Managing your spending is getting easier with a range of budgeting apps now available in Australia. Some of the big banks have also started to introduce in-app budgeting tools for their customers.

Each app has different pros and cons so the best budgeting app is the one that best suits your specific needs.

With that in mind we’ve road tested a few of the more well known ones to help you find the right app for your needs.

Pocketbook

Pocketbook allows you to automatically connect multiple Australian bank accounts and set a custom spending limit based on your regular income, expenses and desired savings amount (they call this ‘Safely spend’).

You can also track upcoming bills, view combined account balances and set budgets by different categories (i.e. envelope budgeting method).

The app automatically brings in new transactions and learns to categorise them based on description. Note: this can sometimes be inaccurate and require manual categorisation (due to changing transaction descriptions).

Of the apps best suited for in-depth budgeting, Pocketbook has the cleanest interface (provided your bank is supported).

- Best suited for: Detailed budgeting

- Strengths: Automated bank integration, high level overview of spending, budgeting by category

- Weaknesses: Not all banks are supported, requires manual categorisation to remain accurate

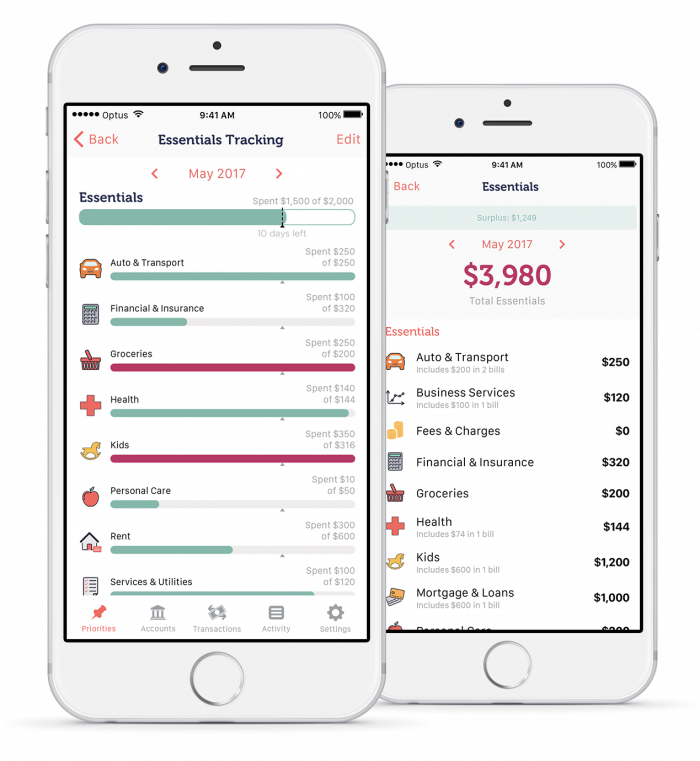

MoneyBrilliant

MoneyBrilliant is packed with features including budgeting, bill tracking, bank account optimisation, savings goals, tax deductions, insurance tracking and retirement planning.

If you are someone who loves apps packed with features then you are going to love MoneyBrilliant. It will allow you to connect a huge range of accounts including savings, credit cards and super.

Overall it’s great that you can add all sorts of different accounts and use different features but it felt like the core value proposition of budgeting was confusing.

- Best suited for: Detailed budgeting

- Strengths: Packed with features, automated integration for lots of different accounts, high level overview of spending

- Weaknesses: Confusing UI, need to pay to upgraded version to access all features, requires manual categorisation to remain accurate

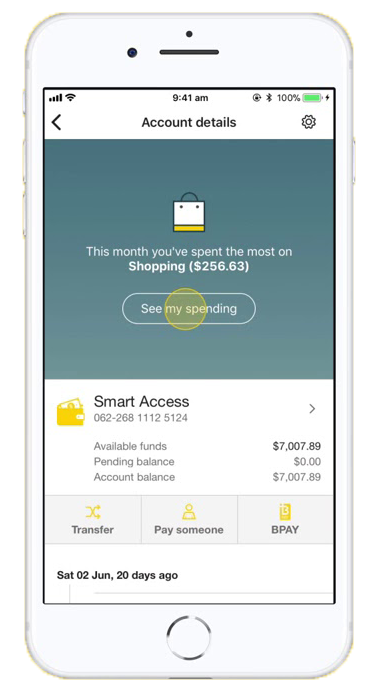

CommBank

The Commbank app has built in budgeting features (requires being a customer). The key value proposition is a simple overview of how much you’re spending month on month.

Other banks may have their own version although we did not have access to these.

The key advantage of using bank based budgeting tools is that your transactions are automatically in app. Third party budgeting apps have to pull transactions in making the process slightly more complex.

The downside to built-in budgeting tools is that if you spend on other bank accounts the transactions can’t be added (making the monthly spend amount inaccurate). You’ll also need to categorise unknown transactions like the other apps as well.

If you’re looking for a low maintenance spend tracker without all the bells and whistles, see if your bank app has these features available.

- Best suited for: High level budgeting (if you only use Commbank and don’t have other bank accounts or credit cards)

- Strengths: Simple overview of monthly spending

- Weaknesses: Unable to add transactions from other banks/accounts, no custom categories, requires manual categorisation to remain accurate

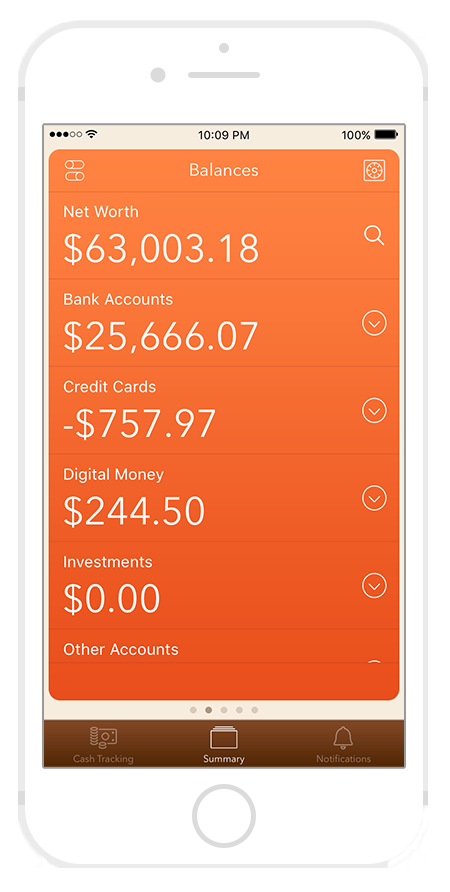

Moneytree

Moneytree was founded in Japan in 2012. Since then it has expanded into Australia supporting a large range of institutions here including savings, super, brokerage, toll and reward accounts (also has capacity to add assets manually).

As such as it serves as a great way to track overall net worth. It also allows users to track cash transactions and work expenses (on a paid plan). It doesn’t seem to have a strong focus on budgeting and expense tracking like the other apps mentioned in the article.

It shows spending in various time periods broken down by category although I found it difficult to visualise where I was actually spending.

- Best suited for: Tracking net worth and cash transactions

- Strengths: Link various accounts including brokerage, tolls, super and reward cards

- Weaknesses: Only has basic spending overview, paid version to access all features

Conclusion

Each of the apps reviewed have different pros and cons. To take best advantage of budgeting apps really requires being able to link multiple accounts, otherwise these apps have very little value.

They will all require a small amount of up-keep to keep your tracking accurate. This is due to new transactions being categorised incorrectly (though they’re pretty good most of the time).

If your savings goal is a few years away, it might be a good idea to think about whether it’s better to leave your money in the bank or consider other options like investing which can boost your savings even further.