Meet Mariam Mohammed

Hi, I am Mariam. I’m originally from Pakistan and now live in Sydney. I run MoneyGirl alongside my co-founder, Mellisa Ma.

MoneyGirl, co-founded in 2019, is a social enterprise that delivers financial education for young women across Australia. MoneyGirl aims to give women the confidence, financial literacy, and skills they need to take control of their finances and their lives.

We saw the need for targeted and accessible financial education for women. This helps them when embarking on their careers, by equipping women with the money skills they need before they end up in crisis or retire in poverty.

Why I decided to trust Stockspot with my investment portfolio

I decided to invest with Stockspot to take care of my retirement. I’m a set-and-forget investor.

When looking for where to invest, I needed an easy-to-use platform that would take my money and do all the hard work on my behalf, at a competitive cost.

Before that, I had determined what my risk profile is, what I did and did not want to put my money towards.

Then I did a comparison of the options available to me at the time. I was happy with Stockspot’s ethical investing offering, its rate of return, cost of investing, and the supplementary education that came alongside it.

Plus, I always like to read Chris Brycki’s [Founder and CEO of Stockspot] market update email every time something big happens in the world!

“I decided to invest with Stockspot to take care of my retirement. I’m a set-and-forget investor.

The Stockspot sign up process was easy as 1-2-3

I found the Stockspot sign up process to be as easy as 1-2-3. You can do it while you’re surfing the net before bed.

It was a simple and stress-free process. Exactly how I want it to be. It was easy to sign up.

I put an initial lump sum in, chose my portfolio and voila! I was done!

From then on, I’d set up an auto-debit from my bank account every month to top up my Stockspot account regularly.

Achieving my investment goals

These days, I’m doing lump sum deposits whenever I have an influx of cash because my income is sporadic – which is the case for everyone who doesn’t work a traditional 9-5 job.

I log in once every few months to see how things are going. But I don’t fuss too much over it.

I’m happy with my investing journey so far but mine is a long-term investment goal – so I’m still working on it!

What I like about Stockspot

There are a few things I like about Stockspot.

I like the ease and simplicity of the whole process.

I like that I, as the investor, can set and forget by making automatic deposits.

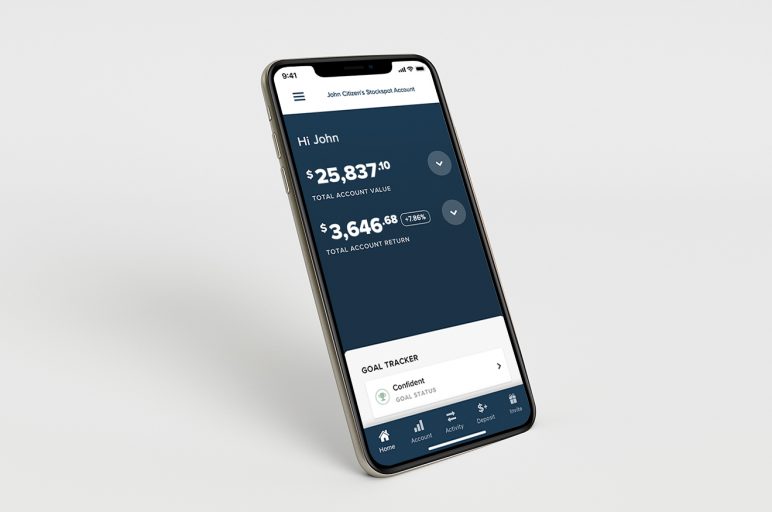

I also like the app! It is clean, beautiful, easy, and useful – a good app is a huge win for me!

My money tips for people considering investing

My advice for people considering investing is that the highest interest you can earn on an Aussie savings account right now is still lower than the inflation rate.

That means you’re losing money!

So, only keep the money you need in cash in a savings account.

Find an appropriate investment tool for the rest, taking your personal circumstances, goals, and risk appetite into account.

A final word about investing

The best time to start saving and investing was yesterday. The next best time is today. The important thing is to start!

Also, don’t bury your head in the sand. Track your expenses.

Finally, set up a money system to deposit funds into your investment account. Then automate it. Don’t rely on your willpower to make things happen.