It’s the oldest trick in the book. If you don’t like what the market is telling you… just ignore it. That’s exactly what some super funds like AustralianSuper are doing when they claim private assets are “less volatile” than listed ones.

In their unlisted asset brochure, AustralianSuper says:

“The valuations of unlisted assets reflect the revenue and operational conditions of the asset, and therefore they are not as easily affected by day-to-day market sentiment.”

Really? So we’re meant to believe unlisted assets live in a parallel universe, untouched by what buyers and sellers are doing in public markets? That the value of similar listed assets doesn’t matter…

Come on.

These unlisted assets aren’t less volatile.

They’re just less transparently priced.

This has nothing to do with smart portfolio construction. It’s what industry veteran Cliff Asness called volatility laundering. Private equity gets to play make-believe with prices… and pretend things are smoother than they really are.

It’s a bit like a kid closing their eyes and thinking no one can see them. Super funds are doing something similar. They own private assets like direct property, private equity and infrastructure. These assets don’t get priced daily like shares or bonds. So instead of marking them down during market falls, some funds simply… don’t.

And when prices aren’t updated, there’s no visible drawdown. No sharp dips on the chart. No scary red numbers for members. The fund looks like it’s gliding along smoothly… while public markets might be tumbling.

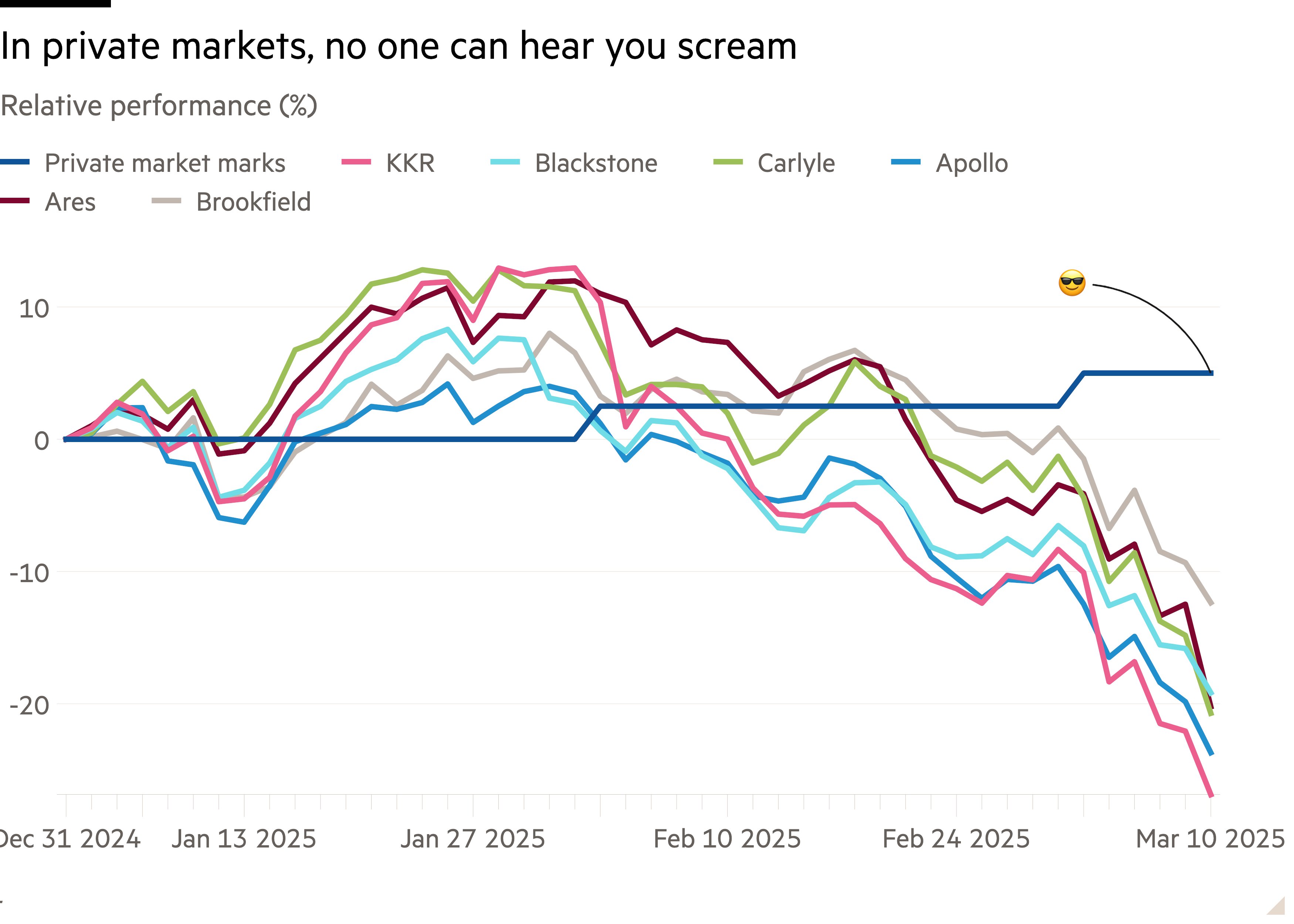

We’ve seen something similar play out recently with the listed private equity players. Their share prices have dropped sharply over February and March 2025… yet their books have been marked as if everything’s just fine.

One reason this illusion holds up is hidden gearing. Super funds often highlight the stability of cash flows from assets like hospitals and infrastructure. But it’s exactly that cash flow consistency that allows them to be highly geared. If cash flows slip, even slightly, the impact on the small slice of equity can be massive. This leverage is often hidden from view – and almost always buried under commercial-in-confidence terms. Many of these super funds also provide the debt that finances these same unlisted assets. You won’t hear about the terms of that debt until it hits the headlines for breaching covenants!

Illiquidity adds another layer of risk. Industry funds like HostPlus often argue that their members are long-term investors who don’t need daily liquidity. They also assume members won’t want to switch funds or withdraw. But try selling a private equity stake and you’ll hit hurdles fast. These assets often require other investors’ approval before they can be sold. There are also first-right-of-refusal clauses and other restrictions that make them hard to exit. The more conditions there are to sell, the less that equity or debt is really worth. Again, none of this is disclosed because it’s considered commercial-in-confidence.

Listed companies are legally required to disclose these risks. There are no such rules for unlisted assets in super.

Mark your own homework, get an A+

The ability for some funds to control when and how private assets are valued is a structural problem within Australia’s super system I’ve highlighted before.

Many members assume the daily price of their super reflects the real-time value of their investments. That’s simply not true when private assets are involved.

These assets are usually only revalued a few times a year. Often by valuers chosen and paid by the fund. And sometimes, the fund trustee even has the power to reject valuations they don’t like.

Imagine marking your own exam and then boasting about being top of the class. It would be a joke. Except that this what’s happening in super and $500 billion dollars in retirement savings are affected.

Take AustralianSuper’s investment in Pluralsight. What was it actually valued at on their books before they wrote it down by $1.1 billion? Or Australian Retirement Trust’s office towers before they were cut by 15%? We’ll never know.

This lack of transparency creates a massive problem. Members might be entering or exiting the fund each day based on unit prices that don’t reflect reality. The result is intergenerational inequity. Some members benefit. Others get short-changed. It also allows funds to game the annual ratings process.

The super regulator, APRA, knows this is a major risk. They recently warned that many funds have serious weaknesses when it comes to how they value unlisted assets. These include poor board oversight, weak conflict of interest controls, infrequent revaluations, and questionable fair value reporting.

“In relation to unlisted asset valuation governance, particular weaknesses were observed in the areas of board oversight and conflict of interest management, revaluation frequency and triggers, valuation control, and fair value reporting.” APRA, 17 December 2024

When opacity is a feature, not a bug

Why would anyone want this kind of smoothed performance?

The answer is as much behavioural as it is financial.

Some investors don’t want to see real volatility. If they did, they might panic and sell. That’s the story some private equity investors tell themselves. They say they’re sticking with it for the long haul. But in reality, they just don’t have to face the music every day like they would with public equities.

There’s nothing inherently wrong with that. People aren’t robots. We all look for ways to reduce regret and avoid painful decisions. But let’s not pretend this is some kind of investment superpower.

If your investment only looks less risky because you’ve chosen not to check the price… that doesn’t mean it is less risky. It just means you’ve chosen to ignore the truth.

Funds like AustralianSuper are doing their members a disservice by claiming unlisted assets are more stable and less volatile.

The real cost of hiding from reality

Here’s the kicker. Investors may actually be paying more for the illusion of safety. Private assets often come with higher fees, less liquidity and more complexity. The hope is that they’ll deliver higher returns to make up for it.

But what if the opposite is true?

What if, instead of an illiquidity premium, there’s an illiquidity discount? What if people are actually accepting lower expected returns just so they can hide from daily volatility? It sounds upside-down. But it’s not hard to imagine. Especially when many of these assets are essentially just levered small-cap equities in disguise.

If investors were honest with themselves, they might realise they’re paying for the privilege of not being told the truth.

What needs to change

I’m not saying private assets should be banned from super portfolios. They can have a place in portfolios. But their pricing needs to be brought into the light.

Funds should be required to disclose what private assets they own, their current valuation, how often they’re valued, who values them and what methodology is used. We need to end the practice of trustees marking their own books without transparency or oversight.

This matters for the $500 billion in unlisted assets held in super.

Because in a compulsory super system, members deserve honesty. Not fantasy returns built on the shaky foundation of infrequent revaluations and opaque processes.

At Stockspot, we believe in real diversification within our investment and super portfolios. Not the kind that comes from sweeping volatility under the rug. True diversification means being exposed to assets that perform differently… not ones that just get valued when it’s convenient.

It’s time for the industry to stop pretending private assets are magically safer. They’re not. And claiming they are is doing a disservice to every Australian saving for retirement.