We have seen some large moves in Australian and global share markets over past few months, particularly August which has been the most negative month since 2011. So what has caused this period of weak performance and what should you do about it?

What’s caused the market fall?

Global share markets just had their worst month since 2011. The Australian share market is now down over 8% during August and some emerging markets have fared worse with falls of over 10%. There have been 3 main factors driving the recent market worries:

1. Concerns that China’s economy is slowing down faster than expected

The Chinese central bank’s (PBOC) surprise decision to devalue their currency against the US dollar has led to sharp moves in global share markets. The 3% devaluation over 11-12th August was the largest single move since 1994. Stock and commodity markets have fallen in response, as some fear that China has begun a wider currency devaluation to make their goods cheaper in global markets.

Countries like Kazakhstan and Vietnam responded quickly by devaluing their own currencies to protect trade and many other emerging market currencies have been dropping fast. South Africa’s rand fell to its lowest level against the US dollar since 2011 and the Colombian peso fell to a record low this week.

If China really is trying to drive down its currency to gain trade advantage, the market is concerned that this could cause a deflationary shock around the world that would be hardest felt by its emerging market and commodity-based trading partners. This fear spilled over to developed market shares last week with US and European shares seeing heavy falls.

2. A collapsing oil price

Last week oil prices dropped below US$40 for the first time since 2009. A year ago a barrel of oil was about US$100. Oil is the lifeblood of economic growth for many developing countries, which are also seeing their currencies lose value because of their economic exposure to China’s currency move. This oil price is compounding the problems for emerging markets.

3. US rate hike uncertainty

Investors had been preparing for the U.S. Federal Reserve to raise its benchmark interest rate in September. However the Greek crisis and Chinese slowdown along with slower global growth may cause the Fed to delay its first rate rise since 2006. This uncertainty has led to investors returning to bonds and gold as safe-haven assets that would benefit from delayed interest rate hikes.

How have the portfolios performed?

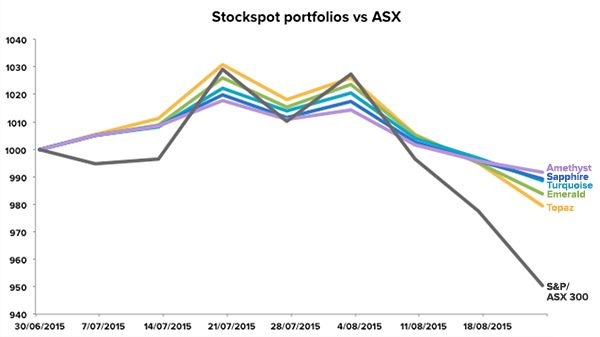

The Stockspot portfolios now look like they could have their first negative quarter since we launched 2014, dragged down largely by Australian and emerging markets shares.

Since the start of this quarter, the portfolios are down between -0.92% and -2.24%. As you would expect, our highest risk portfolio (Topaz) has seen the largest fall while the most conservative portfolio (Amethyst) has been less exposed.

This is exactly what you would expect in a down market since the less-risky portfolios own more bonds which are defensive assets and have risen as share markets have weakened.

All of the Stockspot portfolios have beaten the S&P/ASX 300 index (-5.11%) during the quarter.

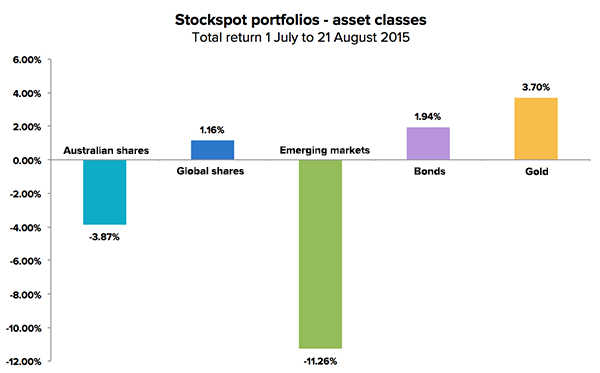

How has asset allocation and diversification reduced losses?

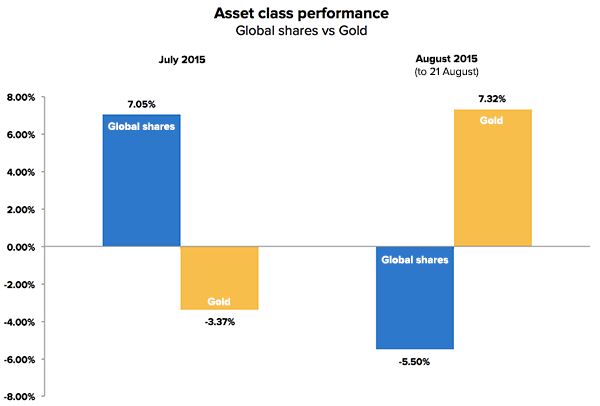

The Stockspot portfolios have benefited from their investments in bonds and gold which are up for the month and have helped to reduce the impact of share market falls.

Recently we wrote an article about how gold helps your portfolio and this has certainly been apparent in August with the metal up 7.3%. Gold tends to move in the opposite direction of global shares and this helps reduce the risk of our portfolios when share markets fall.

What you should do about it?

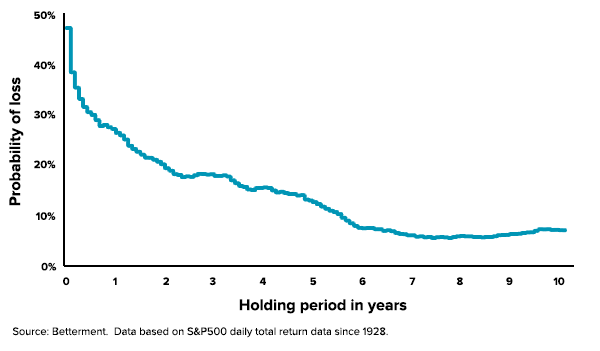

When there are big moves in the markets, people typically want to sell everything in an attempt to “limit” the loss. If you’re feeling this response now, it’s probably because you are extrapolating the past few weeks of market falls forward into the indefinite future.

However no one can predict where the market is going to be in a few weeks or months. Selling to limit your losses is just one way of trying to time the market and when individual investors try to time the market they are much more likely to buy and sell at the worst times.

Nobel Economics Prize-winner Daniel Kahneman in his 2011 book Thinking Fast and Slow, showed that over the past 30 years the average individual share market investor in the US earned an average annual return of just 3.7% compared to the S&P 500’s 11.1% annual return.

That’s a huge amount of performance lost because the majority of investors buy when everyones optimistic and sell when markets are down.

Positive steps

As discussed in our blog ‘Making the most of market dips’, there are some positive actions you can take when markets fall to help your long-term performance. These include;

1. Keep investing. If you are investing regularly, as many of our clients do, you can take advantage of the market’s dip through dollar-cost averaging, or regular deposits. Automating your investment deposits is the best way to stick to your long-term investment plan and ensure that you avoid the temptation to buy and sell at the wrong times.

2. Take a break from monitoring. If you have a tendency to get nervous when your investments go up and down, consider monitoring your portfolios less frequently. This helps prevent your short-term emotions from overpowering the long-term game plan.

3. Don’t forget dividends. Even though the value of your portfolio might decline over the short-term, it’s likely that you’re still earning returns through dividends and distributions. When markets fall, dividends and distributions can be reinvested at a lower price, helping you benefit even more when markets do recover.

The long-term trend

When markets are falling, the key is not to fight your emotional reactions, but channel them into positive strategies and actions that will improve your long-term returns.

-

Regular deposits ensure that you invest at different parts of the market cycle, so can take advantage of lower prices when markets fall.

-

Stockspot’s automated rebalancing will help you buy low and sell high when investments move far from their target portfolio weights.

Despite a rocky few months, all of our investments have still generated positive returns since Stockspot launched in April 2014 with global shares the best performer at +16.99% even including the recent market fall. This shows that it’s time in the market rather than timing the market that drives investment success. The longer you invest, the better your chance of a positive return.

Of course that’s easy to say and the real trick is sticking to the plan even during periods of market turmoil when it may be tempting to change course or stop investing altogether.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Past performance of financial products is no assurance of future performance. Actual performance of your portfolio may vary from our published returns due to the timing of investments, rebalancing and your fee tier. The Stockspot indices have been published since July 2013 and open for investment since May 2014.