What is Smart beta investing?

Smart beta – also known as strategic beta, alternative beta, fundamental beta, advanced beta, and enhanced beta – aims to combine elements of passive index investing and active fund management to deliver the best of both worlds: transparency, broad diversification, and market-beating returns – all at low cost.

Instead of picking stocks by how big they are in size (i.e. market capitalization), smart beta uses a quantitative rules based approach to pick stocks based on other factors such as smaller size, high dividend yield, high quality or low volatility.

Smart beta ETFs can seem attractive because of their historic higher returns, but these are volatile investments, meaning investors could be unprepared for a bumpy performance ride. Factor investing is a type of smart beta and refers to grouping investments based on a trait or characteristic. It’s risen in popularity in recent times, but has also confused investors. We discuss factor investing in a separate article.

On this page, we look at smart beta ETFs listed in Australia – what they are, how they are built and how they’ve performed.

A refresher on index investing

To properly understand smart beta ETFs, it’s important to understand the role indices and indexing play.

The first share market indices were designed to measure the broad market and serve as a point of comparison for ‘active’ (stock picking) fund managers. They typically weighted stocks by size – the stocks with the biggest market value made up a larger portion of the index.

Examples of size-weighted indices include popular ones you’ve probably heard of like the S&P 500 (started in 1957) or S&P/ASX 200 (started in 2000).

When John Bogle, founder of Vanguard, launched the first index fund in 1975, it was intended as a sensible, low-cost way for individuals to invest into these indices. The Vanguard 500 Index was not intended to beat the market, but simply ensure investors kept up with the stocks in it.

Over 50 years, Vanguard has grown into the largest mutual fund manager in the world with over US$7 trillion under management and index investing has become so popular that an entire industry has emerged on the back of it.

Smart beta and indexing

All index funds, by definition, are passive investments. This includes smart beta. There’s no fund manager making trading decisions and all buying and selling is done according to a strict set of rules.

However, smart beta indices aim to fix some of the perceived shortcomings of weighting investments by market size when building an index. One example is that during a bubble, some shares can make up a larger and larger share of the index, like technology stocks did during the ‘tech boom’ in the late 1990s, or mining stocks when commodity prices rocketed in 2006-2011. This can cause traditional size-weighted indices to ‘overshoot’ during booms and busts.

To address this and other similar observations about size-weighted indices, new ways of constructing indices have emerged – with weights determined by different approaches such as dividends, research ratings, simple averages, or consistency of cash flows. This is what’s meant by smart beta.

Common smart beta strategies

Some common smart beta approaches to building indices include:

- High dividend strategies that pick stocks with higher dividend yields to boost investor income.

e.g. Vanguard Australian Shares High Yield ETF (VHY) - Other fundamental indices that focus on measures like sales revenue or free cash flow as a more accurate measure of economic contribution rather than using market capitalisation.

e.g. BetaShares FTSE RAFI Australia 200 ETF (QOZ) - Equal weighting – the simplest form of index construction that just averages an entire universe of stocks, thus giving each stock the same importance.

e.g. VanEck Vectors Australian Equal Weight ETF (MVW) - Low volatility strategies which target a smoother ride by carefully selecting less risky stocks.

e.g. iShares Edge MSCI Australia Minimum Volatility ETF (MVOL) - Quality – choosing stocks that exhibit high quality metric scores such as a strong balance sheet, low debt or high returns on equity

E.g. VanEck Vectors MSCI World Ex-Australia Quality ETF (QUAL)

While some of these funds may advertise a new way of thinking about investing, their basic premise is to use a rules-based approach to prioritise exposure to certain market factors.

These factors include style (growth and value), size (large, mid, small), or momentum (consistency). The challenge for investors is in deciding which factors to want exposure to (if any).

Smart beta bets on market factors

All smart beta ETFs take a bet on certain market factors being more important than others:

- Low volatility and high dividend stocks tend to have a bias towards value stocks that have lower growth and more stable earnings since they tend to be less volatile than companies with less predictable profits like mining businesses or biotechnology. However, when investors crowd into low-volatility or high dividend stocks, it can push valuations in some sectors (e.g. telecommunications, utilities, and property) to the point they actually become more risky. This can, perhaps counterintuitively, make low volatility or high dividend strategies dangerous after a period of good returns.

- Fundamental indices may use operating cash flow as a better indication of economic size. Analysis shows these approaches have a strong value stock bias as well.

- An equal weighting methodology introduces a significant bias towards small companies because the stocks that have a lower market size have the same weight in the index as bigger businesses like Commonwealth Bank (CBA). The portfolio will likely also have a value bias because equal weighting will expand the weight of value stocks, which tend to trade at lower price compared to their profit.

Shortcomings of smart beta

How smart is it really?

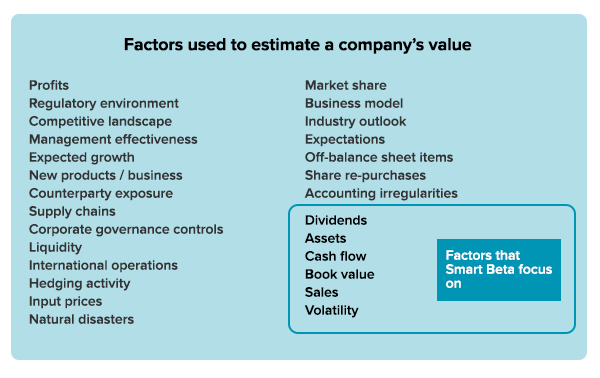

By offering enhanced exposure to some factors, like value and size, smart beta strategies must also be de-prioritising other factors. Because current price reflects every factor used by any investor to estimate a company’s value, a market-size-weighted index also represents an all-factor approach to investing.

On the other hand, smart-beta is essentially taking a bet that a few select factors are more important than an all factor (market value) approach.

Source: Vanguard

Backtesting can give false confidence

Smart beta strategies are often marketed as being able to ‘beat the market’. However the truth is often a lot more murky. Many have only outperformed from backtesting over a select, historical time period which introduces a few significant issues.

Think of an index like a deck of cards. Backtesting lets you shuffle a deck of cards thousands of times until a favourable “shuffle” emerges to match the order you want to show.

In essence, backtesting lets the smart beta strategies and ETFs ‘stack a deck’ of stocks in a way that outperformed the index in the past. But there’s no guarantee that the same strategy will work going forward. As a result, many smart beta strategies could have simply worked in the past by chance.

Let’s say you rebuilt S&P/ASX 200 but weighted the companies according to the birthday of their CEOs and found that this new index outperformed a size weighted index by 20% over 15 years.

This would not be because January-born CEOs are better at managing businesses than December ones. This would just be an example of how you can use a random set of data to prove any hypothesis when backtesting.

What about risk?

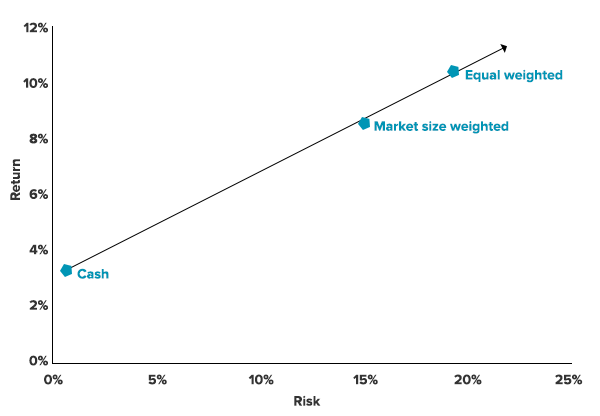

Some smart beta strategies have been able to outperform over the long-term, but the differences in return can usually be explained simply by risk. For example, equal-weight indices of stocks can tend to outperform market-size weighted indices over the long-term.

However this can be explained entirely due to equal weight taking more risk (due to having more small stocks). On a risk versus return basis, you’re no better off owning the equal weight index even though it generated higher returns. Also, there are sometimes lower-cost ways to get the same factor exposure (small companies) and return profile.

Sources: CRSP US Stock and Index Database, S&P Dow Jones Indexes, Federal Reserve

Smart beta follows in-vogue style trends

It’s no coincidence that many of the smart beta funds launched over the past couple of years in Australia have been focused on things like quality, value and sustainability. Back in the early 2010’s it was dividend focused ETFs as they had a great run of performance. ETF issuers know that it’s much easier selling strategies that have done well recently than those that haven’t since people tend to chase returns.

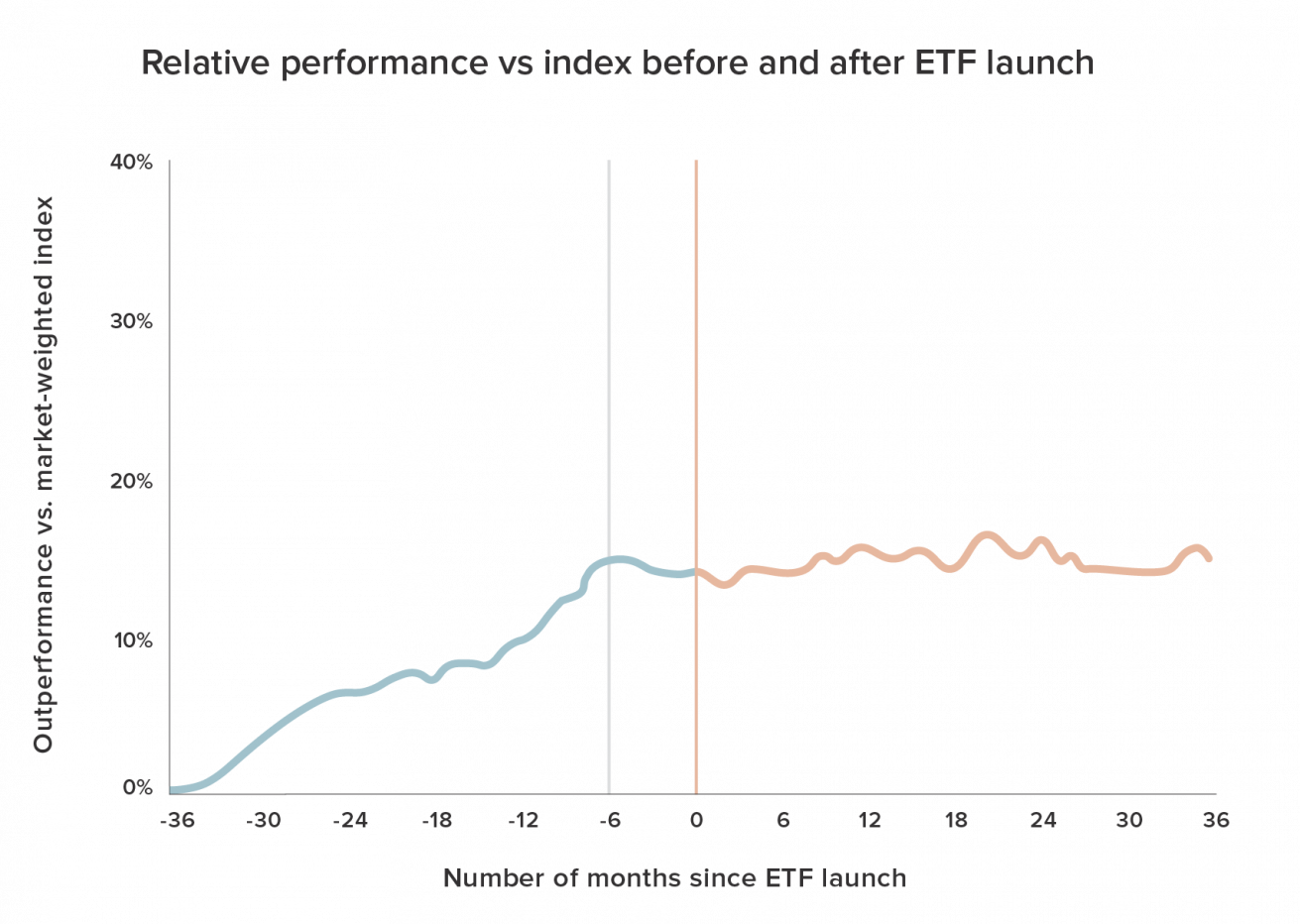

In fact research has shown that on average, new funds launch about 6 months after the peak in their particular strategy compared to the broad index.

This is not a coincidence – the product teams launching new funds usually take about 6 months to get them launched so when they decide to launch a fund it’s usually at exactly the point that the particular strategy is showing it’s best results compared to benchmarks. Unfortunately, outperformance tends to end soon after smart beta ETFs are launched.

Source: Research Affiliates

Source: Research Affiliates

Conclusion

Smart beta ETFs give investors the ability to tilt their portfolios towards certain factors that active fund managers have used for years.

But if you’re considering investing in a smart beta ETF, it’s important to understand that you are actually taking bets on certain market factors beating others. You should be comfortable with what those factor bets are, and why you’re taking them.

If you don’t understand the bets you’re taking and the only reason you’re investing in smart beta is backtesting or recent performance, then what you’re buying into isn’t smart beta as much as it’s smart marketing, and that’s not smart investing.

As any card player will tell you, reshuffling the deck won’t give you better odds of success.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.