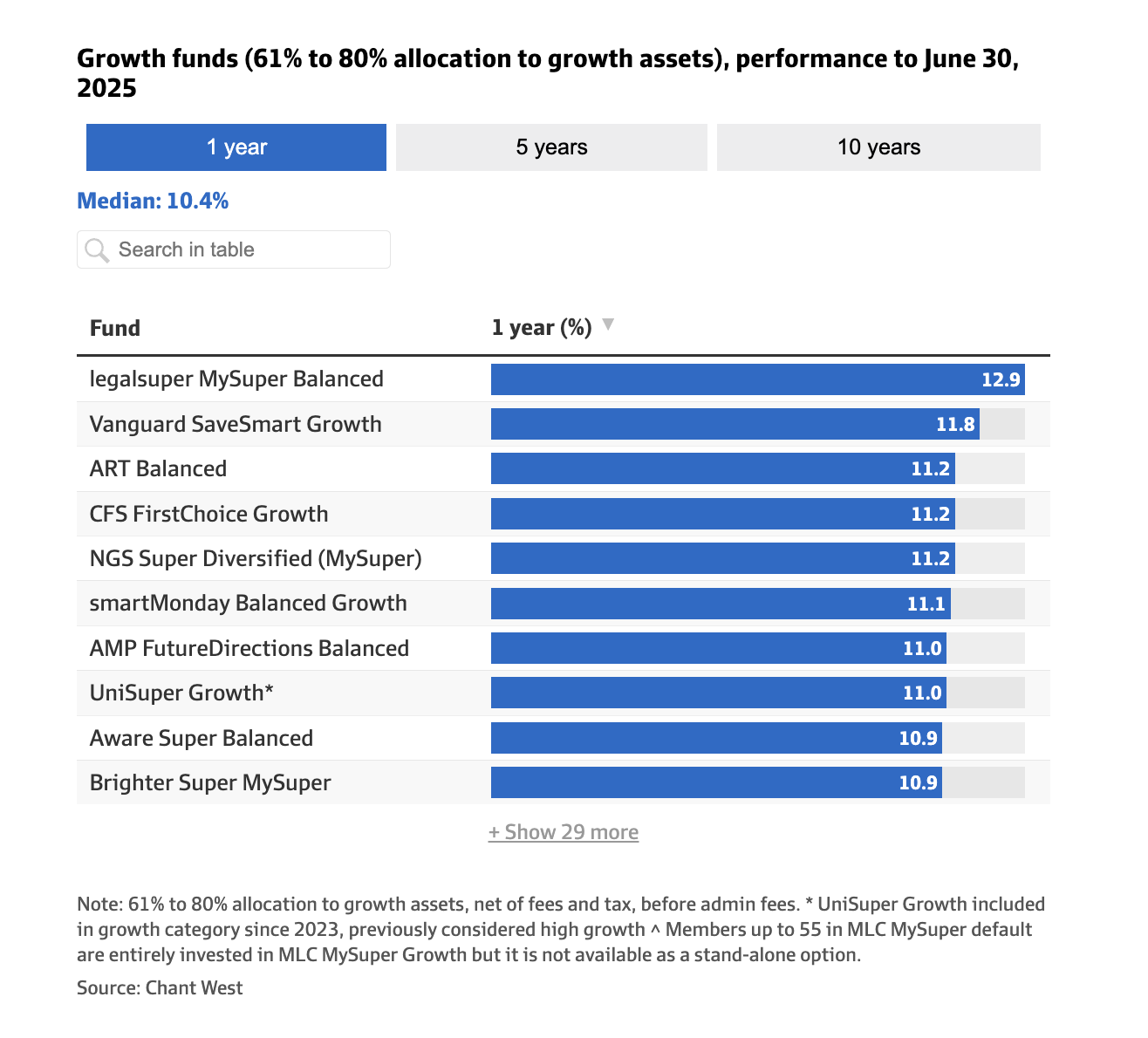

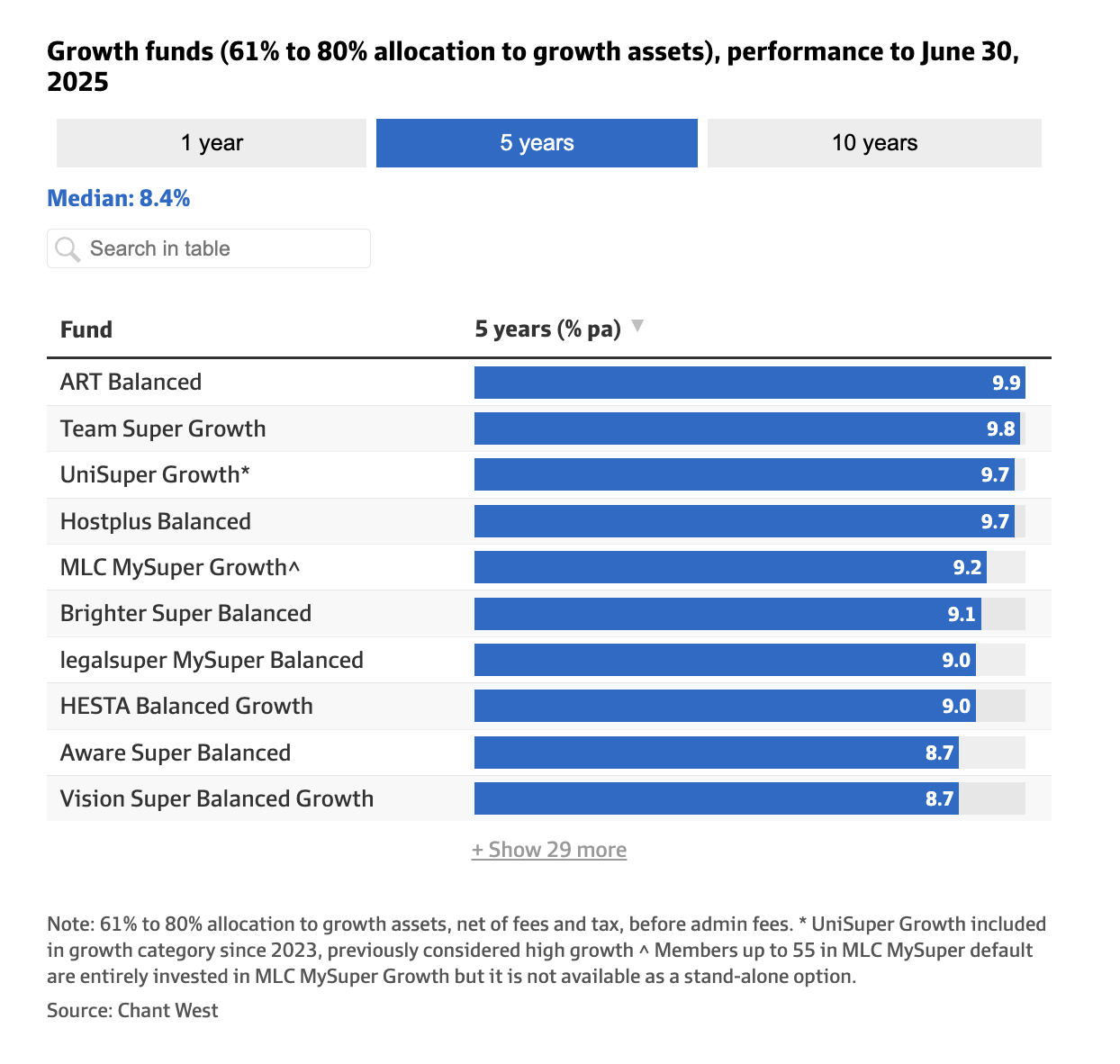

Take the 78% growth / 22% defensive Topaz portfolio we recommend to younger SMSF clients as an example. It holds just five ETFs and delivered returns of 18.2% after fees in FY25- comfortably ahead of the largest super funds’ growth options which returned 10.9% to 12.9%.

The Gold ETF played a starring role in the Stockspot portfolios. It returned 42.5% over the year, and with around 15% exposure it cushioned portfolios from volatility while boosting returns.

Most big super funds have overlooked gold entirely, preferring to chase private debt and venture capital- higher-fee assets that add layers of complexity and liquidity risk.

But the lesson goes deeper than one strong year.

Simplicity beats complexity

Over 5 years, the same five-ETF portfolio has returned 10.9% p.a. Even after factoring in super tax and typical SMSF admin fees, returns remain ahead of most of the big funds’ diversified options over that period which returned 8.7% to 9.9%. The same goes for 10 year returns.

The reason for this is simple. Fewer moving parts mean fewer costs. Straightforward strategies avoid endless trading, layers of management fees and the opaque costs of illiquid private assets. They’re also easier to stick with. When you know exactly what you own (a simple mix of shares, bonds and gold ETFs) you’re less likely to panic during market swings.

During the tariff-driven volatility earlier this year, and even through COVID in 2020, very few Stockspot SMSF clients felt the need to change their strategy.

Big super funds typically take the opposite approach. They build multi-layered portfolios of active managers and private assets. Each layer adds friction. Every “tactical bet” introduces more risk.

In pooled structures, members even inherit hidden capital gains tax from other members’ switching options. And when super funds that claim to predict the future inevitably get it wrong, members lose confidence and become more likely to switch options themselves.

SMSFs investing into ETFs don’t have those problems.

SMSFs leading the ETF revolution

It’s no coincidence SMSFs have been one of the biggest drivers of ETF growth in Australia. Trustees have embraced ETFs as a simple, transparent and cost-effective way to build diversified retirement portfolios without relying on expensive active managers.

ETFs give SMSFs the same access to domestic and global markets as the large super funds – but without hidden fees or unnecessary complexity. In many ways, SMSFs have led the shift towards evidence-based investing in Australia. While big super funds have been slow to adapt, individual trustees have voted with their feet, preferring the control and clarity ETFs provide.

The numbers tell the story. According to the 2025 Vanguard/Investment Trends Self Managed Super Fund Report, new SMSF ETF allocations have surged to a record 12% (up from 9% in 2024). Today, 315,000 SMSFs hold at least one ETF. Among newly established SMSFs, 61% already use ETFs.

At Stockspot we’re seeing that the typical trustee is younger, more engaged and more cost-conscious, with many in their 40s managing balances of $200,000 to $400,000.

Complexity creates an illusion of sophistication

Decades of evidence show that lower-cost, diversified strategies consistently outperform most high-fee portfolios. The latest S&P SPIVA results confirm it – over the fifteen years to the end of 2024, fewer than 15% of active funds managed to beat the market.

Yet complexity persists in large super funds because it creates the illusion of sophistication.

It gives consultants and asset managers something to sell – and something to charge for. It also gives super fund chief investment officers and investment teams a reason to exist. According to the latest APRA data, super funds spent over $12 billion on expenses last year, most of it on internal and outsourced investment management.

But complexity rarely adds value. Every extra hand that touches your super takes a cut. Every opaque structure hides risks that may only surface years later.

A simple, rules-based ETF strategy doesn’t rely on heroic stock bets or predicting which fund manager might outperform next. It keeps you invested in a sensible mix of assets, capturing market returns without unnecessary leakage.

What this says about super

The fact that SMSFs are quietly outperforming the country’s largest funds with much simpler strategies should spark a bigger conversation. Is Australia’s super system really serving members’ best interests, or is it holding onto complexity that costs billions and benefits only a few?

For SMSFs and individual investors, the lesson is clear. Bigger isn’t always better. You don’t need a finance degree or a team of consultants to do well. You just need sensible asset allocation, low-cost ETFs and the discipline to stick with it.

For super funds, the challenge is harder. Can they unwind decades of built-up investment complexity and refocus on what genuinely benefits members’ best interest? Or will they keep playing an expensive game fewer and fewer people believe in?

This article by Chris Brycki was originally published in the Australian Financial Review on July 23 2025: Why SMSFs are quietly winning and what it says about superannuation