For over a decade, Stockspot has been leading the fight for better superannuation in Australia – calling out high fees, hidden investments, and underperforming funds.

In 2013, we launched the first Fat Cat Fund Report, exposing how Australians were losing billions of dollars in unnecessary super fees.

Since then, we’ve continued to push for reform, making submissions to the Productivity Commission and the Royal Commission into Misconduct in the Banking Industry.

The impact has been significant:

- Many of the worst-performing Fat Cat Funds have shut down or been forced to merge after failing APRA’s performance test.

- Funds that once threatened to sue us for our Fat Cat Fund research later collapsed or merged after their high fees and poor performance were exposed.

Yet, the fundamental problems remain.

Australians still hand over $32 billion in super fees each year—money that should be compounding toward a better retirement. If super funds focused on cost-efficient investments and stopped wasting money on stadium sponsorships and sports teams, Australians would be $240 billion better off by 2035.

When I started Stockspot in 2014, I knew I wanted to launch a better super product – one that truly put members first. But setting up in the super industry isn’t easy. Regulatory roadblocks, entrenched industry resistance, and outdated investment models have kept many new entrants out.

We never gave up on the idea.

Now, after years of research and advocacy, we’ve built the super product we wish had existed all along.

Introducing Stockspot Super – the smarter way to invest your retirement savings.

Why Stockspot Super is Different

After a decade of analysing the super industry, we’ve identified five key areas where change is urgently needed:

- Lower fees & greater transparency through ETFs – so more of your money stays invested.

- Evidence-based, index investing – because 80% of fund managers fail to beat the market after fees.

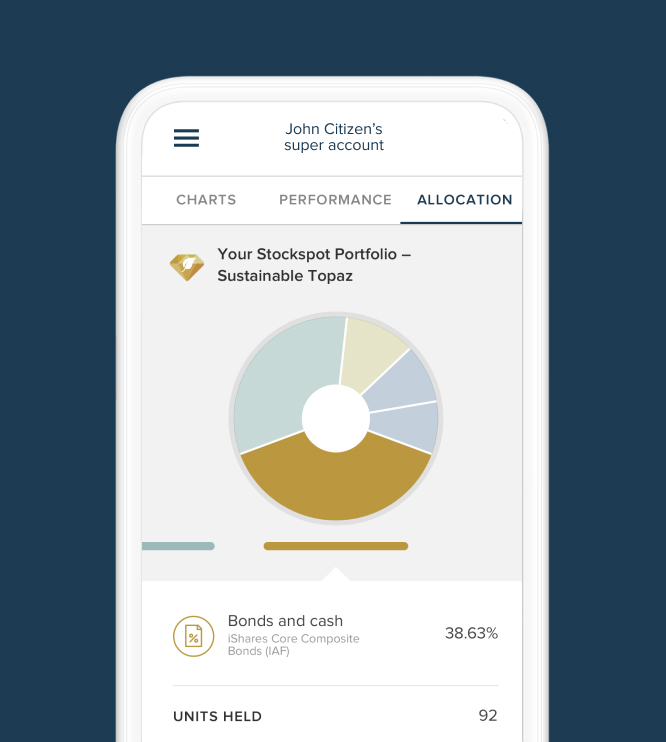

- Daily pricing & full investment visibility – so you always know where your money is.

- A strategic allocation to gold – to hedge against inflation and market volatility.

- Age-based portfolio management – ensuring a smooth transition to retirement without costly financial advice.

These five pillars of Stockspot Super are designed to fix what’s broken in super and give Australians a modern, data-driven alternative to traditional funds.

1. Lower Fees & Greater Transparency Through ETFs

ETFs have grown to $250 billion in Australia, yet most super funds still invest in high-fee, unlisted assets that lack daily pricing and transparency.

Unlike many super funds that hold private equity, property, and infrastructure assets with stale valuations, Stockspot Super invests exclusively in ETFs – so you always know exactly what you own, how it’s performing, and how much you’re paying.

If super funds focused on cost-efficient investments, Australians would be $240 billion better off by 2035.

Why this matters: Every dollar saved in fees is a dollar that continues to compound for your future

2. Evidence-Based Index Investing: why the data proves it wins

For over 20 years, research from S&P SPIVA has shown that more than 80% of active fund managers fail to beat the market after fees.

- In the past five years, 98% of global fund managers have underperformed a simple global share market ETF.

- Despite this overwhelming evidence, most super funds still rely on high-cost active management.

Stockspot Super follows the data, investing exclusively in ETFs to deliver better returns with lower fees.

3. Daily Pricing & Full Investment Transparency

Many traditional super funds value private assets only quarterly or annually, leading to unfair price distortions that benefit some members at the expense of others.

- With ETFs, pricing happens daily, ensuring that your contributions and withdrawals always occur at a fair market price.

- Unlike most funds that only disclose holdings once a year, Stockspot Super provides full transparency—so you always know where your money is invested.

No more hidden investments. No more stale valuations. Just full transparency.

4. A Strategic Allocation to Gold: the missing piece in most super funds

Gold has been a proven hedge against inflation and economic downturns, yet most Australian super funds have little to no exposure to gold.

Research from Bank of America shows that 71% of investors hold 1% or less of their portfolio in gold, leaving many superannuation portfolios overexposed to property, ASX50 shares, and cash.

Stockspot Super is the first Australian super fund to allocate a meaningful percentage to gold, providing protection against inflation and market volatility.

If your super fund lacks gold exposure, it’s time to ask why.

5. Age-Based Portfolio Management: A smarter way to transition to retirement

Unlike most super funds, Stockspot Super builds on the benefits of ETFs by managing portfolios based on age.

Traditional super funds often require members to manually switch investment options as they approach retirement, leading to poor timing decisions or costly financial advice fees.

Stockspot Super automatically adjusts investment allocations based on age, ensuring that members gradually transition to a more stable portfolio without unnecessary complexity or costs.

Super should adjust to your needs – not force you to make costly decisions.

Stockspot Super: built for those who expect better

Australians deserve better than the current super system. Stockspot Super is designed to put members first – through low-cost, transparent investing and expert support.

If your current super fund is charging high fees, failing to disclose where your money is going, or relying on outdated investment strategies, now could be the time to make the switch.